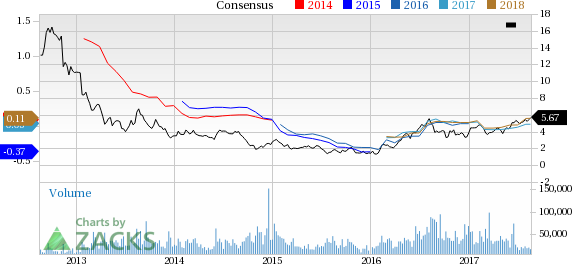

Shares of global gold exploration and mining company Iamgold Corp (TO:IAG) , scaled a fresh 52-week high of $5.75 on Aug 17, before pulling back to eventually close the day at $5.64.

Iamgold has a market cap of roughly $2.63 billion. Average volume of shares traded in the last three months is around 6,100.7k.

Shares of Iamgold have moved up 27.1% in the last three months, significantly outperforming the industry’s 2.4% growth.

Driving Factors

Iamgold swung to a net profit (as reported) of $506.5 million or $1.09 per share in second-quarter 2017, against a net loss of $12.2 million or 3 cents recorded a year ago. Barring one-time items, adjusted earnings came in at a penny per share for the quarter, compared with a break-even result reported a year ago. The figure was in line with the Zacks Consensus Estimate.

Sales rose roughly 18% year over year to $274.5 million in second-quarter 2017. Sales benefited from increased sales at Westwood and Essakane, partly offset by lower sales at Rosebel and lower realized gold prices.

Attributable gold production was 223,000 ounces for the quarter, up 13% year over year and all-in sustaining costs fell 12% year over year to $975 per ounce in the quarter.

According to Iamgold, Essakane and Rosebel are benefiting from operational improvements while developments at Westwood continue to be on track. The reserves at Rosebel concession increased by 80% and the company has also entered into a joint venture for its Cote Gold Project, which demonstrated low operating costs, significant conversion of resources into reserves and attractive returns.

Moving forward, the company has maintained cost and production guidance for 2017. It expects gold production in 2017 to be in the band of 845,000 to 885,000 ounces. Also, total cash cost is expected to be between $740 and $780 per ounce. All-in sustaining cost is anticipated between $1,000 and $1,080 an ounce.

In June, Iamgold entered into a joint venture (JV) with Sumitomo Metal Mining Co., Ltd. with respect to the Cote Gold Project in Ontario with Iamgold owning 70% of the total participating interests in the joint venture while Sumitomo having the remaining 30%. Iamgold's established track record as a successful builder and operator in the mining industry will complement Sumitomo's profound expertise in operating and building mines.

As both companies have robust business development capabilities, the JV will support Iamgold's objective to grow its production pipeline, by seeking opportunities beyond the Cote Gold Project and exploring areas of common interest.

Zacks Rank & Key Picks

Iamgold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Arkema SA (OTC:ARKAY) , POSCO (NYSE:PKX) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Arkema has expected long-term earnings growth rate of 12.8%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos Worldwide has expected long-term earnings growth rate of 5%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Iamgold Corporation (IAG (LON:ICAG)): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research