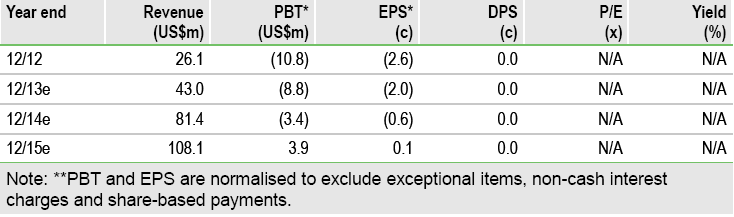

Hydrodec has entered into an agreement whereby it will co-locate its Australian transformer oil re-refining operation at the Southern Oil Refining Pty site in New South Wales. Southern Oil will also support development of Hydrodec’s proprietary technology for re-refining used industrial and engine oils. We update our estimates to reflect the one-off costs of the relocation in FY14 and subsequent improvement in profitability from FY15 onwards. We raise our valuation from 20.3p/share to 20.9p/share to acknowledge the change to estimates and the reduction in risk to the Australian industrial oils programme.

Transformer oil plant co-location

Hydrodec will continue to sell SUPERFINE-branded transformer oil and base oil in Australia, but re-refining using its proprietary process will be carried out by Southern Oil at its plant in New South Wales, where it already processes used industrial and engine oil using conventional refining techniques. Hydrodec will retain all rights to its process and pay Southern Oil a tolling fee for processing the transformer oil. Hydrodec and Southern Oil will work together to commercialise Hydrodec’s proprietary process for potentially re-refining industrial and engine oil at the latter’s sites in New South Wales and Queensland.

Benefits of agreement

The rationale behind the agreement with Southern Oil is very similar to that behind the collaboration with Essar Oil in the UK and the strategic partnership agreement with G&S Technologies Group in the US. In all three cases, the relationship with an established industry partner both de-risks and accelerates technology deployment. In this particular case, the relationship also improves profitability from FY15 onwards, addresses the issues associated with the remote location of the current Australian transformer oil re-refining operation and provides a solid platform for developing an industrial oils re-refining business in the region.

Valuation: Raising valuation to reflect de-risking

Our valuation is based on the sum of discounted cash flows from the programmes in which Hydrodec is engaged, including both operational activities and those at the planning stage. We raise our valuation from £151.3m (20.3p/share) to £156.1m (20.9p/share) to acknowledge the change to estimates and reduction in risk to the Australian industrial oils programme. We note the upside to our valuation from potential adoption of Hydrodec’s process by Southern Oil at two refinery sites.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hydrodec Group Agreement With Southern Oil Refining

Published 11/15/2013, 01:53 AM

Updated 07/09/2023, 06:31 AM

Hydrodec Group Agreement With Southern Oil Refining

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.