Here is a simple way for investors to take advantage of a generational opportunity utilizing a value approach to equity markets today. A while back, Research Affiliates introduced its Fundamental Indexes, available in ETF form at Charles Schwab (NYSE:SCHW). These represent fixes for the two greatest problems with traditional passive investing.

The first problem for traditional passive indexing is that a market-cap weighted methodology gives a greater allocation to individual equity the more overvalued it is and a smaller allocation the more undervalued it is.

In other words, it systematically does the opposite of what a value investor like Warren Buffett attempts to do in limiting risk and maximizing return through valuation. As Rob Arnott recently put it, passive investors are “chasing growth,” and abandoning value, via this methodology even if they don’t know it.

The second problem is related to a change made to the methodology of passive investing back in 2005. At this time, index fund providers realized they couldn’t efficiently allocate to equities that had low float (shares available to trade by the public) so they modified the market cap-weighting to adjust for this.

Essentially, companies with large insider ownership are systematically underweighted by the index and companies without are overweighted. Furthermore, net insider buying means the index must underweight a stock and net insider selling means the index must overweight, precisely the opposite of what you would intuitively try to do as an intelligent investor.

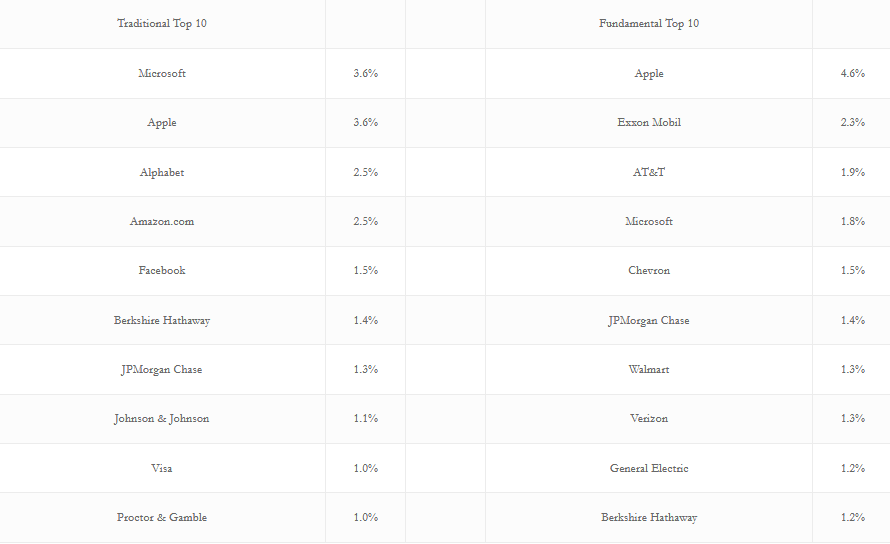

Fundamental Indexes simply weigh stocks differently than these traditional passive indexes and, in doing so, they provide a much more efficient and logical way of investing in a passive way. As a result, the composition of the fundamental index is dramatically different and you can see this in the top 10 components of it versus the traditional total stock market index.

Yes, there is some overlap between the two but notice how stocks like Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) don’t even make the top ten in the fundamental index.

This is simply because they don’t generate the sales and cash flow to qualify as a top ten company under the improved methodology. You may also notice that Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) don’t show up in the Traditional Index. This is due to the fact that the stocks are currently out of favor even though they do qualify as top ten companies based on their fundamental, not price, performance.

