Although aluminum is the worlds largest non-steel metals market it is arguably the most opaque. This week’s announcement by the International Aluminum Institute (IAI) that they have stopped reporting global inventory stocks has made matters even worse.

According to Reuters, the IAI has announced it will no longer publish its monthly producer inventory figures, saying its own members are either not submitting the data at all or struggling to do so on a timely basis. The problems have become so acute that the IAI now feels that “the continued reporting of this incomplete information could be misleading,” Reuters says.

To be fair, the IAI data has never been the whole story as to producer inventory, but when it started in the 1970s’ 73% of production was concentrated into just 6 of the IAI’s members Alcoa, Alcan, Reynolds (NYSE:RAI), Kaiser (NASDAQ:KALU), Pechiney and Alusuisse, making their monthly figures were a sound basis for assessing global stocks.

Now? China produces half the world’s aluminum and Rusal (MCX:RUALR) is the world’s largest producer and, although it is a member of the IAI, it inexplicably does not provide monthly data. In addition there is a massive off-warrant market that has sprung up since 2009 around the stock and finance trade, none of which appears in the IAI’s figures – you can understand why they say their numbers could be misleading!

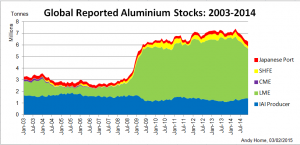

Inventory levels are a major issue for all commodity markets as they should reflect the balance of supply and demand, rising when supply is abundant and falling in times of deficit, but if you can’t accurately measure the inventory using incomplete data can, indeed, be misleading. The following graph produced by Reuters on the basis of exchange data and IAI data is in itself only part of the picture

As the writer points out, the Shanghai Futures Exchange (SHFE) stocks are merely the very small tip of a much bigger stocks iceberg in China, while the LME inventory is overshadowed by the massive off-market stock and finance inventory. Even the IAI’s estimates of Chinese inventory have a huge margin for error, they estimate unreported output in China at 3.6 million tons per year, equivalent to the combined production of western Europe!

A large part of the problem is that unlike copper, Zinc, Lead, and even tin there is no government-sponsored body responsible for monitoring, analyzing and reporting on the aluminum market. They all struggle with the lack of data coming out of China but, generally, the regulators’ figures are taken as a decent stab at their markets.

For a market as dynamic in growth terms and with its position as the largest volume among base metals, the lack of data will make understanding what is happening and assessing fundamentals even harder in the future. Fortunately, MetalMiner has hedging tools to help consumers manage their price risks, it looks like they will become increasingly vital in the years ahead.