I told you to put away the Kleenex. Why? Because it doesn’t matter who’s in the White House.

As investors, we need to find a way to profit no matter what.

With that in mind, I highlighted the top performing asset classes during President Obama’s first term. Then I shared the asset classes we should expect to perform best during his second term.

As promised, I’m continuing my analysis today.

Let’s get to it…

Consumers Get Their Grove (Back) On

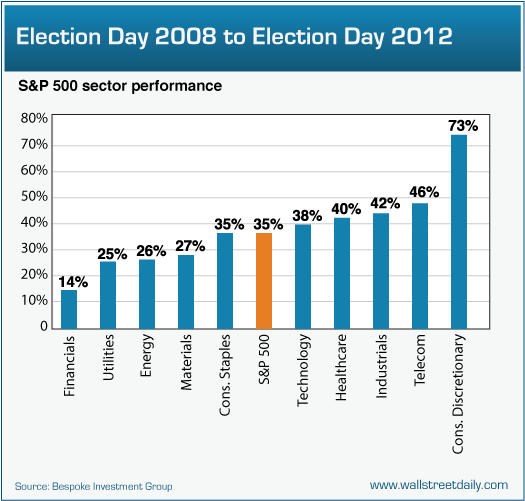

The first thing that jumps out in the chart below is that the consumer discretionary sector has increased almost 75% since Election Day 2008.

That’s more than double the return of the S&P 500 Index.

Based on the share price performance of consumer discretionary stocks like Priceline (PCLN), Chipotle (CMG) and Whole Foods Markets (WFM), you’d never know we experienced the Great Recession. The stocks are up 1,067%, 457% and 821%, respectively.

Is the rally over, though? Hardly.

Although consumers don’t account for 70% of GDP, like it’s widely misquoted, they still contribute a meaningful amount. And as the labor market improves, incomes rise and household balance sheets continue to heal, it’s only natural to expect their spending -- and, in turn, the outperformance for consumer discretionary stocks -- to continue, too.

Two areas within the sector that I’d like to focus on would be automobiles and housing. Both suffered from unprecedented demand erosion during the recession. Despite rebounding, we’re still well below historical norms in terms of annual production for both new cars and homes.

Simply put, homebuilders and automotive stocks have much more room to run.

Dialing Up Gains

Now, it’s doesn’t surprise me at all that the telecom sector ranks as the second best performer in the chart above.

It was a safety trade. Investors flocked to the recession-resistant qualities of telecom companies -- and their healthy dividend yields -- to weather the downturn. And it worked.

But can we expect it to continue?

I’m not convinced. About a year ago, I started sounding the alarms, noting the unsustainability of dividends being paid by popular telecoms like Frontier Communications (FTR), Windstream (WIN) and CenturyLink (CTL).

And today, I’m more convinced than ever that we need to proceed with caution in the telecom space. Here’s why…

The average price-to-earnings (P/E) ratio for a telecom stock went from 9.2 at the market bottom to 23.4 today. That’s a 150% multiple expansion.

Yet over that period, the average telecom stock only advanced 75% in price, which means share prices increased much faster than earnings.

In other words, since share price ultimately follows earnings, telecom stock prices have gotten a little too far ahead.

AT&T (T) is the perfect example. It sports a P/E ratio of 44.8, compared to a 10-year average P/E ratio of 18.28. That’s almost a 150% premium.

Before you think I just cherry-picked an example to prove a point, look at Verizon Communications (VZ). It trades at a 54% premium to its 10-year average P/E ratio.

Like I said, telecom stock prices have gotten too far ahead of earnings. Accordingly, I’d wait for a pullback to more modest valuations. I’d also focus on companies with dividend payout ratios below 80%.

A Healthy Outlook

Although it’s volatile at times, the healthcare sector put up impressive gains, too -- outpacing the S&P 500 by about five percentage points.

I expect the sector to remain a top performer, and not simply because Obamacare will now be implemented.

For me, the demographics matter most. As America grays, we require more medical attention.

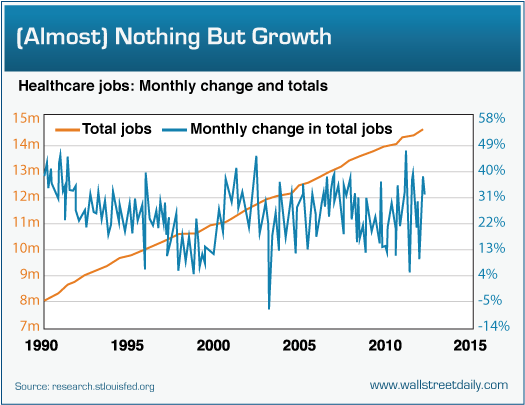

The chart below sums up the situation for me. It shows the monthly change in healthcare jobs and the total number of healthcare jobs.

Since 1990, the monthly change in healthcare has only gone negative one time. And the total number of employees keeps rising.

Heck, job growth in the healthcare sector could rival the growth in the government sector. (I’ll save that comparison for another day.)

In terms of specific opportunities, the most upside resides in biotech stocks. Case in point: Almost two-thirds of the top 30 best-performing stocks in the Russell 3000 Index this year are biotech stocks.

They’re more risky, of course. And they require more due diligence. But the potential rewards more than make up for the extra work.

On the flip side, I’d shun investing in hospital operators. Why? Because it’s a notoriously low margin business. And margins are in the process of being squeezed even more.

If you want proof, look no further than Orlando Health’s latest activities. It just announced the largest workforce reduction in its 100-year history, as a result of reduced income and the threat of even less in the years ahead.

Bottom line: For the next four years, I’d bet on the American consumer and innovative healthcare companies. But I’d consider hanging up on telecom stocks.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How To Invest In Obama’s Second Term (Part 2)

Published 11/21/2012, 10:30 AM

Updated 05/14/2017, 06:45 AM

How To Invest In Obama’s Second Term (Part 2)

Two weeks ago

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.