Thousands, I tell you. Hail Mary, save us from the terror.

With the requisite large italicized bold font and collage of tearful family beside a smoking wreck of a home, designed to strike fear into the heart of the reader, grab their family in clutched embrace in seek of “safety” I, on the other hand, remained unfazed. Like James Bond in the face of danger I smiled to myself and began running the math with the help of my trusty laptop.

I reckon I’m made of far sturdier stuff, something which I credit to the immense amounts of peanut butter consumed as a child, resulting in my now imperviousness to fear driven marketing, it was clear to me that on a percentage basis most folks don’t return home from a days work to find their home in smoking ruins with little charred teddy bears lying on the front lawn. Thank heavens for facts.

I looked at a few countries in order to get a decent blend. Countries I chose:

- the United States (lots of data and lots of homes and people)

- Australia and

- New Zealand, both countries with large middle class populations.

My blended result came in at 0.26%.

This means that I, along with many readers who may happen to own real estate in any of these countries have less than 1% statistical chance of our property burning down. Heck, less than a half a percent. Though the risk is tiny, I am inundated with providers who will sell me insurance to cover this fractional risk. Insurance is ubiquitous on homes and in many countries mandatory, should you have a mortgage. In this particular instance, the cost of insuring my home comes in at roughly $2,500 per year.

Comforted by both the fact that my home has less than half a percentage point chance of self combustion, that peanut butter consumption was not for naught and I can rationally assess my risks, and further comforted by the knowledge that should the terrible actually occur, I am able to cover that risk with a few grand a year. All this got me thinking of the REAL risks that do threaten peoples homes. You know, something with a higher probability than a meteor strike, something far more likely… like a stock market bubble or crash, for example.

Something like….

Interest rate risk

In a recent conversation I had with a friend who is a professional valuer, I asked him how business was. His response… great. I asked what was driving this and his immediate answer – cheap money.

When we speak of interest rate risk what we’re really looking at is bond market risk. In order to really get to grips with how mammoth this problem really is our team has been hard at work putting together a dedicated report on global debt. Present subscribed readers to Capitalist Exploits will get it as soon as we complete it. It promises to make you laugh, cry, run in terror or begin positioning yourself accordingly.

I then had a conversation with Brad Thomas trader of the Capex Asymmetric Trader, and relayed the insurance data I’d found. This laid the ground work for long discussion on how with each passing day the risk to the bond market grows and with it the risks to literally millions of financial assets supported by or tied to the bond markets.

The very real fact that much of financial engineering is tied in some shape or form to the bond markets and global interest rates is of course not lost on central bankers. At the root of the immense bond bubble we find ourselves in is this knowledge. Unwinding this bubble is now simply impossible as the numbers are simply too large and so unlike my risk to fire burning down my house, rising interest rates poses far greater a risk to any mortgage holder than is currently understood or anticipated by market participants.

Brad, being the ever optimistic trader, sees opportunity in insanity and in his own words “would rather profit than cry when this all goes sideways”. At the very least, buying insurance against problems in the bond market, causing a spike in interest rates and thus mortgage payments strikes me as smart.

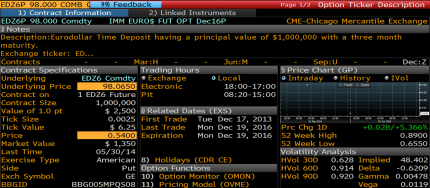

Brad shared with me the graph below of the Eurodollar and the contract specs of the December 2016 expiration $98 strike put option. Now, the Eurodollar, if you’re not aware, is a US dollar deposit in a non US financial institution. Eurodollar futures represent the interest rate risk on these deposits.

As Brad explained to me one can buy a put option on the December 16 expiration Eurodollars (2.5 years to expiration) for $0.54 which will cost $1,350. Break even will be at $97.46. In essence, expectations of 3 month rates have to increase by 50 basis points within 2.5 years. This doesn’t seem a heavy price to pay.

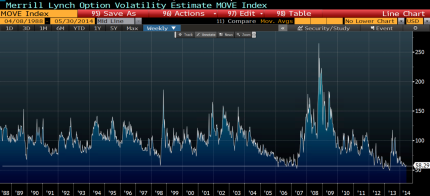

Below is the MOVE Index (volatility of 3 month to expiration options on at the money options trading on the US 2,5,10, & 30 year Treasuries). Note this isn’t the volatility of the Eurodollar, but if there was an index of the volatility on Eurodollars then it would look very similar to this. In essence, volatility on Treasury options is very, very cheap. With volatility being this cheap there is absolutely no reason why anyone needs to employ leverage to get a geared payoff to the yields rising.

People all over the world today are paying thousands of dollars insuring their homes against fire, theft and “acts of God”. At the end of the year none of them turn around and say “wow that was a failed investment, I never got to collect on that policy”. If I had mortgage debt, the very first thing I’d be doing is insuring against the inevitable interest rate risk.

While it isn’t guaranteed that your house will burn down in the next five years, what is highly likely is that bond markets come under pressure and interest rates rise within the next five years. I know which insurance policy I’ll be taking out.