HP Inc. (NYSE:HPQ) just released its fourth-quarter financial results, posting earnings of $0.44 per share and revenues of $13.93 billion. Currently, HP is a Zacks Rank #2 (Buy), and is down almost 5% to $21.35 per share in after-hours trading shortly after its earnings report was released.

HP:

Matched earnings estimates. The company posted earnings of $0.44 per share, matching our earnings estimates of $0.44 per share.

Beat revenue estimates. The company saw revenue figures of $13.93 billion, topping our consensus estimate of $13.25 billion.

HP reported fourth-quarter earnings of $660 million. On top of that, the tech giant’s Q4 revenues jumped 11%. For the full-year, the technology company reported EPS of $1.48 and $52.06 billion in revenues

For the first quarter of 2018, HP expects EPS in the range of $0.40 to $0.43.

“Our results demonstrate that HP is strong and getting stronger” CEO Dion Weisler said in a statement. “We posted top-line growth across both Personal Systems and Print, with broad-based, double-digit growth in all three regions, while also growing operating profit and non-GAAP EPS year-over-year.”

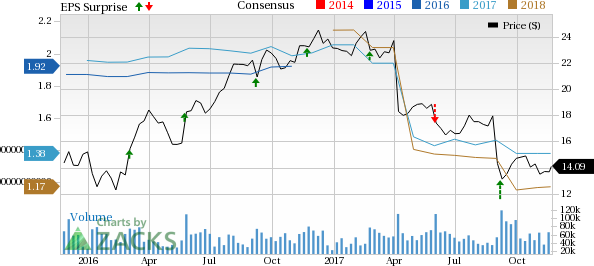

Here’s a graph that looks at HP’s Price, Consensus and EPS Surprise history:

HP Inc. is the surviving entity following the November 2015 split of Hewlett-Packard Company into publicly traded entities - Hewlett Packard Enterprise Company and HP Inc. The company's focus will be on the PC and printing products and services. HP Inc. is headquartered in Palo Alto, California.

Check back later for our full analysis on HP’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

HP Inc. (HPQ): Free Stock Analysis Report

Original post

Zacks Investment Research