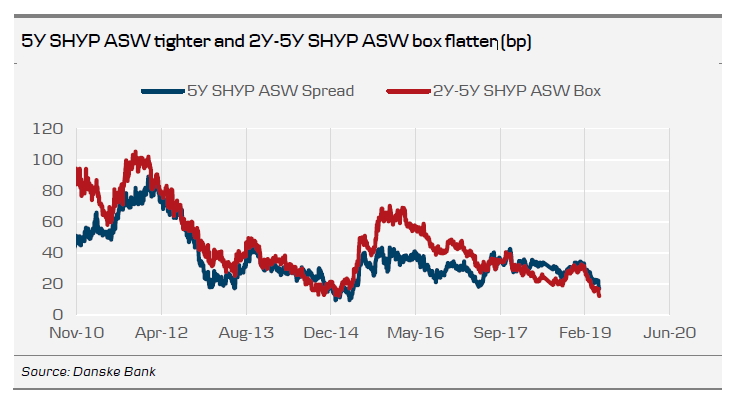

Following the Riksbank's decisions to reinvest parts of its bond holdings (SEK45bn until December 2020), postpone the first rate hike to late this year or early 2020 and flatten the repo rate path, we saw a significant market reaction with outperformance of SEK covered bonds and flatter curves.

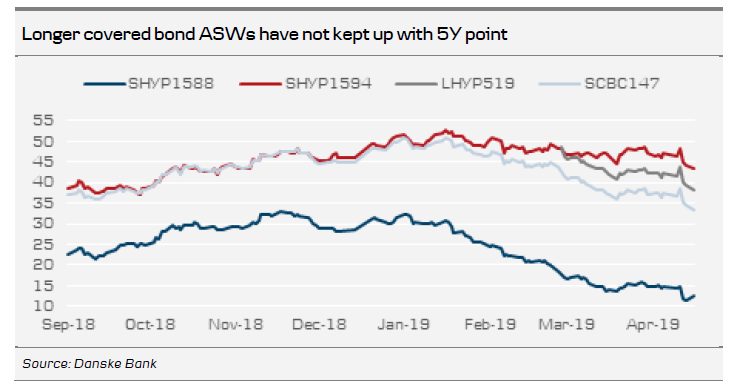

However, there are also opportunities further out on the curve. The longest covered bonds within the benchmark programmes, in particular SHYP1594 (September 2028, SEK5bn outstanding), LFH519 (September 2026, SEK3.7bn) and SCBC147 (June 2026, SEK21.2bn) have underperformed against the 5Y segment. These longer covered bonds are a bit less liquid and the outstanding volumes are smaller than the covered bonds with maturity up to 5Y. However, we think these bonds are attractive in a hunt-for-yield environment, for both real-money investors and repo-financed ASW investors.

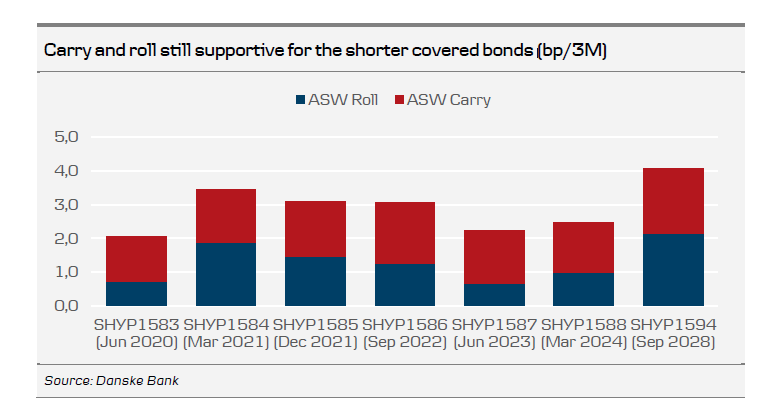

Although the levels in 5Y covered bond ASWs and the flattening of the curve could be motivated by a hunt-for-yield environment, we think there are other points of the covered bond curve that look more interesting for investors. From a pure carry and roll perspective, the 3Y segment still looks more attractive than the 5Y segment and we thus maintain our recommendation to buy SHYP1585 (Dec 2021) ASW.

However, there are also opportunities further out on the curve. The longest covered bonds within the benchmark programmes, in particular SHYP1594 (Sep 2028, SEK5bn outstanding), LFH519 (Sep 2026, SEK3.7bn) and SCBC147 (Jun 2026, SEK21.2bn) have underperformed against the 5Y segment, with the SHYP1594 actually trading cheaper in ASW terms than when it was issued in July 2018.

These longer covered bonds are a bit less liquid and the outstanding volumes are smaller than the covered bonds with maturity up to 5Y. However, we think these bonds are attractive in a hunt-for-yield environment, for both real money investors and repo-financed ASW investors. We note that the first nominal SGB with positive yield is the SGB1059 (Nov 2026), while the almost matching LFH519 (Sep 2026) yields 0.96%. Given the limited volume and liquidity in these longer maturities, we reason that pricing could adjust relatively quickly to investor flows.

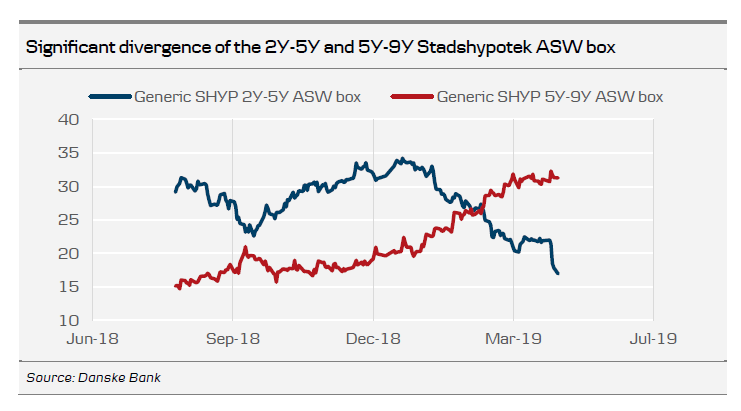

We recommend buying the longer covered bonds mentioned above either outright versus swaps, or in an ASW box against the 5Y segment. Thus, we recommend buying for instance LFH519 ASW versus SHYP1588 ASW at 27bp. We set the P/L levels at 15bp/36bp.