PREFACE

There has been a unique and profitable opportunity in Broadcom Limited (NASDAQ:AVGO) options that benefits simply from the stock not collapsing.

Broadcom Stock Tendencies

The company’s focus is in wireless and as a chipmaker that supplies chips to help speed up processing in cloud data centers. It used to be heavily reliant on Apple Inc (NASDAQ:NASDAQ:AAPL), but times have changed.

Broadcom is now the tech marvel that powers Apple’s iPhone, Samsung’s Alphabet Inc (NASDAQ:NASDAQ:GOOGL) Android driven devices, as well as Google Pixel smartphones with chips that reduce interference from other communications devices. As smartphones get smarter, the company has grown and now calls all three major phone makers a customer.

But, with the market near all-time highs it’s a reasonable question to ask if there is way to profit from Broadcom simply not seeing its stock drop a lot rather than a continuation of a stock rise. The answer is a resounding yes.

Getting Smart With Options

Selling an out of the money put spread benefits if the stock rises, but it also profits if the stock simply doesn’t drop a lot. It’s “semi-bullish,” but really, it’s just “not very bearish.” Here are the results of selling an out of the money put spread, every week, returned over the last 2-years in Broadcom Limited.

It’s curious how this strategy can actually be a loser even though the stock is ripping. But AVGO has some odd stock dynamics we need to address.

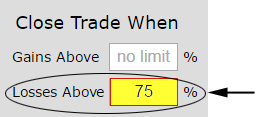

A smart approach to optimizing the reality of Broadcom’s stock dynamics is to let the winners run, but cut the losing put spreads off early. We can do this by putting in a stop loss. While a short put spread can lose upwards of 200% of its value, we can put in a rule:

In any week, if the put spread loses 50% of its value, let’s cut it off, and trade the next week.

We are effectively removing three-quarters of the downside risk.

We can do this with the tap of the mouse:

And here are the results, with the risk reduced strategy on the right and the old version on the left for ease of comparison.

We can see a 50 percentage point increase in return while reducing the risk dramatically. Yes, we have reduced risk by 75% and the return is actually higher.

IS THIS REALLY POSSIBLE?

If our analysis is correct, this stop loss implementation of shorting a put spread should have worked better than the normal strategy of just selling and holding for all time periods.

It turns out that this is exactly what we find. Here are the results, side-by-side, for one-year for AVGO:

We are focusing on the systematic adjustment to the strategy that took less risk and created more wealth. This has worked over the last 6-months as well:

What Just Happened

The key to option trading is quite simple — understanding the dynamics of the stock you’re looking at allows you to adjust the option strategy to reflect those dynamics.

This could have been any company — like Apple or Amazon (NASDAQ:AMZN), or any ETF and any option strategy. What we’re really seeing is the radical difference in applying an option strategy with analysis ahead of time, whether that’s a stop loss or avoiding earnings, or both. This is how people profit from the option market — it’s preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Thanks for reading, friends.

The author has no position in Broadcom Ltd(NASDAQ:AVGO) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.