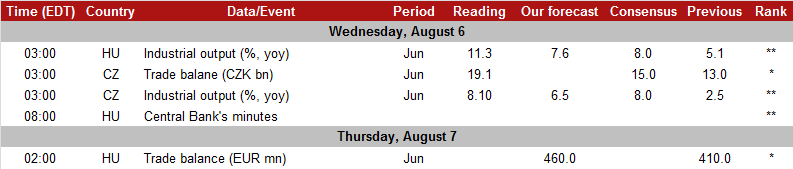

CALENDAR

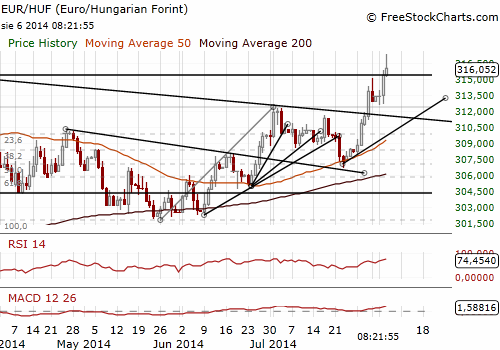

EUR/HUF

- The National Bank of Hungary released minutes from its recent rate-setting meeting. The bank said that eight of its nine rate setters backed a 20 bps rate cut last month. In the minutes the bank said also that one rate setter, Janos Cinkotai, voted to keep rates on hold. At July’s meeting the end of easing cycle was announced.

- Industrial output rose by an 11.3% yoy in June according to preliminary unadjusted data. The reading was better than median market forecast of 8.6% yoy. The annual rise was the fastest since November 2010.

- The European Central Bank said that Hungary's plans to force banks to refund borrowers for overcharging could hurt financial stability. Prime Minister Viktor Orban's government wants banks to pay for unfair charges and interest rate hikes applied on loans in the past and wants to get rid of foreign currency loans that are burdening Hungarian households. The new law says that the exchange rate spread applied in foreign currency loan contracts was void. Banks will have to recalculate the spreads based on the central bank's exchange rates. The law also declares unilateral interest and fee rises in loan contracts, for both forint-denominated and foreign currency loans, unfair and void unless banks challenge this provision and prove their right in court within tight deadlines. The new law applies to contracts that were signed between May 1, 2004, and the date when the law takes effect, except for those contracts which had already been closed more than five years before the legislation becomes effective. The National Bank of Hungary has estimated that the compensation could cost the banking sector even HUF 900 bn.

- The HUF touched its lowest levels against the euro since January 2012 and reached the daily high of 317.22 despite better-than-expected industrial output data. The depreciation of the HUF resulted from a rising threat of a direct intervention by Russia's military in Ukraine.

Significant technical levels:

Resistance: 317.30 (session high Aug 6), 324.20 (historic high Jan 5), 330.0 (psychological level)

Support: 312.50 (low Aug 5), 310.94 (low Jul 31), 307.60 (100-dma)

We have currently no trading positions on CEE markets.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.