Investing.com’s stocks of the week

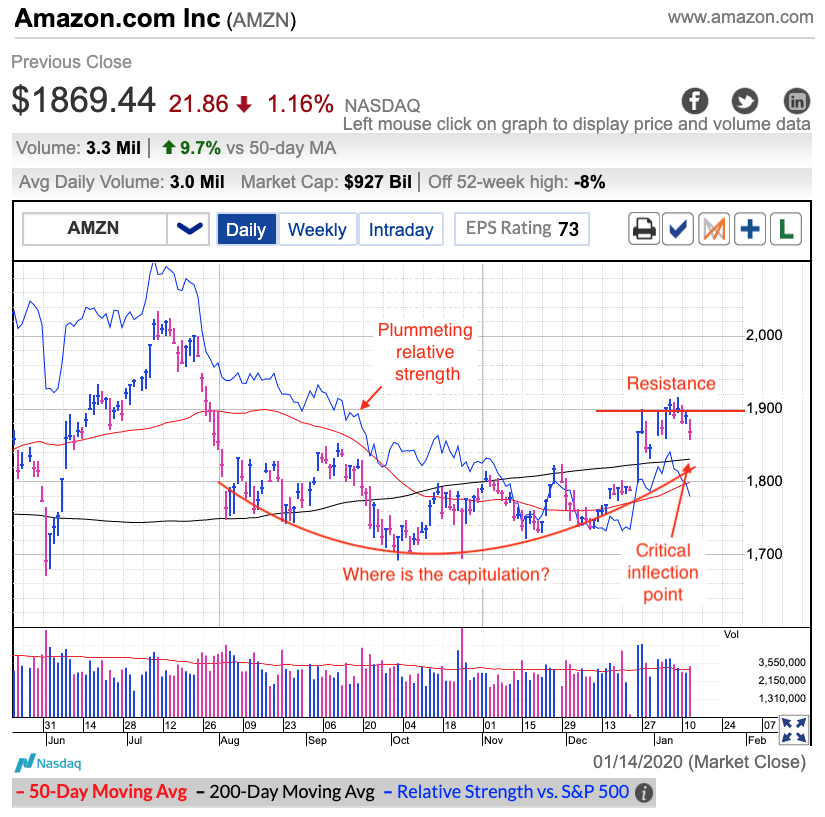

Amazon.com (NASDAQ:AMZN) finds itself at an important inflection point. While its FAANG peers Apple Inc (NASDAQ:AAPL), Facebook Inc (NASDAQ:FB), and Alphabet (NASDAQ:GOOGL) are busy making record highs and Netflix (NASDAQ:NFLX) is constructively digging itself out of the hole it fell into last year, AMZN has kind of been stuck in neutral without a clear sense of direction. We got a really nice pop a few weeks ago when Amazon announced record holiday sales but no further details were given and we have to wait until earnings at the end of the month to learn what “record holiday sales” really means. Since that initial pop, the stock has been mostly holding under $1,900 resistance as traders wait to see what comes next.

I was a big fan of buying NFLX’s dip last fall because after a few months of relentless selling, the stock became oversold the crowd had given up hope and it reached a capitulation bottom. It had finally got “so bad it was good”. But I don’t see the same capitulation in AMZN’s recent consolidation. This is more of a rounding out and it really hasn’t tested investors’ resolve the same way the NFLX dip did.

That said, the stock is still above the far more significant 200dma and that is constructive. Remain above this moving average and the stock is doing well enough to earn the benefit of doubt. But if we fall under this level over the next few weeks, that dramatic capitulation drop could be just around the corner. But just like any good capitulation point, that will be our opportunity to jump in, not bailout.

I won’t pretend to know what AMZN’s earnings will look like when they report at the end of the month, but whichever direction the stock moves in the days after earnings, expect that to be the start of the next big move. Thrill investors and AMZN will return to the highs. Disappoint and new lows are ahead of us. In the meantime, I would be wary of holding too much AMZN. At this point, the risks seem larger than the reward. Wait for that definitive move after earnings and then place your bets. It is better to be a little late on this trade than a lot early.