Nike Inc (NYSE:NKE)

Consumer Discretionary - Textiles, Apparel & Luxury Goods | Reports March 28, After Market Closes

Key Takeaways

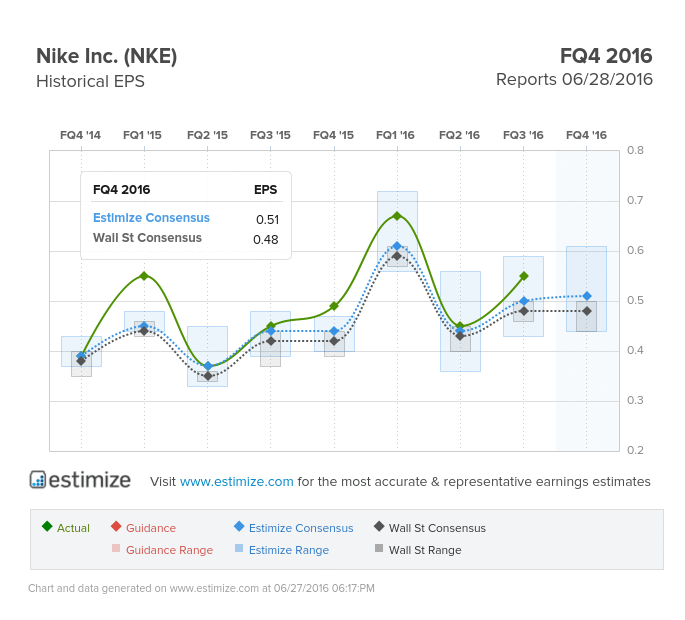

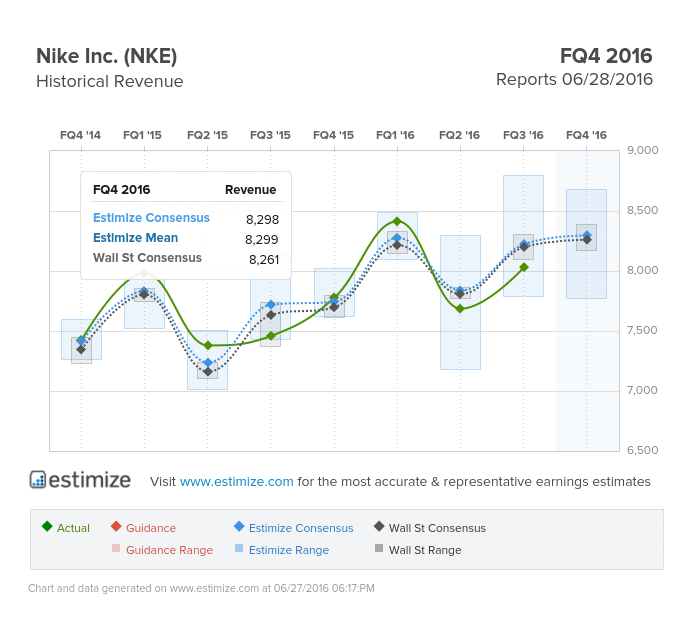

- The Estimize consensus is calling for earnings per share of 51 cents on $8.30 billion in revenue, 3 cents higher than Wall Street on the bottom line and $37 million on the top

- Nike is looking to leverage the major sporting events as a platform to advertise and drive merchandise sales

- Foreign currency headwinds and the looming uncertainty following Brexit could adversely impact margins in the near future

Headlining this week of earnings is multinational athletic and footwear manufacturer Nike. The Nike swoosh is an iconic part of American history contributing to the company’s long streak of growth and success. However, expectations this quarter are rather muted compared to past performance. This likely has to do with the weaker spending environment and rising competition from Under Armour Inc (NYSE:UA) and Adidas (DE:ADSGN). Future performance will certainly be hurt by the Brexit vote given Nike’s international presence.

The Estimize consensus is calling for earnings per share of 51 cents on $8.30 billion in revenue, 3 cents higher than Wall Street on the bottom line and $37 million on the top. Compared to a year earlier this reflects a 4% increase in earnings and 7% in sales. Revenue growth is largely in line with past performances but earnings growth had been over 20% for the past 7 quarters. Muted expectations coupled with increasing uncertainty has driven shares down 17% year to date.

Despite its size and reach Nike continues to astound investors with robust growth. The past 7 quarters have featured double digit bottom line growth and mid single digit top line growth. Nike’s primary focus in the past few years has been expanding its direct to consumer business. This has been the highest margin margin sector with the most impactful product cost per unit.

The sporting event’s calendar has worked favorably in 2016. Besides the annual events sports fans also get the Euros and Olympics this summer. Merchandise sales from these events and continued growth in China and emerging markets should offset some of the negative effects of Britain leaving the Union.

Nike will undertake heavy advertising investments to ensure they are featured at at the upcoming sporting events. This will likely weigh on the company’s bottom line and with foreign currency trending downwards, margins might see more trouble. Under Armour also has less exposure to the pound and the U.K. and may gain some market share on Nike if Britain falls into recession.

Do you think NKE can beat estimates?