If you like train wrecks, you’re gonna love today’s article…

You see, since I started profiling companies using my C.H.A.O.S. tech stock screener, I’ve mainly focused on ones with strong upside potential.

Like Immersion (NASDAQ:IMMR), up 20% since May 10, and Ambarella (NASDAQ:AMBA), up 19% since May 24.

As the name suggests, the goal is to identify companies that are creating chaos within their industries and shaking up the status quo.

But C.H.A.O.S. isn’t just about sunshine and rainbows!

The strategy is also adept at pinpointing landmine stocks – ones that could blow up your portfolio.

Like the company I’m talking about today.

But in true C.H.A.O.S. style, I’ve got a way for you to profit, regardless…

~Cash

Pandora Media (NYSE:P) is like The Curious Case of Benjamin Button – the older the company gets, the younger it appears.

At this point, the internet radio firm is looking more like a startup. Only, it’s not. It was founded in 2000.

On the surface, Pandora seems to be killing it…

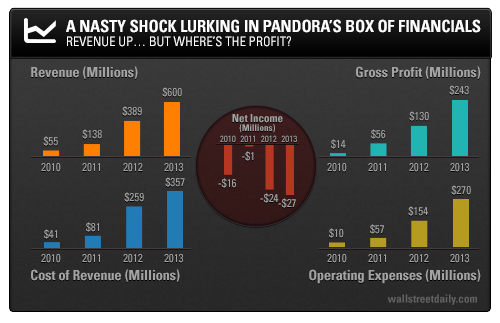

As you can see, the company has massive top-line growth, with annual revenue and gross profit soaring every year.

But when you look a bit deeper, you’ll see that Pandora doesn’t have a lot to sing about.

For example, while gross profit is nice, Pandora you can also see that isn’t turning a net profit.

Now, if you’re familiar with C.H.A.O.S., you’ll know that a lack of profit isn’t always a deal breaker. That is, if it’s a young micro cap and is making moves to emerge from the red.

However, that’s not the case for Pandora.

The company sports a $5.4-billion market cap.

And it isn’t pulling itself out of the red. In fact, it’s sinking even deeper. The reason?

Operating expenses.

Pandora can’t tame its wild spending. In 2013, for example, while Pandora’s gross profit rose by $113.5 million… its operating expenses rose by $115.8 million.

Ultimately, Pandora finished 2013 with $3 million more in net income losses.

The same was true for Q1 2014…

When compared to Q1 2013, Pandora’s gross profit increased by $51 million… but operating expenses grew by $42 million, which almost negated its gains.

For a company that’s as well established and as large as Pandora, you need to do a lot better than that if you want to stick around.

Especially when your rivals include the likes of Apple (NASDAQ:AAPL), which just teamed up with Beats – and Google (O:GOOGL) (NASDAQ:GOOG), which just acquired Songza for $15 million. That means Pandora’s advertising costs will soar in the coming years as the firm tries to stay relevant.

C.H.A.O.S. Meter: 5/20

~High Impact

When Will Glaser and Tim Westergren founded Pandora (under the Music Genome Project), their concept was simple: to create an individual radio station for every user, based on their music tastes.

To do that, they created an algorithm that factors in over 400 unique musical attributes and over 2,000 “focus traits” (i.e., tone, tempo, lyrics, vocal texture, emotional intensity, etc.).

Glaser developed the technology, and the musical input came from Westergren. It was a terrific concept.

But the men then teamed up with Jon Kraft to form Savage Beast Technologies, which steered the model away from the vision of the Music Genome Project.

So in 2004, Glaser and Westergren re-established the “choose your own music” idea under Pandora. When Pandora launched, it hit with extremely high impact, especially in tandem with the iPhone, where it became one of the first streaming music technologies for the mobile world.

Pandora’s technological innovations include…

- Music Genome Project: A database of over one million songs from over 100,000 artists within 500 genres and sub-genres. Pandora’s “playlist-generating algorithms” decide which songs play and in what order, based on users’ feedback.

- Comedy Genome Project: It hasthe same format as music, butpertaining to comedians and the comedy genre. This database holds over 25,000 tracks from more than 1,500 comedians.

Pandora’s mobile streaming technology ensures continuous playback, even when mobile reception is patchy. And Pandora’s automotive protocol works with manufacturers, suppliers, and after-market audio systems to deliver its service to cars.

By 2010, Pandora was one of the hottest companies around. But a lot has changed in four years.

Top of the list: competition.

