That will certainly be the most common decision made by Americans as the calendar flips into 2014, whether it’s a conscious one or not. Because the stats don’t lie…

Currently, two-thirds of adults (and nearly one in three children) are overweight or obese, according to the U.S. Surgeon General.

No wonder “losing weight” is the most popular New Year’s resolution year in and year out.

Always the opportunist, I find myself wondering if this is a tradable phenomenon. So I decided to dig into the numbers to find out.

Let’s just say that the results were more shocking than the number of people who actually keep their New Year’s resolutions.

‘Tis the Season

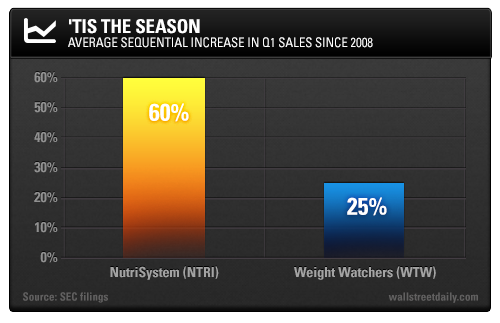

The sudden urge to slim down each New Year definitely boosts sales for leading weight-loss companies, NutriSystem, Inc. (NTRI) and Weight Watchers International, Inc. (WTW).

Their first-quarter sales have improved sequentially over the past six years – by an average of 60.2% and 25.1%, respectively.

Now, plenty of companies witness such severe seasonality – particularly in the retail sector. And as investors come to expect it over time, this shouldn’t be an exploitable phenomenon.

Well, that’s where the shock comes in…

Another Market Myth Gets Busted

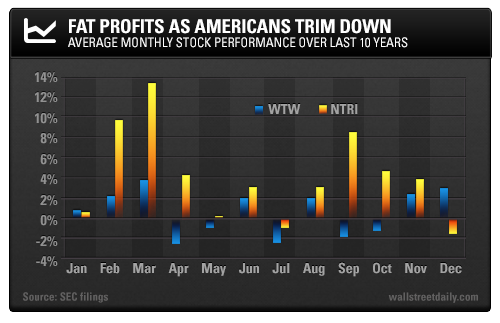

Over the last decade, both NutriSystem and Weight Watchers averaged gains in the first three months of the year. And February and March represent particularly positive months, meaning the strong sales results coincide with strong stock returns.

(Consider this the latest proof that efficient market hypothesis is total bunk.)

Now, what about the inconsistent performance during the middle of the year? Well, it’s hardly coincidental…

After all, 36% of Americans give up on their New Year’s resolutions within one month, 54% cry uncle within six months, and only a pathetic 8% keep their resolutions all year, according to research out of the University of Scranton.

Essentially, as more customers bail – forcing the companies to adjust sales guidance – investors head for the exits, too.

Like clockwork, though, investors return near the end of the year in anticipation of a new crop of weight-loss resolutions.

Again, this stock market seasonality shouldn’t exist. But it does, making now an attractive time to consider entering a position.

Careful, though! Only one of these stocks represents a solid investment.

Choose Wisely

All signs point to NutriSystem being the best bet.

It averages positive returns 66% of the time in the first quarter of the year, compared to 43% for Weight Watchers.

February is historically the best month for the stock, with positive returns an impressive 90% of the time over the last decade.

A quick glance at the fundamentals seals the deal.

NutriSystem might be trading at a higher valuation than Weight Watchers, with a forward price-to-earnings ratio of 25.7 versus 11.2. But it’s deserved.

Analysts expect the company to boost sales and profits by 15% and 65%, respectively, next year. In comparison, Weight Watchers is expected to witness an 8.5% decline in sales and almost a 10% decline in profits in 2014.

Bottom line: Self-improvement goes hand in hand with the New Year. And profits can, too, now that you know how to cash in on Americans’ inability to commit.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How To Trade New Year’s Resolutions

Published 12/19/2013, 06:27 AM

Updated 05/14/2017, 06:45 AM

How To Trade New Year’s Resolutions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.