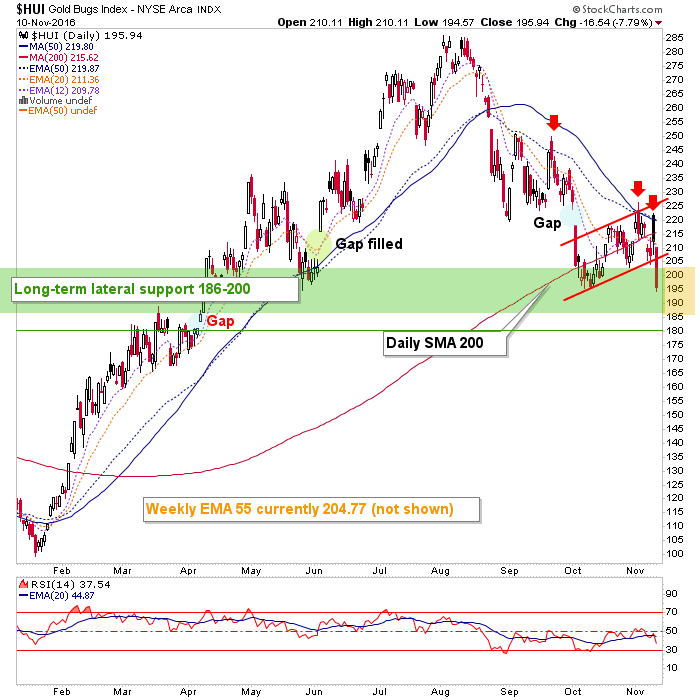

HUI has been targeting as low as the gap at the 180 area for months now, since losing the 50-day averages. This chart is one of a few that we’ve used to manage the process of a correction that was well earned.

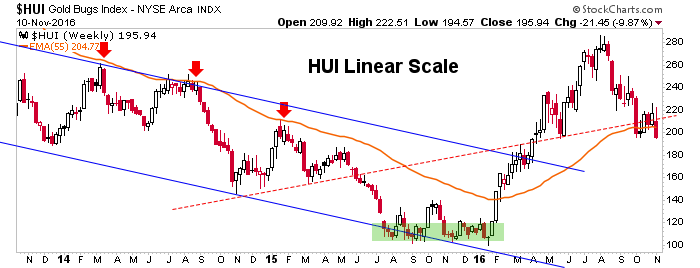

Here is a simple one that shows the 55-week moving average as a key support parameter that needed to hold in order to avoid a date with the gap at 180. In breaking down from the daily bear flag above, it has now lost the EMA 55 and 180 is loaded.

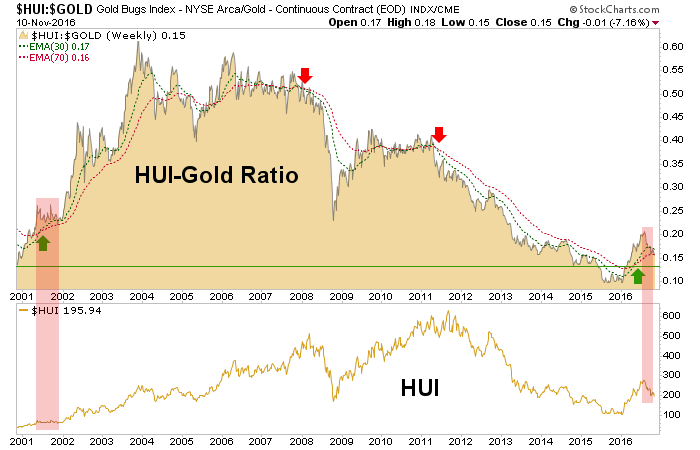

The correction that began over 3 months ago was originally projected to last several months using the HUI-Gold ratio ‘comp’ to what happened in 2001.

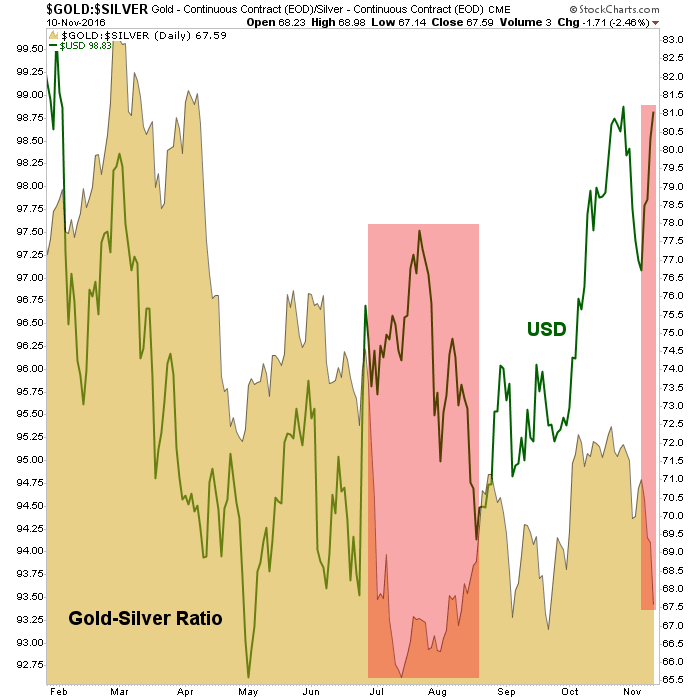

Finally, a curious divergence in the 2 Horsemen. I mean I know that Trump is making America great again and all, but how long can America feast on the risk-on, inflationary signaling of a declining Gold-Silver ratio while the US dollar rockets in the other direction? The relationship disconnected when the precious metals topped last summer and now it is doing it again, obviously to the detriment of the PM complex. The Gold-Silver ratio is acting like the VIX right now and has been hammered, while Uncle Buck is sporting himself a little Trump Tower in his pants.

At some point equilibrium will come back into the markets but for now, the post-Brexit election landscape is a little wacky. Let’s let them party since we (NFTRH, with its favored plan) led them to the damn party in the first place. Meanwhile, as I have been saying, people should not be gold bugs in a vacuum or even listen to other people who only know how to talk about gold. I mean, we’re in the 4th month of a correction, and it will not end until the obsessives are thoroughly sanitized.