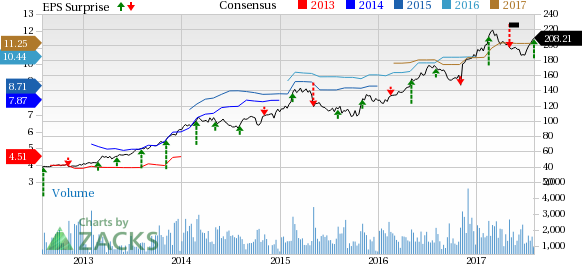

Huntington Ingalls Industries, Inc.’s (NYSE:HII) second-quarter 2017 earnings of $3.21 per share surpassed the Zacks Consensus Estimate of $2.62 by 22.5%.

Reported earnings improved 14.6% from $2.80 per share in the year-ago quarter owing to a rise in the top line and operating income.

Total Revenue

Total revenue in the second quarter was $1.86 billion, ahead of the Zacks Consensus Estimate of $1.79 billion by 4.1%. The top line rose 9.3% from the year-ago figure of $1.70 billion. The upside was primarily due to higher contribution from its Ingalls and Technical Solutions divisions.

Segment Details

Newport News Shipbuilding: Segment revenues were $1,001 million, up 0.2% year over year due to higher sales from naval nuclear support services. Operating income declined 18.4% to $80 million.

Ingalls Shipbuilding: Segment revenues were $639 million, up 9.2% year over year on higher revenues in assault ships and the Legend-class National Security Cutter (NSC) program. Operating income at the segment improved 11.4% to $98 million.

Technical Solutions: Segment revenues were $244 million, up 70.6% year over year primarily, due to higher volume in integrated mission solutions services. This, in turn, was due to the acquisition of Camber in the fourth quarter last year and higher volumes in fleet support and oil and gas services. Operating income at the segment was $9 million.

Backlog

The company received new orders worth $3.4 million during the reported quarter, as a result of which, its total backlog reached $21.1 billion as of Jun 30, 2017.

Financial Update

Cash and cash equivalents as of Jun 30, 2017, were $553 million, down from $720 million as of Dec 31, 2016.

Long-term debt, as of Jun 30, 2017, was $1,281 million compared with the 2016-end level of $1,278 million.

Cash from operating activities in second-quarter 2017 was $186 million, compared with $169 million in second-quarter 2016.

Zacks Rank

Huntington Ingalls currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Earnings Review

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) posted second-quarter 2017 adjusted earnings of $1.57 per share, beating the Zacks Consensus Estimate by 30.8%. Earnings improved 29.8% from the year-ago figure of $1.21.

The Boeing Company (NYSE:BA) reported adjusted earnings of $2.55 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.32 by 9.9%. In the year-ago quarter, the company had reported a loss of 44 cents.

Raytheon Company (NYSE:RTN) reported second-quarter 2017 adjusted earnings from continuing operations of $1.98 per share, beating the Zacks Consensus Estimate of $1.74 by 13.8%. The figure also improved 5.3% from $1.88 in the year-ago quarter.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Boeing Company (The) (BA): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research