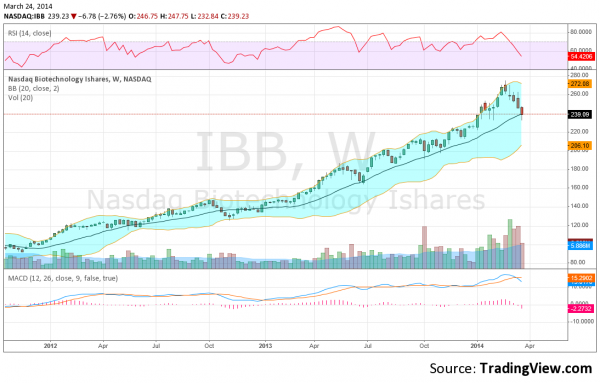

The iShares Nasdaq Biotech ETF (NASDAQ:IBB), is ready to reverse higher*. The chart below shows the ETF on a weekly basis going back to November 2011. From that time it has exhibited a clear trend higher, bounded on the upside by the upper Bollinger® band and to the downside by the 20 week Simple Moving Average (SMA). With the recent pullback reaching that 20 week SMA today it is now ripe for a reversal trade higher. Don’t you want to feel good and get rich from this reversal trade?

*Reversal trades work best when confirmed by a higher candle in the next period. There are several indications that this trade may not work for you. If you cannot stomach a stop loss under Monday’s low at 232.84, then stop doing this trade immediately and keep your money in cash. Other traders have experienced being stopped out of reversal trades in this ETF before. If you do not use a stop loss you run the risk of losing a lot of money and blowing up your account. Watch for failing RSI, already making lower lows and a MACD crossed lower and falling. Continuation of these can be signs of continued down move and failure of the reversal trade. Only take this trade on a good nights sleep and after a full breakfast. If you take anxiety tablets you may wish to consult your broker before taking this trade.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.