Hyatt Hotels Corporation (NYSE:H) yesterday announced reorganization of its leadership team and operations and expects the process to be completed in the second quarter of 2018.

Per Mark Hoplamazian, president and chief executive officer of Hyatt, the step is aimed at fast-tracking Hyatt’s differentiated strategy to better cater to high-end travelers.

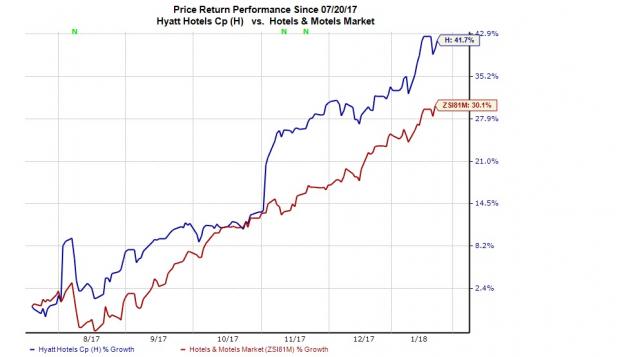

We observe that Hyatt shares have rallied 41.7% in the past six months, outperforming the industry’s 30.1% growth.

New Position to Commercial Services

The company will form a new commercial services portfolio at the Executive Committee level that will combine guest and customer engagement functions. The position of chief commercial officer will be created to oversee the new portfolio along with one that encompasses global marketing functions, sales functions, contact centers, and information technology.

Selection for this new position is expected to be completed in the second quarter. Further, managed and franchised hotel operations and owner relations will merge into one portfolio under its global president of operations. Hyatt is also considering realignment of the legal and corporate services portfolio under the new leadership.

Older Positions to be Removed Post Departures

There will be two departures, that of global chief marketing officer Maryam Banikarim and global head of Capital Strategy, Franchising and Select Service, Steve Haggerty. Hyatt will remove these positions following their departure.

Banikarim will lead the marketing organization through the end of April, and Haggerty will remain as a special advisor to the CEO through July.

A Move to Align Strategies with Opportunities

According to Hoplamazian, “the changes we’re making will better position us to grow with focus to serve our high-end customers and guests in the places and with the experiences that matter most to them.”

Hyatt Hotels Corporation Revenue (TTM)

We believe that these key changes will help Hyatt strategize and adapt to changing market trends, driving more guest and customer engagement. They will help accelerate Hyatt’s global expansion plan, which in turn will help the company gain market share in the hospitality industry, thus boosting its business.

Zacks Rank and Stocks to Consider

Hyatt carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the hotels and motels space include Hilton Worldwide Holdings (NYSE:H) , Choice Hotels International (NYSE:H) and Marriott International (NASDAQ:MAR) . While Choice Hotels sports a Zacks Rank #1 (Strong Buy), Marriott and Hilton carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Choice Hotels, Marriott and Hilton’s earnings in 2018 are expected to improve 14.6%, 19% and 27.7%, respectively.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Marriott International (MAR): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Choice Hotels International, Inc. (CHH): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Original post

Zacks Investment Research