Investing.com’s stocks of the week

A number of indicators are used at Schaeffer's to assess the temperature of a stock, and to better understand trader sentiment. One of the more ubiquitous indicators is the Schaeffer's put/call open interest ratio, or the SOIR, which measures a stock's short-term open interest and can be used to gauge near-term option traders' expectations.

What Exactly is the SOIR?

The SOIR is a sentiment indicator that measures near-term open interest -- or the number of call and put contracts that have been bought or sold to open but have not yet expired. An equity's SOIR is calculated by dividing the number of open put contracts by the number of open call contracts that are set to expire within the next three months.

For instance, a SOIR reading below 1.0 suggests that calls are more prevalent than puts among near-term options, while any ratio above 1.0 means that puts are more popular. A ratio of 1.0, of course, indicates that near-term puts and calls outstanding are roughly equal.

Arguably more important, however, is how this ratio compares to all other readings from the past 52 weeks; this percentile ranking can reveal extremes among near-term traders. For instance, a SOIR that ranks in the 100th percentile of its annual range would indicate that near-term puts haven't been more popular in the past year, while a 0% ranking would mean near-term traders haven't been more call-biased in the last 52 weeks.

Using the SOIR in Real Time

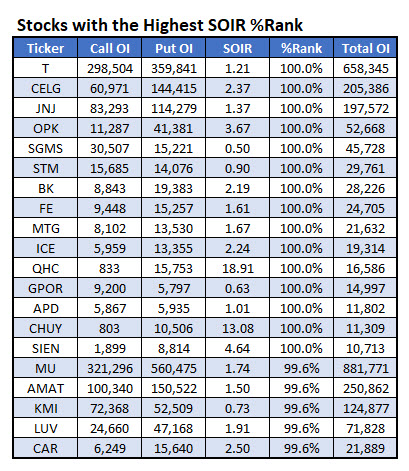

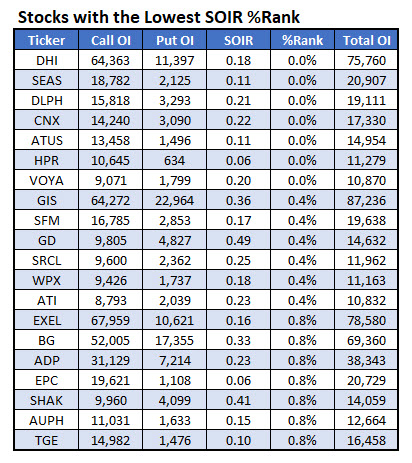

Provided by Schaeffer's Senior Quantitative Analyst Rocky White are two tables with stocks that carry at least 10,000 contracts in open interest and have extreme SOIRs right now.

For instance, hospital operator Quorum Health Corp (NYSE:QHC) has an extremely high SOIR of 18.91, which sits in the 100th percentile of its annual range. This means that short-term put open interest is outnumbering call open interest by the widest margin in at least a year. On the surface, this would suggest near-term traders are bearish on QHC.

On the flip side, telecom concern Altice USA Inc (NYSE:ATUS) sports a modest SOIR of 0.11 that sits below nearly every other SOIR from the past year. This means that near-term option traders have rarely been more call-heavy on ATUS in the past 12 months, which on the surface could suggest heightened optimism.

It is important to remember that this indicator should not be used on its own when assessing options trader sentiment, especially because it includes both bought and sold options. The SOIR should be used in tandem with other key technical and sentiment indicators, and should be considered just one component of our Expectational Analysis methodology.