Investing.com’s stocks of the week

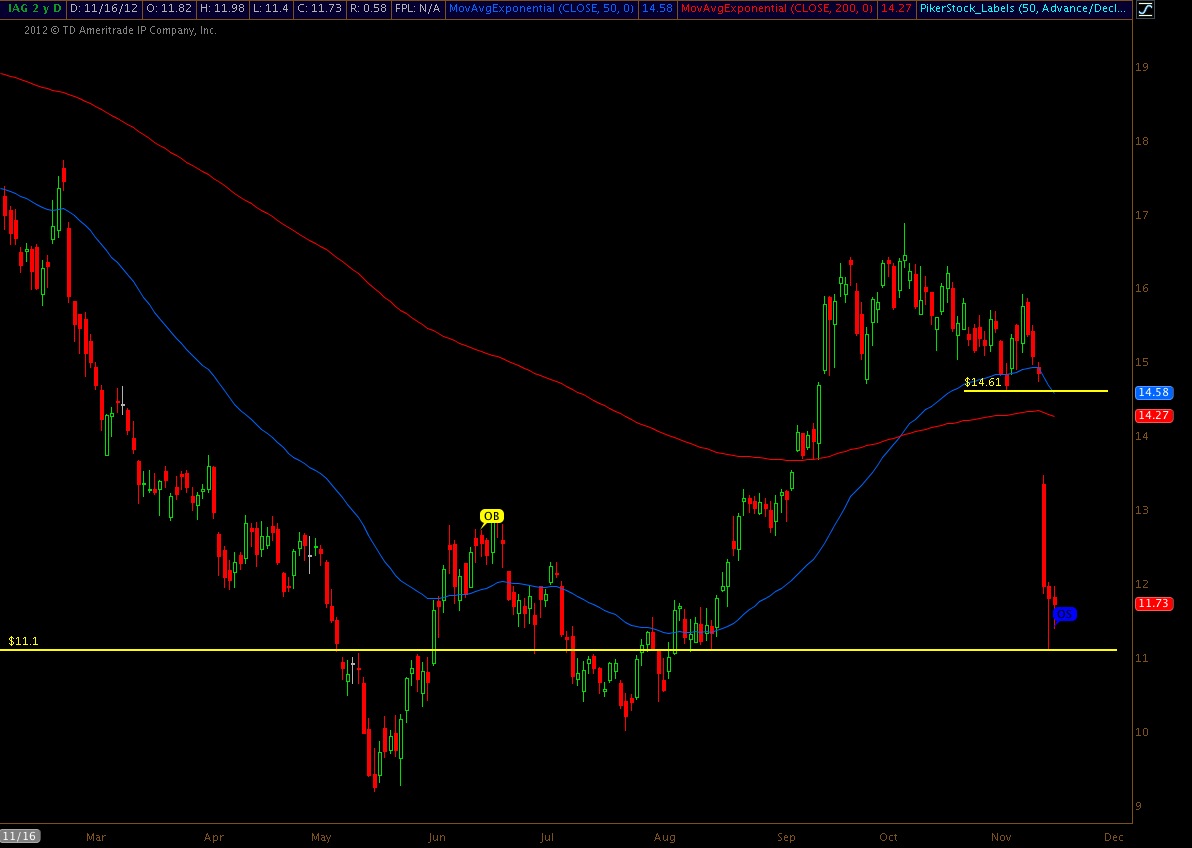

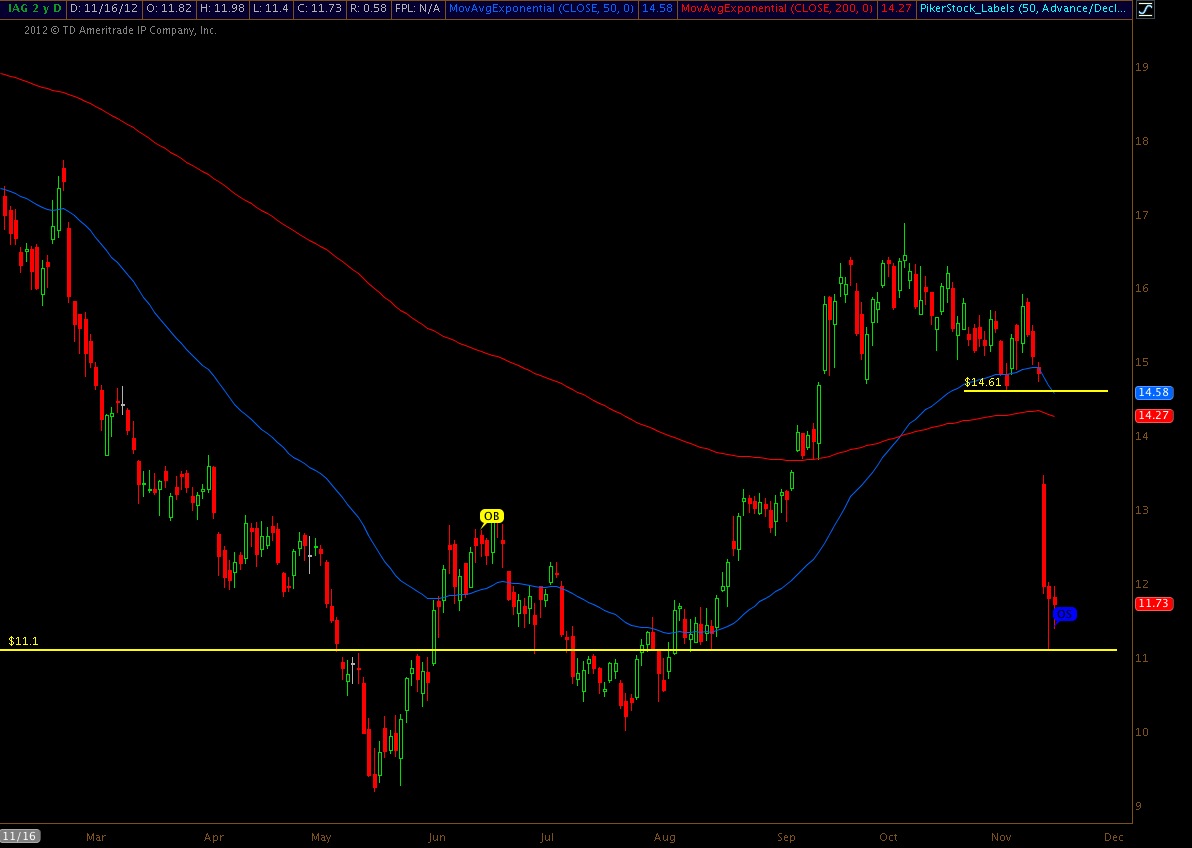

IAG has sold off hard last week dropping ove 23% starting on 11/14. This strong sell off has sent IAG back near its lows of the year and near a small support level which IAG has been bouncing off of. The 11.10 and 11.39 has been swing lows during the 23% drop.

The long candles show a stock that drops but buying pressure picks up near the low 11.30′s. IAG staying at support makes trying to catch this falling knife somewhat safe since these levels provide solid entry points and stop losses. The dollar also looks to be weakening at this levels and would be bullish for gold, allowing miners to rally.

Price Targets for a Rebound: The hard sell-off leaves a large gap above it at 14.61 which could be a potential price target. The first resistance level is at 13.29 and 13.68 the slight consolidation level September.

Flagged Oversold: IAG has also been flagged as oversold by the Piker Signals.

