IBM’s second-quarter results, published earlier this week, make for dismal reading. Big Blue unveiled its 21st straight quarter of revenue contraction, and even though the company topped analysts’ expectations for profit, once again the bottom line was boosted by some one-off figures, something the company has become increasingly dependent on to meet targets in recent years. Pro forma earnings per share of $2.97 beat expectations of $2.75 but a one-off tax benefit in the quarter added $0.18 to earnings per share.

The results also showed that growth at IBM's so-called “strategic imperatives” divisions slowed significantly, from 13% in the first quarter to just 7% after adjusting for currency swings. The “strategic imperatives” are the cloud, analytics, mobile, social and security businesses on which Big Blue has pinned its hopes for future growth, and without growth here, prospects for the technology giant look dim.

IBM has pinned its hopes for growth on the success of its strategic imperatives and Watson supercomputer, which it hopes will become the go to provider for businesses looking to expand their AI and deep learning capabilities. However, analysts at investment bank Jefferies aren’t so sure that this will be the answer to all of IBM’s problems.

IBM's Watson Worth Less Than The Cost?

According to a new research report on IBM from Jefferies, Watson has dominated the company’s investor communications over the past few years clocking up a staggering 200 mentions in prepared remarks and earnings calls since the first quarter of 2013. What’s more, the company has spent an estimated $15 billion developing the initiative, excluding $5 billion spent on data acquisitions since 2015. This spending, as well as the academic input from IBM employees, has created, in the words of Jefferies, “one of the most complete cognitive platforms available in the marketplace today.” However, while the platform is enormously powerful Jefferies’ analysts write that “many new engagements require significant consulting work to gather and curate data, making some organizations bulk at engaging with IBM.”

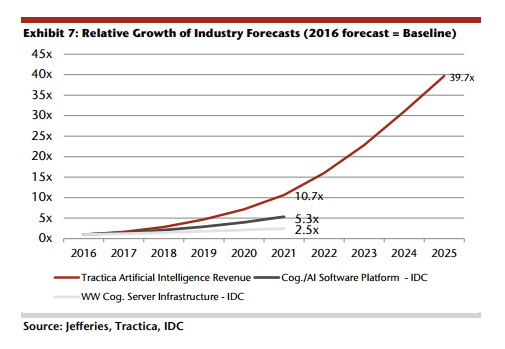

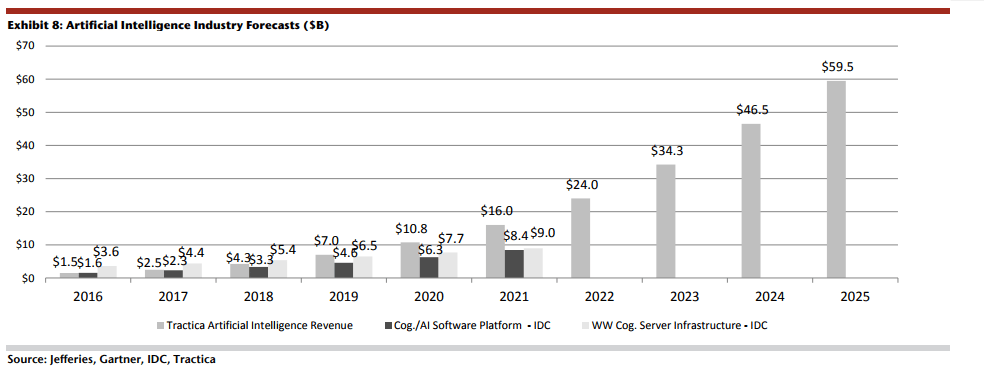

This lack of user functionality would be acceptable if IBM was the largest and only player in the game, but the company is operating in an increasingly crowded and commoditized space. Many major companies are making significant investments in AI, and private capital formation is booming, growing over 50% to $4.3 billion in 2016 per CB insights, with nearly 1900 startups in the space tracked by Venture Scanner. (These are conservative forecasts. In the bull case the market could grow by as much as 40 times from $1.4 billion in 2016 to $60 billion by 2025). Jefferies’ analysis of job listings also suggests “IBM appears outgunned in the "war" for AI talent; Amazon.com (NASDAQ:AMZN), for example, has more than 10x the job listings of IBM.”

Add all of the above together, and it’s starting to look as if IBM will ever struggle to make Watson a significant part of its business without making massive changes. Tens of billions of dollars are being invested in AI technologies around the world, and if IBM's Watson is the most complex platform to use, no matter how brilliant the system is, IBM will have to lower costs to draw in customers, reducing the payback period for investment. The company has already gone down this path, dropping the price of IBM's Watson Conversation over 70% from $0.0089 to $0.0025 per API query per month in October of 2016. Jefferies’ analysts reach the following damning conclusion:

IBM disclosed very little on Watson’s financial performance. However, based on market research data, public filings, and our checks, we built financial models to evaluate the impact of Watson on IBM over the long-term. We looked at whether IBM’s investments were likely to generate shareholder value and the potential impact to EPS. We believe the results of this analysis should be somewhat disappointing for investors. Even under generous assumptions in the Base case IBM is barely recouping its cost of capital. In the Bear case value is being destroyed.

…

From an EPS perspective, it seems unlikely to us under almost any scenario that Watson will generate meaningful earnings results over the next few years. In our Base case, Watson and associated “pull-through revenue” contributes 3% to Consensus EPS in 2019; in the Bull case, it’s still only 5%.”