is a company I recently found while looking around for a possible long term multi-bagger based on the emergence of new technology. Granted, selling for a price of $1.38 and a market cap of $65.44m (as of this writing) does indicate it is a risky investment, no question. However, with high risk does come high reward.

In 2004 I bought a stock for around $0.50 and ended up selling it 3 years later for $5.50. Unfortunately, I was not able to buy as many shares as I would have liked, but still made 6 figures on the investment before the company turned investor unfriendly. My big small cap long term investment, Antares Pharma (AIS) has done very well for me, with a profit near 100k to date, and no plans to sell a single share anytime soon.

If I had the money freed up at this time from AIS, I would make a long term speculative investment here. I did buy a small amount of shares for a short term catalyst trade, however. In this article, I will get into the reasons I believe iBio should make a nice short term gainer along with a possible long term multi-bag gainer.

The first thing that caught my eye while researching iBio is the backing it receives from the Bill & Melinda Gates Foundation along with the US Govt's Defense Advanced Research Projects Agency (DARPA).

iBio also has a partnership with The Fraunhofer USA Center for Molecular Biotechnology (FCMB) for the development and refinement of iBioLaunch. The Bill & Melinda Gates foundation and DARPA have provided over $70 million in non dilutive funding to FCMB, and iBio owns all the IP that comes out of FCMB. DARPA has been responsible for funding the development of many technologies which have had a major effect on the world, including computer networking and NLS.

Key technology platform: iBioLaunch.

The iBioLaunch platform uses transient gene expression in plants for superior efficiency in protein production. Advantages include significantly lower capital (more than a 90% reduction) and process costs (more than a 90% reduction), and the technology is designed for infectious disease applications or proteins where speed, scalability, and surge capacity are important.

To get a better idea from the company about iBioLaunch, let's take a look at the following statement from iBio's most recent 10Q summary:

In order to attract appropriate licensees and increase the value of our share of such intended contractual arrangements, we engaged the Center for Molecular Biotechnology of Fraunhofer USA, Inc., or FhCMB, in 2003 to perform research and development activities to develop the platform and to create our first product candidate. We selected a plant-based influenza vaccine for human use as the product candidate to exemplify the value of the platform. Based on research conducted by FhCMB, our proprietary technology is applicable to the production of vaccines for any strain of influenza of H1N1 swine-like influenza. A Phase 1 clinical trial of a vaccine candidate for H1N1 influenza, based on iBio's technology, was initiated in September 2010. We announced positive interim results in June 2011. The vaccine candidate demonstrated strong induction of dose correlated immune responses, with or without adjuvant, as assessed by virus microneutralization antibody assays and hemagglutination inhibition ("HAI") responses. The vaccine was safe and well tolerated at all doses when administered with and without adjuvant.

In layman's terms, iBioLaunch in part is designed to make influenza vaccines better by eliminating conventional animal cell production techniques. Current Swine flu (H1N1) vaccine shots are made up of all kinds of animal pathogens. Many people become ill just from receiving animal pathogen based vaccines, as it is common place for these conventional vaccines to actually cause their own illnesses. iBio's process would greatly reduce, or eliminate these side-effects all together.

The iBioLaunch platform also offers significant advantages over earlier plant-based methods that rely on transgenic plants or plant cell cultures. These include the speed at which different proteins can be expressed and produced at commercial scale, which presents a significant commercial advantage, as well as public safety benefits when vaccines for pandemic diseases are required. Other advantages include scalability, no risks of contamination by animal pathogens, and the ability to express complex proteins at which other systems have failed.

iBioLaunch also bolsters the claim its vaccines can be created in under 5 weeks. Conventional techniques can take up to 16 months and can cost upwards of $1 billion to construct a conventional facility to produce conventional proteins. iBio production facility cost is under $100 million. This is a major factor why DARPA pays for all the clinical research for iBiolaunch. Epidemics and pandemics need faster responses, or the possibility remains for a serious outbreak to occur, which could be a threat to The United States National Security.

