For more than half a century, OPEC ruled the oil market. It decided how much oil would hit the market, which in turn set the price for its members.

Not everyone agreed with this system, but it worked.

Now, the tides are changing...

The reign of mighty OPEC is coming to an end. As Resource Strategist Sean Brodrick wrote earlier this year, “OPEC will fall into chaos and perhaps split into separate groups - the haves and the have-nots.”

Just last week, we caught a glimpse of what’s to come. OPEC failed to reach a deal to stabilize oil prices. The group also failed to agree on a new production ceiling and therefore did not change its output policy.

It’s no surprise.

Since 2014, OPEC has shifted away from protecting a fair market price for oil. Its new focus? Protecting its share of the oil market.

As a result, the group loosened caps on production quotas (the maximum output levels each member country was allowed to produce). And now, many OPEC countries routinely exceed their quotas.

To bolster prices, OPEC needs to regain control of production levels. It’s a big problem...

But it isn’t the group’s biggest problem.

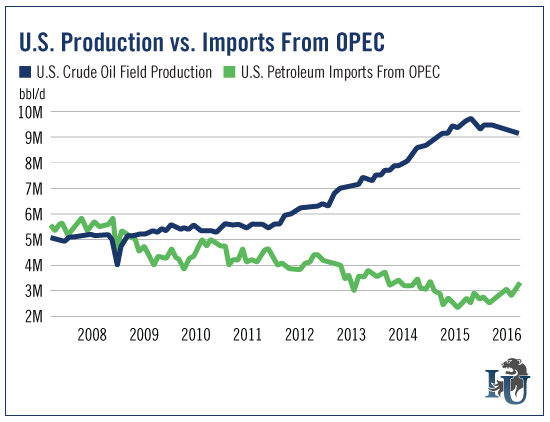

As you see in this week’s chart, OPEC’s share of the global oil market started slipping long before it relaxed its stance on production quotas. That’s thanks largely to the emergence of U.S. shale production.

Once OPEC’s top customer, the U.S. is now the world’s No. 1 oil producer. And the amount we import today is roughly half of what we were bringing in eight years ago.

It’s only adding to the pressure OPEC is feeling.

That pressure isn’t going away, either. As Sean wrote here,

“U.S. exports are ramping up as we start shipping oil to customers all over the world. And there are other forces at work, including interruptions in oil nations like Iraq, Venezuela and Nigeria.”

In that column, Sean talked about five companies that should do well in spite of the turbulent energy market. One company set to benefit most is EOG Resources (NYSE: NYSE:EOG).

It has invested heavily in ways to drill more accurately, which saves time and money. This, in turn, makes EOG’s wells more productive.

In a recent note, the company told investors that it will profit on some of its production at $30 a barrel.

So, even if prices take another dive, EOG should be able to make money. It’s a definite possibility - especially if OPEC can’t get a handle on production.