PREFACE

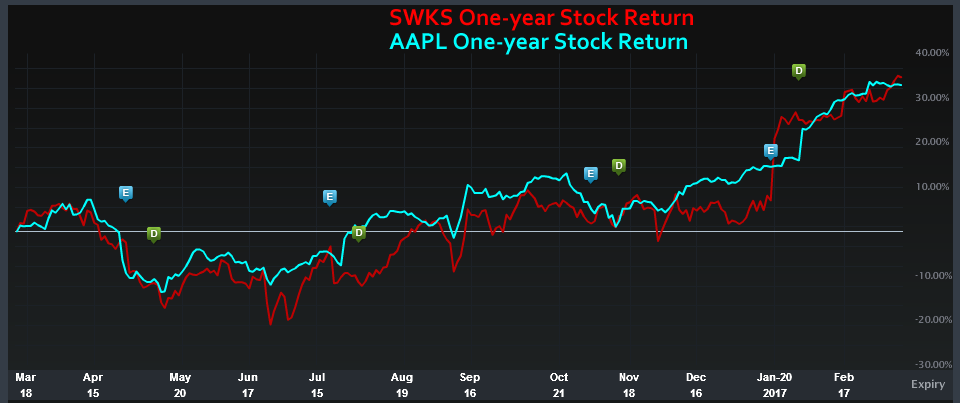

Skyworks Solutions Inc (NASDAQ:SWKS) has been on a tear of late. It’s a specialty chip maker that makes the guts of each device that will connect the world of IoT and 5G. Here is a one-year stock chart with Skyworks Solutions Inc in red and Apple Inc (NASDAQ:AAPL) in light blue:

There’s a reason for that high correlation between the two stocks.

Skyworks Solutions Inc’s (NASDAQ:SWKS) largest customer is none other than Apple Inc (NASDAQ:AAPL). But, here’s the opportunity — the company is quickly diversifying its portfolio of customers and now calls Amazon.com Inc (NASDAQ:NASDAQ:AMZN), Alphabet Inc (NASDAQ:NASDAQ:GOOGL) and Microsoft Corporation (NASDAQ:NASDAQ:MSFT) clients.

Further the company now powers “China’s Apple,” called Huawei, and the Korean giant Samsung (KS:005930).

Given the upward momentum in Skyworks’ business as well as Apple Inc’s (NASDAQ:AAPL) business, there is a very clever way to use options to profit from a belief that, at the very ;east, the stock will not “go down a lot.”

Skyworks Stock Tendencies

While Skyworks stock has moved higher with Apple’s renewed strength, the stock tends to move in chunks of momentum — or in English, when the stock rises, it tends to do so for an extended period of time, and the same can be said about a decline.

Selling an out-of-the-money put is one of the most common strategies to benefit from a bull market. The strategy has been exceptionally good for Skyworks, but because of the stocks tendencies that we discussed above, we have to be clever in our approach. Let’s take a look.

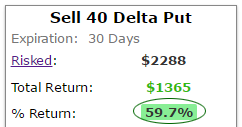

First, here is how selling an out of the money put every month has done over the last year:

While a 59.7% return is huge, as anyone who has traded options knows, there’s a hidden risk here — it puts lump in all of our throats when it comes — and that risk is earnings. Here’s how we get clever.

We can see what happens if we avoid earnings — that is, while we sell a monthly out of the money put — when earnings come around, we simply skip that week. Here are the results.

By removing the enormous risk of earnings, the 59.7% return has turned into a 103% return — nearly two-fold higher, while taking away that lump in our throat risk called earnings.

Is This Really Analysis, or Just Luck

Skepticism is natural — trading isn’t a game. Skyworks doesn’t always move with Apple Inc (NASDAQ:AAPL) stock. We have to prove to ourselves that this isn’t luck or happen stance. If our trading analysis is correct, this approach should work consistently for all time periods. That is, 3-years, 2-years and 1-year, across the board.

It turns out that this is exactly what we find. Here are the results, side-by-side, for two-years for Skyworks Solutions Inc (NASDAQ:SWKS):

It’s not a magic bullet — it’s just easy access to objective data. A 73.2% winner, when shedding a bundle of risk by avoiding earnings, has turned into a 93.7% winner. We can even look at how this approach worked over the last three-years for Skyworks:

The results over three years are less dramatic, but still, the risk of earnings is gigantic, especially when selling options. We have seen across the board better returns when we avoided that risk.

What Just Happened

This is how people profit from the option market — it’s preparation, not luck.

To see how to do this for any stock, beyond Skyworks, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Thanks for reading, friends.

The author is long Skyworks Solutions Inc (NASDAQ:SWKS) stock at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.