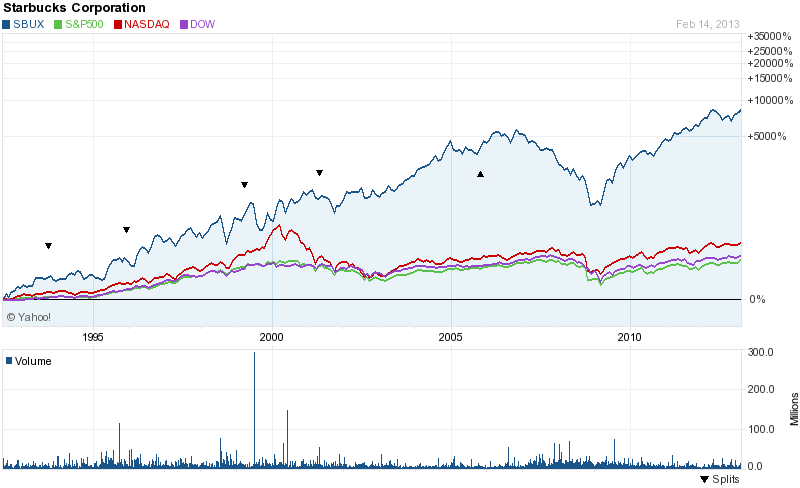

Coffee Futures Contracts declined 87 dollars or 38.84 percent during the last 12 months. Historically, from 1972 until 2013, coffee averaged 123.3 cents/lb reaching an all time high of 339.9 cents/lb in April of 1977 and a record low of 42.5 cents/lb in October of 2001.

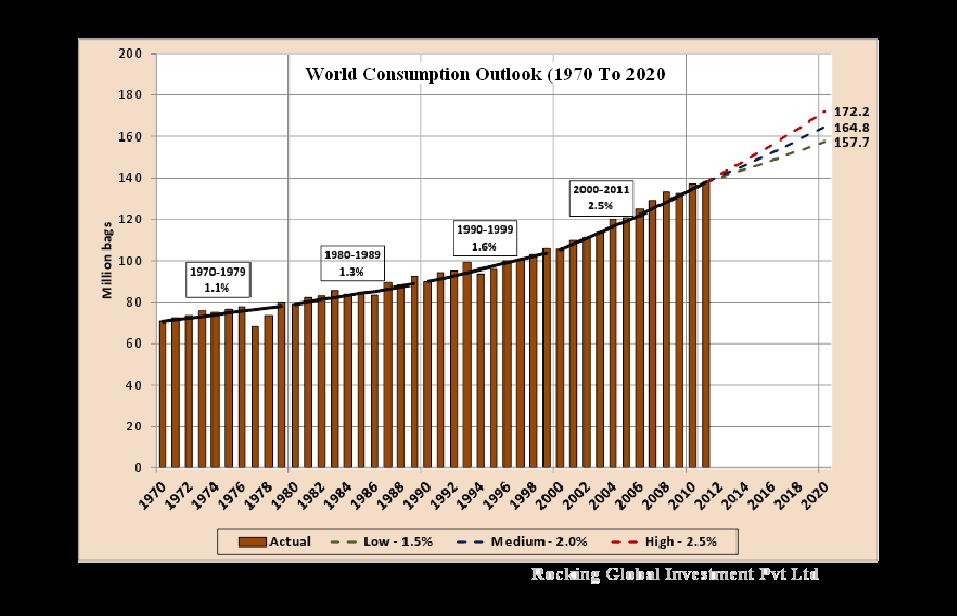

A consumption outlook until 2020 under three different growth, scenario: low 1.55% medium 2% and high 2.5%. Given historical growth rates and the strong potential demand in emerging market and exporting countries.

--> Technical Trend Of Us Coffee 13th March Future

Coffee prices slid again as investors worry about large supplies coming from south America. US coffee 13th march future trading near day low 137.53 (-0.69%). Intraday high 139.28 and low at 137.40. Technically coffee future semiannual charts creates a format of head and shoulders in an up trend which gives a signal of bearish trend, will continue below 140.33. You can see 144.87 to 155 level if coffee futures close above 140.33. semiannual chart indicate that future RSI below 40 so we can see some short covering in short term. You can see 129 below if break 135.23. Traders should follow the levels given below :

--> Bullish Trend – 140.33 Above – 144.87 – 149.38 – 154.72

--> Bearish Trend – 135.23 Below – 129.63 – 124.25 – 118.11

Coffee futures hit a fresh 2-1/2 year low this week, and are now 38.84% from their highs that were just hit last year on February15,2012 at 224.88. Coffee future trading below 200,100 and 50 days SMA. 20 days simple moving average 140.33 is crucial resistance for short term. Coffee future historical chart creates a structure of head and shoulders as a reversal pattern in minor up trend, it indicates a new fresh boom just on 140.33. If coffee future breaks crucial support of 129.63 then next target can be 118.11 and 100 below. 129.63 is crucial support for long term. You can see 161.46 to 175.99 if prices will sustain above 50 DMA 146.87.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ICE Coffee Futures Hit A Fresh 2-1/2 Year Low. Can It Glide Below 100?

Published 02/15/2013, 05:54 AM

Updated 07/09/2023, 06:32 AM

ICE Coffee Futures Hit A Fresh 2-1/2 Year Low. Can It Glide Below 100?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.