The iBioLaunch technology platform addresses several multi-billion dollar markets. Its applicability to a broad range of product classes enables iBio to target global commercial collaborations in high-growth markets such as orphan biologics ($54.6 billion in 2009), biosimilars/bio-betters (~$80 billion worth of biologics sales will be susceptible to biosimilar competition, by 2013) and new proprietary biologics. The speed and superior economic scalability of the iBioLaunch technology make it the ideal platform for new personalized therapeutics as well as for vaccines ($32 billion in 2013).

In my opinion, iBio represents the future of preventive vaccines, and also new drugs that will utilize biobetter and biosimilar platform technologies.

One of the main reasons I am heavily vested in Antares Pharma is based on biosimilar and biobetter technologies. Companies that are engaging in biobetter and biosimilar technologies are where aggressive speculation biotech investors need to be focusing on in my opinion. Some traditional large pharmas are seriously behind the ball in this aspect. In my strongest opinon, these large pharmas along with some analysts are failing to fully grasp the changes that are under-way in this segment. In a way, these views are about as short sighted as when the music industry ignored the emergence of mp3 technology in the late 90s.

Even after the emergence of this technology, instead of capitalizing on it, they engaged the RIAA to try to stop it. These large companies lost out on billions of dollars in revenue because of their collective short-sightness. Embracing change is smart, resisting change shows a history of lost opportunity. Only recently have these companies decided to embrace and offer mp3 downloads some 7 to 12 years later and after again, billions lost in unrealized revenue.

Sales of biosimilars are expected to reach between $1.9 billion and $2.6 billion by 2015, up from $378 million for the year to the first half of 2011, according to IMS Health. With a new abbreviated FDA approval pathway for biologics in the United States, and increasing adoption of biosimilars globally, large pharmas need to get up to speed in this segment.

Biogen Idec (BIIB) and Samsung (SSNLF.PK) have an agreement to invest $300 million to establish a joint venture to develop, manufacture and market biosimilars. Samsung will take a leading role in the joint venture, with Biogen Idec contributing its expertise in protein engineering and biologics manufacturing. Samsung will contribute $255 million of the $300 million for an 85 percent stake and Biogen Idec will contribute $45 million for a 15 percent stake in the joint venture.

In December 2011, Amgen (AMGN) and Watson Pharma (WPI) announced that they will be working together to develop and sell biosimilar versions of several biotech cancer drugs. Amgen will assume primary responsibility for developing, manufacturing and initially commercializing the biosimilar cancer drugs, the companies said. Watson will contribute up to $400 million in co-development costs and take advantage of its expertise in the sale and marketing of specialty and generic drugs. Watson will initially receive royalties and sales milestones from product revenue.

All of these factors do not guarantee that iBio will be successful, but a speculation that the company should be successful and make billions in the future from its patented technologies which include biosimilar and biobetter technologies.

For these reasons, it is my opinion that iBio is about as strong as it gets in the category of speculative long term investments. Being a developmental company at this time, it is not making money and is in fact burning cash, but at a reasonable rate of around $1.5 million a quarter.

Short term catalyst event:

Protalix (PLX) is currently awaiting approval of its lead drug candidate, taliglucerase alfa, with a PDUFA date of 5/1/2012. Protalix is producing proteins using plant cells but in isolation. PLX uses poly bio reactors and derivative of carrot cells in isolation. IBIO uses no bio reactors as the plant is the reactor. IBIO has much less CAPEX and quicker growth from start to finish with higher yields due to the patented vectors delivering DNA to plants to grow the proteins.

The only other company with a similar type of technology to iBio, is Protalix. Its catalyst event is tied into iBio for this obvious reason.

A perfect example of a cataylst tie-in to another company's catalyst is when Vivus's (VVUS) weight loss drug Qnexa's received a favorable recommendation from the FDA advisory committee . This event has had to date, a huge impact on Arena Pharma's (ARNA) stock price because Arena has its own weight loss drug candidate, Locaresin being considered for approval. After hitting an intra-day low of $1.54 on Jan 26, 2012, Arena's stock price has more than doubled, hitting an intra-day high of $3.47 on Mar 27, 2012. I remarked in a prior article that Arena had the potential this year to see a triple in its stock price, and so far, we have seen more than a double in the pps.

