While the collapse of Chinese markets has taken over the headlines, the world continues to keep one eye on Greece. Everyone wants to know...

What will happen next?

On Thursday, Greek Prime Minister Alexis Tsipras agreed to accept some of the European Union’s proposed austerity measures as part of a bailout deal.

Will the EU accept Greece’s proposal? How will the Greek people respond to Tsipras’ proposal? Just how did we get here in the first place?

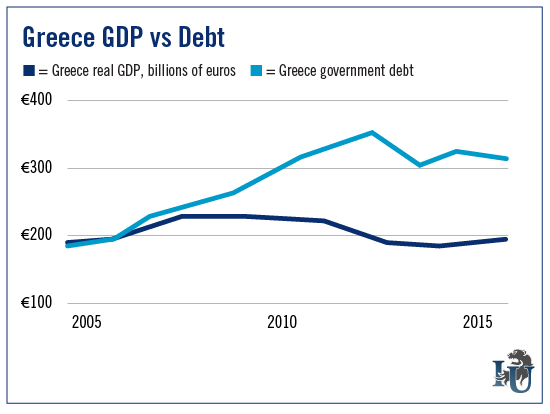

Today’s chart sheds some light on Greece’s woes by taking a look at the country’s gross domestic product (GDP) vs. its debt since 2005.

As you can see, Greece’s GDP has declined steadily in recent years (though it saw modest improvement in 2014). Meanwhile, despite desperate pleas from neighbors, the country has struggled to push its debt below the 300 billion euro mark.

How did this gap between debt and GDP grow so big? The bailouts Greece received over the years were supposed to buy time to stabilize the country’s finances and lessen market fears. But while they have helped, Greece’s economic problems certainly haven’t gone away...

Its economy has shrunk by 25%... unemployment is above 25%... and youth unemployment is nearly 50%. The austerity measures attached to EU loans shoulder some of the blame.

You see, most of the bailout money has gone toward paying off Greece’s international debts, rather than making its way into the economy.

Right now, the government holds a staggering debt load of 317 billion euros that it cannot begin to pay down... unless a recovery takes hold.

It’s no surprise Greece is moving away from the idea of a eurozone exit. To do so now would hurt the Greek people the most. As Alex Green wrote in his Monday Investment U column, “The nation’s economy is only the size of South Carolina’s. The effect on global GDP will be indiscernible.”

And over the past few years, Europe has built safeguards to prevent Greece’s situation from overflowing into other countries.

Investment U’s globetrotting Resource Strategist Sean Brodrick called Greece's bluff last week. In his words: “[Central bankers] are likely to make a deal, for the simple fact that it’s in their own best interest to make a deal. If that’s the case, this crisis is a buying opportunity.”

Those quotes, by the way, are taken from Sean’s latest report, now available in the Investment U Bookstore. It’s called “Greek Default: 4 Picks to Profit From the Post-Crisis Rally.”