The likely date of the first interest rate hike by the US Federal Reserve (Fed) draws ever nearer. Janet Yellen, the chair of the Fed, reiterated recently that it would be appropriate to start the process of raising rates at some point this year. The excessively easy monetary policy in the US over the last seven years has led to significant capital flows to emerging markets (EMs) in search of yield. The normalisation of US monetary policy could reverse these capital flows, as it did in mid-2013 during the so-called taper tantrum. What lessons can EMs learn from the 2013 taper tantrum ahead of the expected first Fed rate hike later this year?

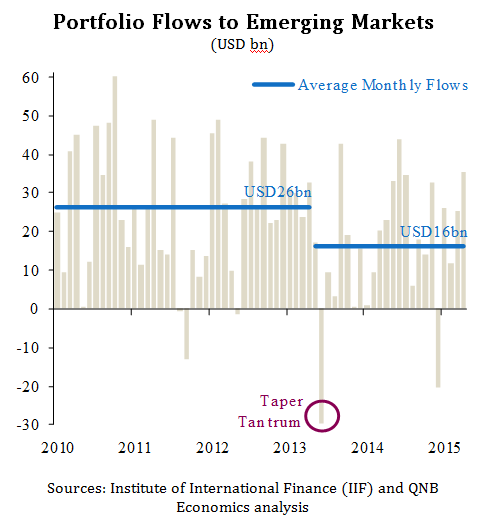

In May 2013, the Fed triggered the taper tantrum when it announced the possibility of reducing the pace of its asset purchases programme. Yields on U.S. 10-Year treasuries rose from 1.7% at the end of April 2013 to 2.5% at the end of June. As US yields rose, EMs experienced USD29bn of net capital outflows in June 2013 alone, compared with average inflows of USD26bn per month in the prior 3.5 years. This forced EMs to react in three ways.

First, by the end of August 2013, a number of major EMs had increased interest rates. India was the most aggressive, raising its lending rate 2% on July 15; Brazil increased policy rates by 1.5%; Indonesia by 1.25%; and Turkey raised its lending rate by 0.75%. Higher interest rates may help to mitigate outflows in the short term, particularly during a crisis. However, they will also suppress economic growth by making it more expensive to borrow. For most EMs, prompt tightening of monetary policy appears to have helped stabilise the situation, with net capital inflows recovering to an average of USD16bn since the taper tantrum.

Second, some EMs made tax and legal changes to encourage capital inflows and limit outflows. Brazil eliminated a 6% tax on foreign bond investment and a 1% tax on currency derivatives (introduced a few years ago when the Brazilian real was appreciating too quickly). India removed a cap on foreign equity ownership in telecoms, introduced incentives for non-resident Indians to deposit their savings in India, and introduced restrictions on gold imports to reduce the large current account deficit.

Finally, capital flight led to sharply weaker exchange rates, despite the fact that a number of EMs intervened to support their currencies, draining foreign exchange reserves. The Indian rupee fell the most, down 22% by the end of August; Brazil’s real fell 19%; Indonesia’s rupiah fell 15%; and the Turkish lira was down 14% over the same period. The benefit of weaker exchange rates is that they make exports more competitive and imports more expensive, helping to reduce current account deficits. However, there are also trade-offs as weaker exchange rates increase the burden of foreign currency debt. In India, where foreign currency debt is only 16% of GDP, the weaker exchange rate probably worked in the country’s favour, helping to reduce the current account deficit from 4.9% of GDP in 2012 to 1.7% in 2013. However, in Turkey, where foreign currency debt is 47% of GDP, the weaker exchange rate may have been more of a drag on growth.

As EMs brace themselves for another possible round of capital flight as the Fed tightens monetary policy, potentially starting this year, they are likely to look back at what lessons they can learn from the 2013 taper tantrum. The trade-offs between growth and stability will differ from country to country, but a mix of policies seemed to have guided EMs through the taper tantrum. Tighter monetary policy as well as temporary and targeted legal restrictions should help to ease capital outflows, while allowing the exchange rate to depreciate could help achieve a painful but quick adjustment to the current account deficit.