During the three months ended December 31, 2011, iBio issued 1,000,000 options/warrants to purchase shares of common stock at $1.96 per share. During this time frame, the stock price did in fact reach the $1.96 level, making the warrants exercisable. Like most developmental companies, iBio exercised these shares, selling most of them to raise money strictly for salary compensation. iBio receives the rest of its money from the sources I mentioned earlier in this article.

Because iBio has been under the radar so to speak, the volume during the time when the shares from warrants/options were being sold was very light, and this is the main reason for the stock price decline to under $1 in my opinion. As of the late, the volume and stock price have been picking up, and I foresee both the volume and share price to increase as we draw near to Protalix's PDUFA date.

I can find no more warrant issuances at this time, and with my plan to cover and follow this company now and in the future, I do not see any reason for the stock price not to appreciate strongly from its current price level, at least until the PDUFA date for Protalix.

Both iBio and PLX are great platforms and the first breakthroughs in manufacturing and production in regards to flu vaccines for over 40 years.

iBio can produce almost all protein therapeutics where PLX can't and PLX can't produce vaccines currently. iBio's IP advantage is being able to circumvent patents held by competitors on the use of cells in isolation to produce recombinant proteins, because the iBio approach relies on transient expression of proteins in whole plants, and does not involve cultivation of cells in isolation, notwithstanding its desire to engage in biosimilar and biobetter products.

iBio will benefit greatly from any PLX success in my opinion, as it will bring awareness to iBio.

If Protalix receives an approval, then both stocks should be off to the races so to speak, with iBio likely seeing a triple in stock price by year's end. However, a rejection for Protalix would mean iBio's stock would lose its run-up appreciation and return back to the $1.30 range, at least on a temporary basis. It is my opinion Protalix will gain approval for its platform drug.

Catalyst run up trading in the bio-pharma sector can be very profitable if traded correctly. iBio is relatively unknown at this time but again, with proper coverage, High risk/high reward bio investors along with short term catalyst traders will really like this company in my strong opinion.

The chart above shows a reversal pattern with an inverted head and shoulders, short term cup and handle, and a continuing triangle in a tight wedge. The MACD and signal have been strong for about a month, showing accumulation in my strong opinion. The longer term trend seems to be setting up an inverted head and shoulders from November 2011. The shorter term trend seems bullish to me, and I would not be surprised to see a move to near $2 a share within a month to 6 weeks.

Also in November 2011, we can see where the company was selling the exercised warrants/options, and where it stopped in January of this year. As I remarked prior, the volume was light during this period, which indicates to me the price decline was caused by exercised warrant/options selling. Again, I do not see any more warrants/options available to be sold to market, so the stock appears poised to have nice run-up ahead for it.

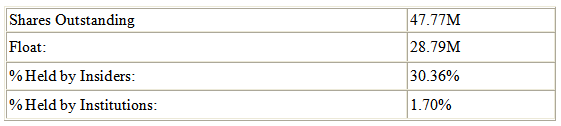

Decent insider ownership is coming in at a little over 30%, but institutions only hold 1.70%. I would like to see a much higher institutional ownership number here for stronger long term appreciation, and I believe the institutions will start to take notice of iBio soon as many of them are looking for speculative type growth companies, especially in the bio-pharma sector. Many of their clients are philantropist type investors as I pointed out in a prior article I wrote not too long ago.

In my opinion, iBio has strong short and long term upside potential. The long term prospects here will be dependent on the company remaining modest with its warrant issuances and stronger average daily volume over the longer term period. It is my opinion both these fundamentals will emerge in a positive manner.

My final opinions on iBio:

Strong short term buy, strong long term speculation buy.

Short term pps target, 2 days to 2 months: $1.70 -$2.20.

Mid term target, 6 months to a year: Uncertain, depends on Protalix approval or rejection.

Long term speculative pps target: 2 to 5 years, $10 -$50.

Disclosure: I am long IBIO, AIS.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

IBIO Stock Analysis

iBio (IBIO)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.