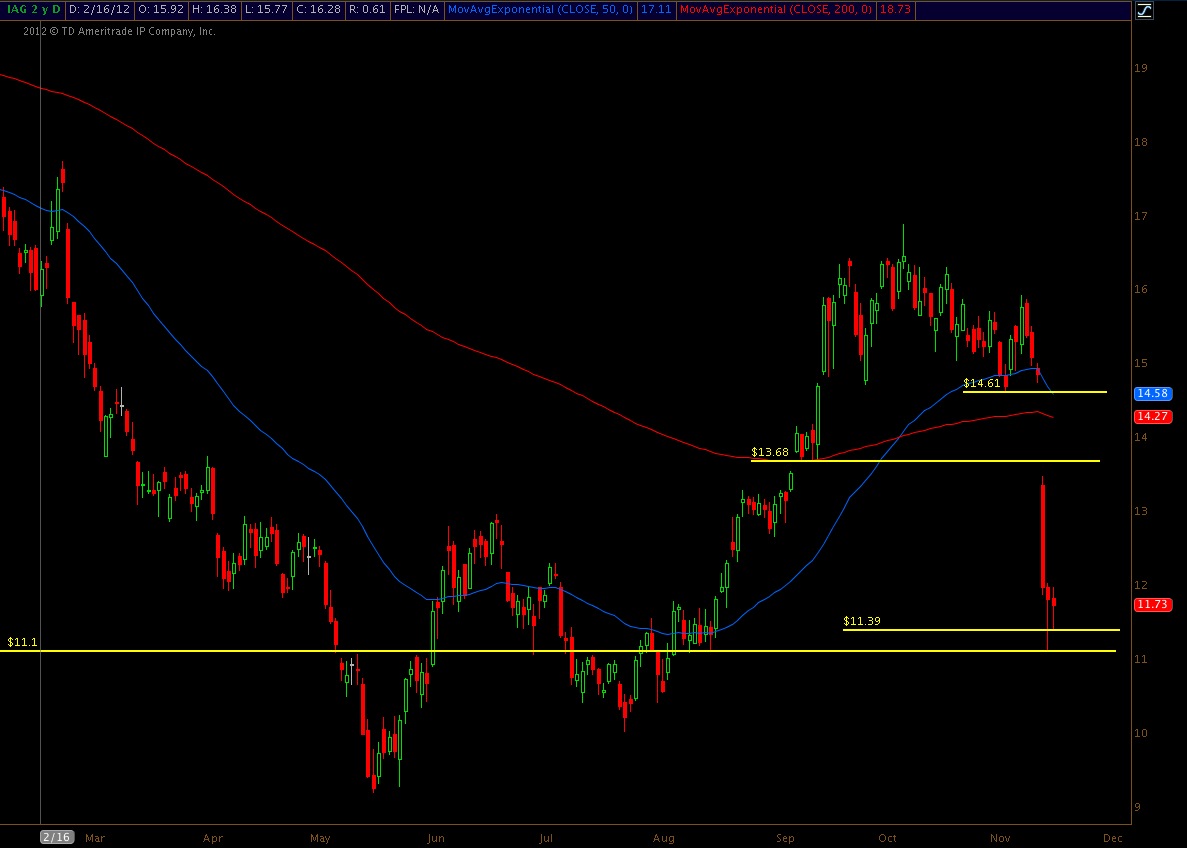

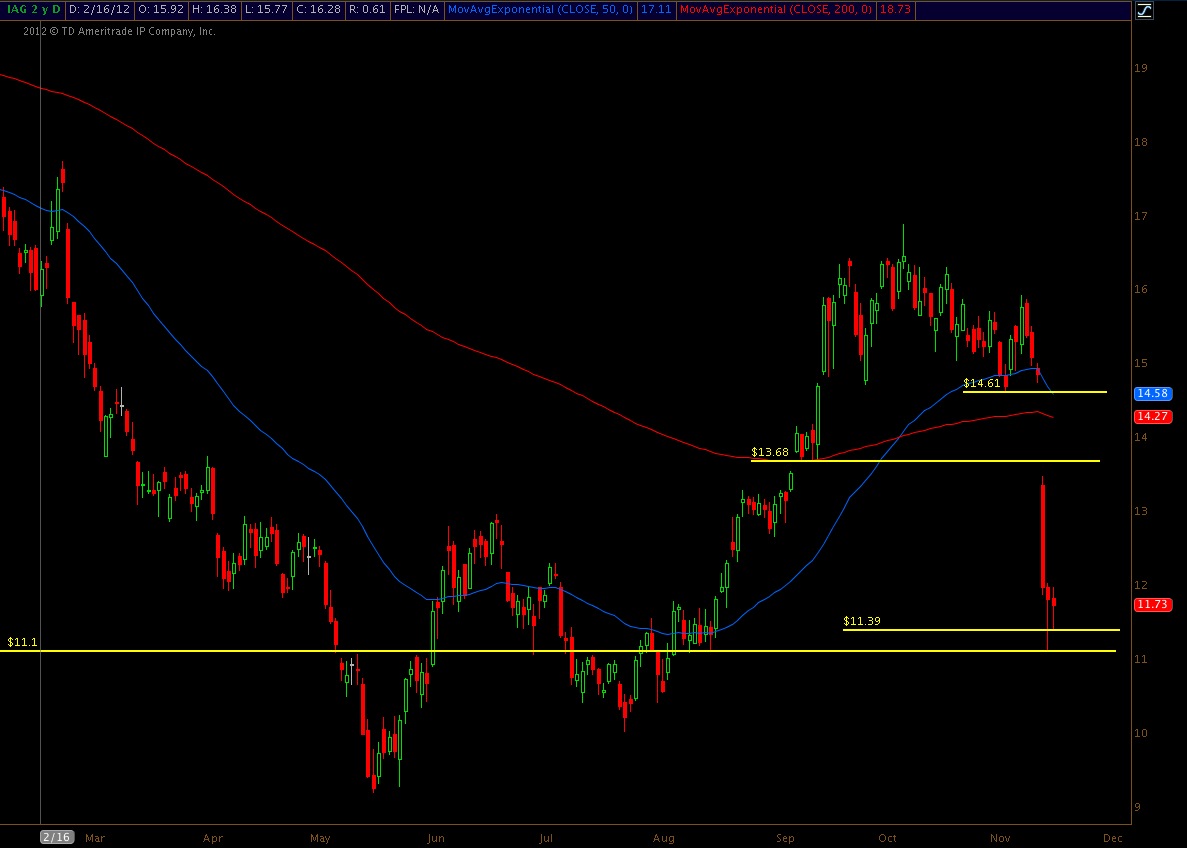

The long candles show a stock that drops but buying pressure picks up near the low 11.30′s. IAG staying at support makes trying to catch this falling knife somewhat safe since these levels provide solid entry points and stop losses. The dollar also looks to be weakening at this levels and would be bullish for gold, allowing miners to rally.

Price Targets for a Rebound: The hard sell-off leaves a large gap above it at 14.61 which could be a potential price target. The first resistance level is at 13.29 and 13.68 the slight consolidation level September.

Flagged Oversold: IAG has also been flagged as oversold by the Piker Signals.