Room for more ECB cuts in the near term

-

We think the ECB will lower the refi rate further.

-

A 50bp cut at the December meeting cannot be ruled out.

-

An emergency rate cut cannot be ruled out either.

-

The ECB refi rate could fall to 0.50%, and the deposit rate is likely to reach its floor at 0.25%.

-

Interest rate corridor to narrow substantially, which should bring down the marginal lending rate.

-

We think the ECB will be able to support lower Euribor fixings as rate corridor narrows and the easing brings some relief.

-

However, big risk is that stress won‟t ease and fixings will remain high.

-

The ECB could introduce 24M LTROs and the markets might price in more credit easing (quantitative easing).

What is priced in?

How to position for ECB cuts

EUR:

-

Short three by one ratio call spread on 3M Euribor March ‟12 future

-

Short two by one ratio receiver swaptions, 1Y1Y EUR

DKK:

-

Buy Danish „flex‟ bonds (non-callable bullet bonds)

SEK:

-

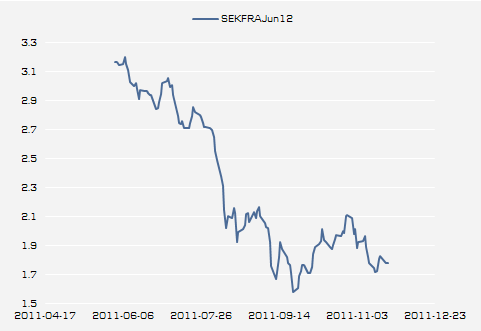

Still room to price further cuts by the Riksbank – receive SEK FRA JUN12

-

Swedish curves flat on a relative basis – ample room for steepening

-

Curve steepening and covered bond performance in Sweden next year

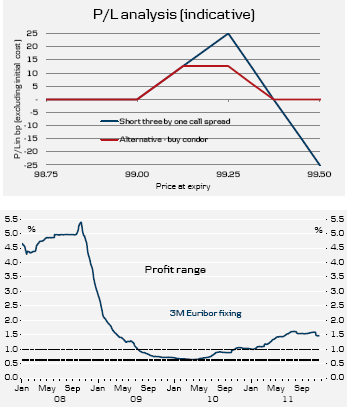

Short three by one ratio call spread on 3M Euribor March ’12 future

We think the ECB will lower the refi rate further.

A 50bp cut at the December meeting cannot be ruled out.

An emergency rate cut cannot be ruled out either.

The ECB refi rate could fall to 0.50%, and the deposit rate is likely to reach its floor at 0.25%.

Interest rate corridor to narrow substantially, which should bring down the marginal lending rate.

We think the ECB will be able to support lower Euribor fixings as rate corridor narrows and the easing brings some relief.

However, big risk is that stress won‟t ease and fixings will remain high.

The ECB could introduce 24M LTROs and the markets might price in more credit easing (quantitative easing).

Short three by one ratio call spread on 3M Euribor March ‟12 future

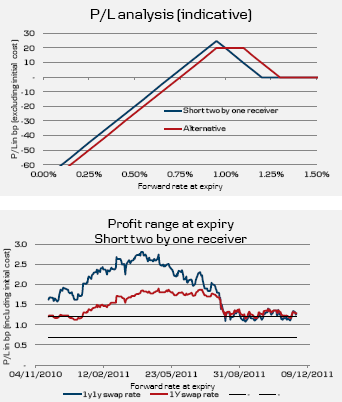

Short two by one ratio receiver swaptions, 1Y1Y EUR

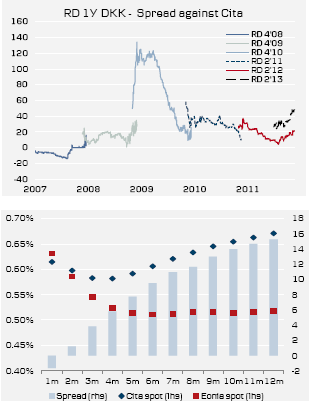

Buy Danish „flex‟ bonds (non-callable bullet bonds)

Still room to price further cuts by the Riksbank – receive SEK FRA JUN12

Swedish curves flat on a relative basis – ample room for steepening

Curve steepening and covered bond performance in Sweden next year

Buy 1 call option at strike 99.00

-

Sell 3 call options at 99.25

-

Spot reference: 98.83

-

Stop at MtM = -10bp

-

No exposure to higher fixings

-

The position can be entered at 1.5bp

-

Biggest risk would be if 3M Euribor fixing declines below 0.67% by March IMM-date

-

Maximum potential downside known, and would materialise if fixings go to zero

-

Alternatively – buy condor

-

Buy 1 call option at 99.00, sell 1 call option at 99.125, sell 1 call option at 99.250, buy 1 call option at 99.375

-

Net price is 3.0bp

Short two by one ratio receiver swaptions, 1Y1Y EUR (3M)

-

Buy 1 receiver swaption at 1.20%

-

Sell 2 receiver swaptions at 0.95%

-

Spot reference: 1.28%

-

Stop at MtM = -10bp

-

No exposure to higher underlying rates and wide profit-range

-

The position can be entered at zero cost

-

Biggest risk would be a sharp decline in the underlying rates

-

Maximum potential downside known, and would materialise if rates fall to zero

-

Alternatively – long receiver ladder

-

Buy 1 receiver swaption at 1.25%

-

Sell 1 receiver swaption at 1.05%

-

Sell 1 receiver swaption at 0.90%

Buy Danish ‘flex’ bonds (non-callable bullet bonds)

-

Buy 1Y Danish „flex‟ bonds – for example RD 2% DKK 13 (Jan) SDRO (CC T) at 50bp-55bp against Cita curve

-

Potential for performance if 1) Cita curve moves lower or 2) spreads narrow to Cita curve

-

Risk: Exposure to stress in Danish money market, which could lead to higher Cita rates and ASW spread widening

-

Alternatively – Buy ‘flex’ bonds against Eonia to hedge some of the risk

Still room to price further cuts by the Riksbank – receive SEK FRA JUN12

-

Expectations about the Riksbank are quite moderate.

-

The large exposure to exports to the euro-zone combined with a weakening domestic sector means that the Riksbank will have to act soon.

-

The fact that ECB has started cutting rates is paving the way for the Riksbank to cut in December.

-

SEK FRA JUN12 is pricing in slightly less than three 25bp cuts. We think there is a clear risk of more cuts.

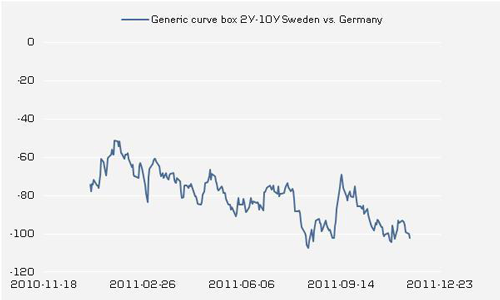

Swedish curves flat on a relative basis – ample room for steepening

-

In our view the downside in Schatz is limited.

-

Even though the spreads in the short end have tightened, SGB1041 still trades high relative to Schatz and should start performing once the Riksbank starts cutting rates.

-

In the longer run we expect a near convergence in policy rates.

-

Thus, we should see the 2Y-10Y curve box move to only slightly negative levels.