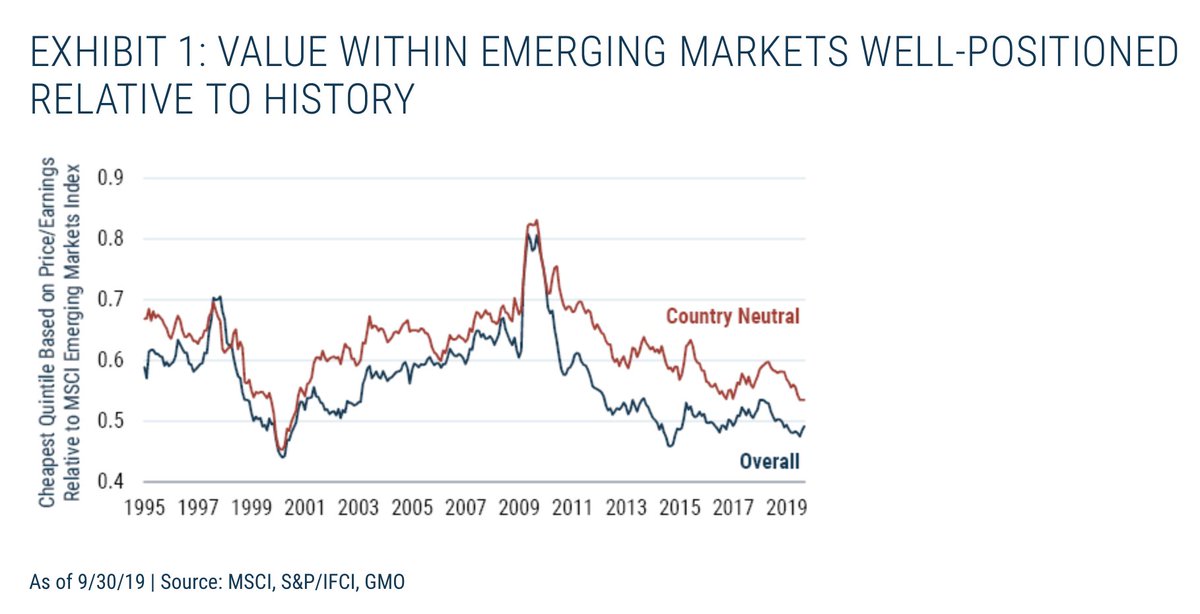

Do this across the entire equity universe and you get a portfolio price-to-earnings ratio of 16.86 for the fundamental index rather than 20.34 for the traditional index. If you understand the margin of safety concept, then this difference is important. The discount of the fundamental index gives it both greater downside protection and greater potential upside than the traditional index. And when you apply this concept to other equity markets, which are cheaper than our own, you can begin to understand how diversifying into these other asset classes by using an improved methodology can make a great deal of sense today. Emerging markets represent especially good value relative to the U.S. today and when implementing a passive methodology that doesn’t chase growth they look especially attractive.

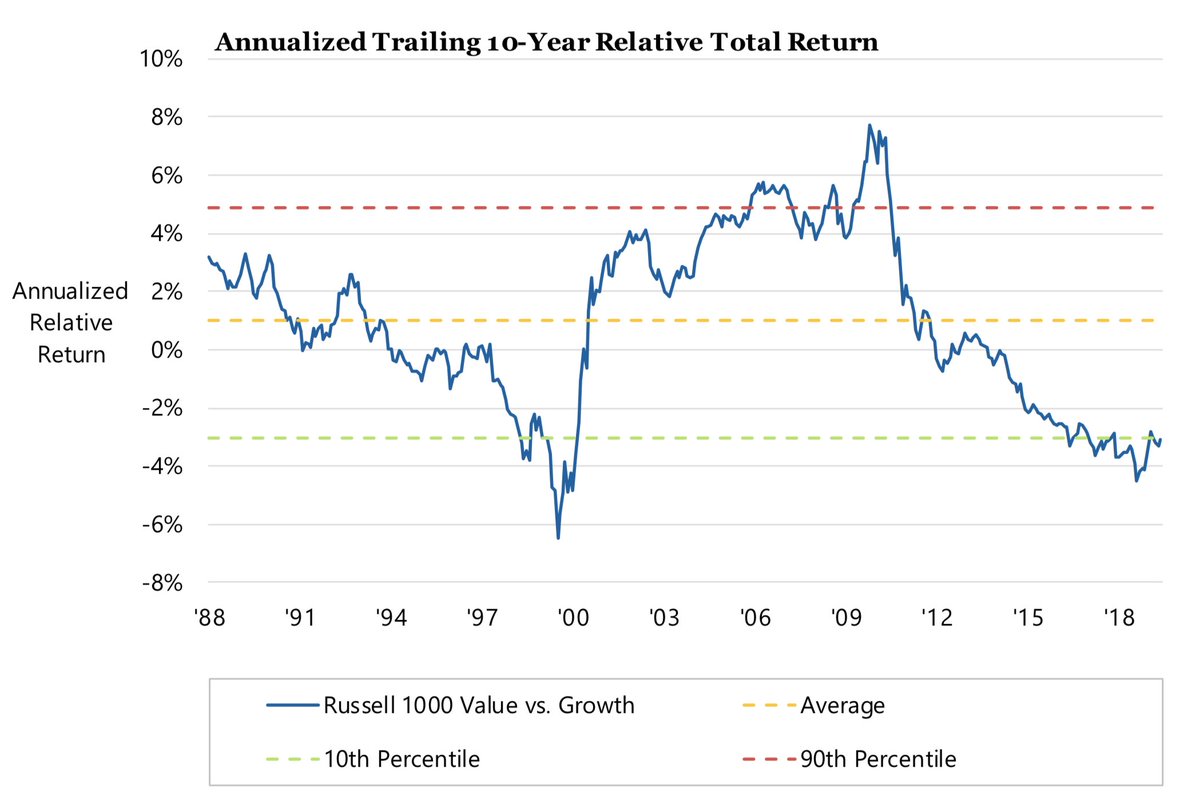

All of this is to simply suggest that investors using an improved methodology like fundamental indexing will be doing much to ameliorate the risks traditional passive investors are taking today while also positioning themselves to take advantage of the nascent renaissance in value. That is not to say that fundamental indexes won’t decline along with traditional ones in a major bear market but it’s my estimation they will likely outperform by losing less. And those who are simultaneously allocating to emerging with the same methodology will likely be happier with that mix than most investors putting all their equity exposure into the traditional, float-adjusted, market-cap-weighted U.S. index.