Hyatt Hotels Corporation (NYSE:H) is a leading global hospitality company and operates under a number of leading brands. The company has a significant presence in major hospitality markets across the world. The company has an industry-leading guest loyalty program — Hyatt Gold Passport program — which serves millions of members worldwide.

Hyatt Hotels stands to gain from increased demand in the United States, which is supported by stronger economic metrics and the increasingly positive employment scenario in the country. Moreover, improved transient demand and greater pricing power should continue to drive Revenue per Available Room (RevPAR).

However, pressure on margins due to lower nominal growth in RevPAR, continued weakness in France exacerbated by the impact of renovations, geopolitical uncertainties in key operating regions, and negative currency translations remain potent headwinds.

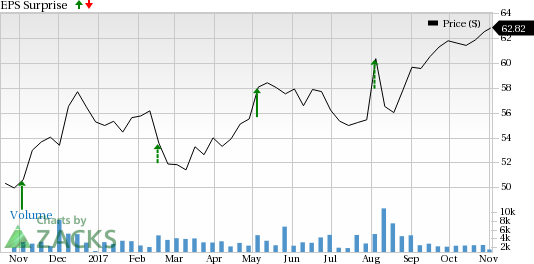

Investors should note that the consensus estimate for H has been stable over the last 60 days. Moreover, H’s earnings have been positive over the past few quarters. In fact, the company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average beat of 85.36%. Meanwhile, revenues have outpaced the Zacks Consensus Estimate in just one of the trailing four quarters.

Hyatt Hotels Corporation Price and EPS Surprise

H currently has a Zacks Rank #3 (Hold) but that could change following Hyatt Hotels’ earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: H beats on earnings. Our consensus earnings estimate called for earnings per share of 17 cents and the company reported earnings of 26 cents per share. Investors should note that these figures take out stock option expenses.

Revenues: H reported revenues of $1.12 billion. This surpassed our consensus estimate of $1.09 billion.

Key Stats to Note: Comparable systemwide RevPAR increased 1.6% in third-quarter 2017. Adjusted EBITDA was $180 million, down 6.7% year over year in constant currency.

Stock Price Impact: In-active in pre-market trading.

Check back for our full write up on this H earnings report!

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Original post