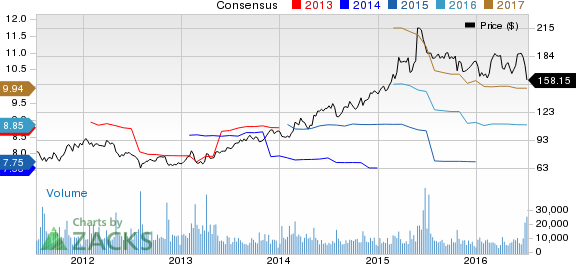

On Jul 11, 2016, shares of Humana Inc. (NYSE:HUM) dropped to a 52- week low of $152.34 on regulatory concerns over its deal with Aetna Inc. (NYSE:AET) . Over the past one year the stock has declined 16%.

Regulators have been increasingly scrutinizing the Aetna-Humana deal since it will create a company holding the largest market share of the highly coveted Medicare Advantage plan.

Medicare government will comprise 47% of the combined company’s business and account for about 65% of total revenue. They will together be the largest provider of Medicare Advantage (MA) plans by a large margin. This will lead to a greater concentration of the company in MA business which is enjoying huge demand due to the high aging baby boomer population. It is feared that the emergence of a single big MA player can be unfavorable for consumers in the form of high premiums and low service quality.

In an effort to win over regulators, Aetna took steps to sell off its MA assets in markets which had significant business overlap. This move, however, failed to satisfy the regulators and investors are skeptical over the stock as they doubt whether that the deal will at all materialize.

Investors were happy with the deal with Aetna as it would have elevated Humana from its current fifth position in the market to the second rank. Now that the deal is on tenterhooks, investors are concerned about the Humana stock.

Nonetheless, Humana carries a Zacks Rank #2 (Buy). Other stocks in the same space that are worth considering include WellCare Health Plans, Inc, (NYSE:WCG) with a Zacks Rank #1(Strong Buy) and Centene Corp. (NYSE:CNC) with a Zacks Rank #2.

AETNA INC-NEW (AET): Free Stock Analysis Report

HUMANA INC NEW (HUM): Free Stock Analysis Report

WELLCARE HEALTH (WCG): Free Stock Analysis Report

CENTENE CORP (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research