It’s heated up to the point where Pandora has almost become paralyzed with fear. That’s bred inertia – and its technology that once defined the industry has become outdated.

Sure… its algorithms are proprietary… but there isn’t a single music-streaming company that can’t provide the same features as Pandora. And their features are more modern.

For example, Google’s newly acquired Songza selects songs for users based on their mood. Beats selects playlists based on users’ current environment.

But Pandora still doesn’t allow its users to rewind or repeat tracks. And they can’t skip more than 12 total songs every 24 hours. So it confines users to the songs it chooses for them, even though it doesn’t always get those tracks right.

Compare that with Spotify and other streaming services, which give listeners free rein over what they want to listen to, and when they want to hear it.

Thumbs down, Pandora.

C.H.A.O.S. Meter: 9/20

~Acceleration

Does Pandora have any acceleration?

You betcha!

Except it’s not on the long side. Since hitting $40 in early March, shares have tanked by 36%.

The only glimmer of near-term hope is the fact that Pandora typically beats its quarterly earnings estimates. Its second-quarter report on July 24 may stop the bleeding for a moment, but expect any news about Apple-Beats and Google-Songza to pummel Pandora shares even lower.

C.H.A.O.S. Meter: 2/20

~Orders

As you saw in the Cash section, Pandora is growing its revenue strongly. It does this through two streams – subscriptions and advertising.

Subscription: Pandora’s free service gives listeners access to music, comedy, and personalized playlists. Pandora One is the company’s premium-level, pay subscription. As such, there’s better audio quality, no external advertising, and it allows users to skip more tracks each day.

At the end of 2013, Pandora had 200 million registered users, 76 million of which were paying subscribers – up by 11 million from 2012. As a result, Pandora’s subscription revenue jumped by roughly $65 million in 2013.

Advertising: Pandora derives the bulk of its revenue from the sale of audio, display, and video advertising, much of it coming from the mobile area, as it continues to grow exponentially. Collectively, ad sales account for 82% of Pandora’s total revenue. In 2013, the company increased this stream by $146 million.

Going forward, however, I don’t think these numbers are sustainable – a fact that Pandora even admits in its 10-K filing.

As I said, the competition is overwhelmingly fierce. In order to compete, Pandora has already been forced to extend its 40-hour, free-side listening limit to 320 hours… at which point, it then asks a subscriber to upgrade to Premium for $0.99 per month. The problem is, barely any of Pandora’s subscribers have exceeded this limit.

On top of that, the competition is only getting stronger, too. I believe more Pandora subscribers will steadily switch to Apple and Google. When they do, Pandora will lose subscription revenue. And with fewer subscribers, Pandora will then lose ad revenue, as companies seek out larger subscriber pools for their products.

C.H.A.O.S. Meter: 13/20

~Scalability

To be blunt, Pandora’s future is pretty dismal.

After all, to scale a business higher, it generally means increasing expenses – a luxury that Pandora can’t afford right now. Especially if it starts losing subscribers, given that it can’t even turn a profit when its subscriber base is growing.

However, Pandora does have a plan…

First, the company plans to expand internationally. Great idea… but incredibly difficult to pull off. Why?

Because it’s tied to the music industry, which is heavily regulated with copyright laws. For example, Pandora has to deal with the Digital Millennium Copyright Act (DMCA), which has limited the company’s exposure to the United States, New Zealand, and Australia.

Changes to copyright laws don’t come easily or quickly – and Pandora doesn’t have the war chest to fight this battle.

It’s also focusing heavily on expanding into the auto industry. While this could certainly help, it leaves much of Pandora’s future prospects in the hands of third-party distributors and manufacturers. Not good.

C.H.A.O.S. Meter: 5/20

OVERALL C.H.A.O.S. RANKING: 34/100

Final Verdict: Pandora is wreaking chaos… but certainly not in a good way. And the company’s issues mean it receives my worst C.H.A.O.S. score since we started publishing.

Even worse… Apple and Google’s recent moves just hammered the final nails in Pandora’s coffin.

Will Pandora crumble tomorrow? Of course not. Its revenue and subscriber base is still growing. But that means little when the company can’t turn a profit – and faces fierce headwinds from rivals.

Regardless of the weak score, however, there’s still a way to profit.

There’s heavy volume in Pandora’s September 2014 $20 put options. Buy a position before Pandora’s volume gets turned down. Way down.

Your eyes in the Pipeline,

Marty Biancuzzo