As I pen this article, gold is set to close the month and the quarter above $1400/oz and holding the majority of its recent gains. That does not necessitate continued strength but it is a good sign.

The technicals and fundamentals are finally in place for gold. It is outperforming all major currencies and the Federal Reserve is weeks away from beginning a new cycle of rate cuts. The U.S. dollar has broken its uptrend.

Gold's near-term outlook is very strong, but if the Federal Reserve cuts three or four times and gold strongly outperforms the stock market, then this move can go to $1900/oz. But let’s focus and the here and now.

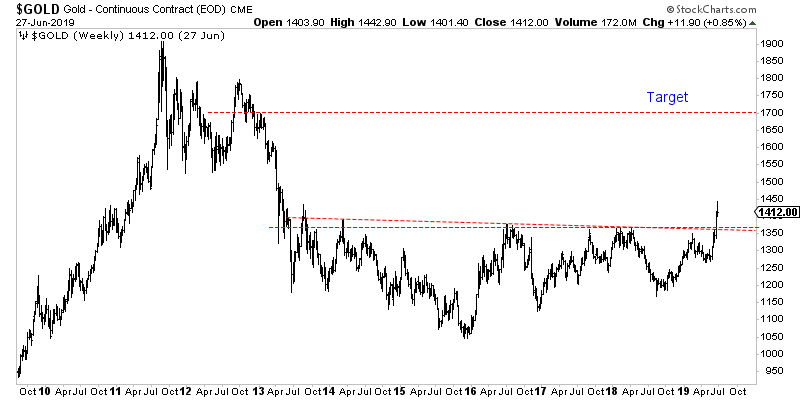

This breakout in gold potentially has quite a bit of room to run. The weekly chart below shows how there is very little resistance from $1420/oz to the low $1500s. Moreover, there are strong measured upside targets of $1600/oz to $1700/oz.

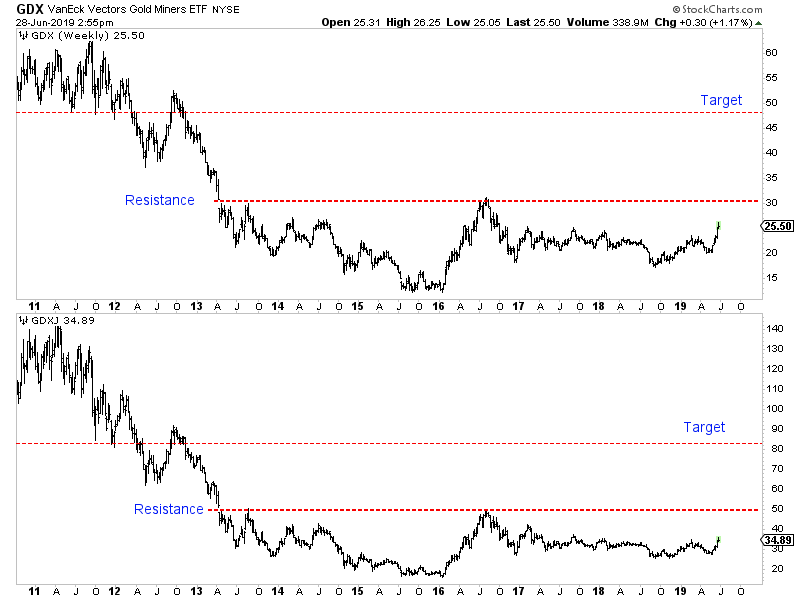

If gold is going to trend higher towards $1600-$1700/oz, then the gold stocks are going to run much higher. The VanEck Vectors Gold Miners ETF (NYSE:GDX) is trading below $26. A break past $30-$31, would trigger a measured upside target of almost $50.

The VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) is lagging both gold and GDX but we know it can catch up quite quickly. First it needs to reach resistance at $50. A clean break past $50 triggers an upside target of ~$83.

If the Fed does cut rates three or four times and either the greenback cracks more or gold outperforms the stock market, then gold should be able to reach the $1700/oz target. If only one of those things happens then the yellow metal still has a good shot to hit $1550/oz.

If the breakout gains traction, then the gold stocks, which have strongly outperformed in recent weeks, will continue to outperform. That is how these type of moves work. As we noted last week, be wary of over anticipating a correction. Bull moves tend to remain overbought with overly bullish sentiment. The perfect entry point is behind us.

That being said, if gold does snap back to $1370-$1380/oz for a retest, then that would be the time to put more capital to work, and aggressively so if you missed the last move.