Zacks Investment Research employs several proprietary methodologies and techniques to make it easier for investors to detect top stocks at any given point in time. Let’s take a look at a recent example of how to put the various Zacks Ranking systems to good use in today’s market environment.

One approach to extracting the most value out of what Zacks has to offer is to implement a top-down approach. With this investment tactic, we’ll start with leading stock market sectors that are identified by our Zacks Sector Rank system.

Zacks Sector Rank: Improve Your Stock-Picking Success

The Zacks Sector Rank is a great top-down method that puts the odds of investment success in your favor. It is calculated by determining the average Zacks Rank for all of the individual stocks in a given sector and then assigning an ordinal rank to that sector. The Zacks Rank is based on the most powerful force impacting stocks prices which is earnings estimate revisions (more on this below). Zacks classifies all stocks into one of 16 sectors. The Zacks Sector Rank is calculated each and every trading day.

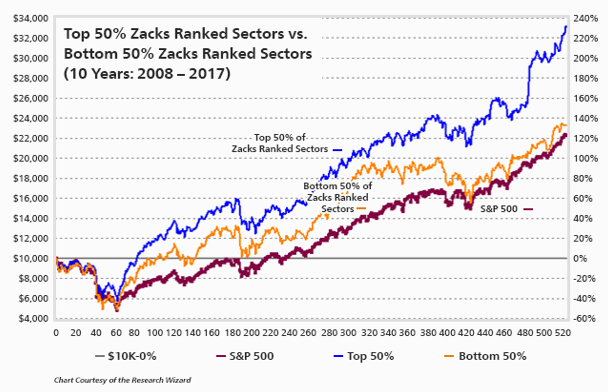

According to our 10-year backtest, stocks within the top 50% of Zacks Sectors beat the bottom half by nearly twice as much. This serves as clear evidence that stocks trading within the top 8 Zacks Sectors can give your stock-picking a decisive advantage.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Starting with this point, we’re going to target the Zacks Finance sector, which currently ranks in the top 13% of all sectors.

Zacks Industry Rank: Locate Stocks with the Best Profit Potential

A plethora of historical research studies have consistently shown that approximately half of a stock’s price appreciation is due to its industry grouping. Investing in stocks within leading industry groups provides a constant ‘tailwind’ to our success. We can use the Zacks Industry Rank to locate stocks with the most potential to outperform in the future.

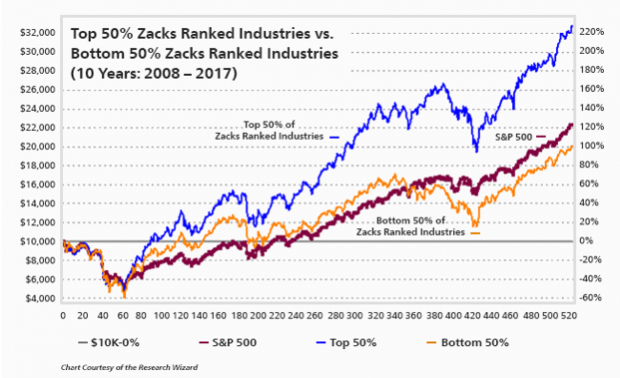

Our industry ranking system sorts companies into more than 250 industry groups. The Zacks Industry Rank is calculated by averaging the Zacks Rank for all individual stocks within a specific industry. Similar to the sector analysis, our 10-year backtest has shown that stocks within the top 50% of all Zacks Ranked Industries outperformed the bottom half by a factor of more than 2 to 1.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Once the top industry groups are identified, we can peel back the curtain to find stocks with the highest Zacks Rank. In our example, we’re going to target the Zacks Banks-Foreign industry group which ranks in the top 37% of all industries.

Zacks Rank: Putting It All Together

The Zacks Sector Rank and Zacks Industry Rank are linked to our ranking system for individual stocks – the Zacks Rank. The Zacks Rank harnesses the power of earnings estimate revisions, which history has shown is the most powerful force impacting stock prices over time. Stocks with rising earnings estimate revisions have significantly outperformed the S&P 500 year after year. This ranking system uses five different ranks: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell), and #5 (Strong Sell).

The Zacks Rank has made the process of identifying top stocks with improving earnings estimates simple (and very profitable). Since 1988, the Zacks Rank #1 (Strong Buy) stocks have generated a 25.4% annual return versus the 11.2% annual return for the S&P 500. Zacks Strong Buy stocks have also outperformed the S&P 500 in 27 out of the 33 years that we have been tracking the data. Only the top 5% of stocks receive the coveted Zacks Rank #1 (Strong Buy) rating.

Our top-down process narrows the investable universe, starting with Zacks Finance sector (top 13%) and followed by the Zacks Banks-Foreign industry (top 37%). Let’s take a look at a leading Zacks Strong Buy stock contained within this top sector and industry combination.

UBS Group AG (SIX:UBSG) (UBS)

UBS Group AG provides financial advice and solutions to institutional, corporate, and private clients globally. The company offers a host of financial-related services such as personal banking, investment advice and solutions, lending, wealth planning, asset allocation, and investment banking. UBS was founded in 1862 and is headquartered in Zurich, Switzerland.

UBS reported Q4 results on February 1st that exceeded analyst estimates. Fourth-quarter EPS came in at $0.38, beating the Zacks Consensus Estimate of $0.24 by 58.33%. Net profit for the Swiss bank rose 14% to $7.46 billion in 2021, which marked a 15-year high. On the back of the impressive yearly totals, UBS management announced that it will double share buybacks, launching another $5 billion worth of repurchases for 2022.

UBS has surpassed earnings estimates in the past several quarters and boasts a trailing four-quarter average earnings surprise of +44.79%. Shares have risen in stride, advancing nearly 39% over the past year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in little more than 9 months and NVIDIA (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research