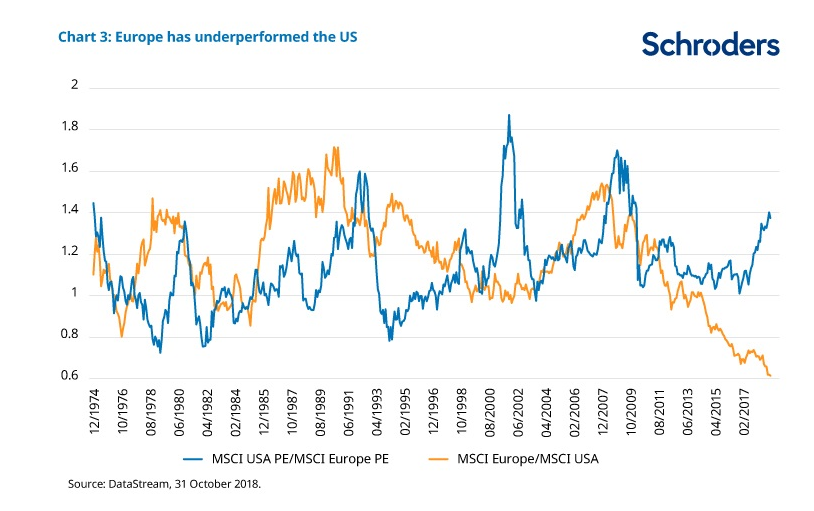

European stock markets have underperformed their U.S. counterparts over the past year, leaving valuations at multi-year lows. Adventurous investors might find this value proposition hard to resist.

The price-to-earnings (P/E) discount of European stocks to the U.S. “appeared extreme” at the end of last year, Rory Bateman, head of UK and European equities at London-based Schroders Investment Management said in a 2019 European stock market outlook.

The gap widened as President Donald Trump’s tax cuts, which helped boost U.S. growth and allowed companies to return cash to investors, lifted U.S. share prices, Michael Hewson, chief market analyst at CMC Markets in London, said in an interview. European stocks suffered from the stalling economy, increasing trade tensions with the U.S. and cooling Chinese growth on top of the uncertainty brought on by Britain’s impending EU exit, he said.

Beyond the geopolitical pressures, the valuation gap is rooted in sectors, with the U.S. overweight technology and Europe more heavily concentrated on financials, Javier Panizo, portfolio manager and global consumer analyst at Nomura Asset Management in London, said in an interview.

Among the European shares that Nomura favors: London-listed British American Tobacco (LON:BATS), also trading in the U.S. as an ADR (NYSE:BTI), Frankfurt-listed carmaker Daimler AG (DE:DAIGn), also trading the U.S. as an ADR (OTC:DMLRY), and Zurich-based staffing company Adecco (SWX:SIX:ADEN), trading over the counter in the U.S. as (OTC:AHEXY).

1. British American Tobacco

What makes British American Tobacco a good pick now? It's trading at less than 10 times expected 2019 earnings, says Panizo. Nomura expects the tobacco company to generate free cash flow of £7.3 billion ($9.7 billion) this year, enough to pay the rich dividend that the company raised by 4% while leaving substantial cash to pay down debt. The current yield on the stock is 6.44% for UK shares, 8.01% for the U.S. ADR.

Shares of the company, which makes Dunhill and Lucky Strike cigarettes, have lost almost half their value after hitting a record high in May 2017. The current price is more than 50% below the future cash flow value of £66.94 per share, according to the financial analysis website Simply Wall St, which calculated this based on estimated future free cash flow for the next 10 years.

The company posted revenue of £25.76 billion (USD $33.9B) for 2018, adjusted for currency fluctuations and the impact of the 2017 acquisition of Reynolds American (NYSE:RAI). That's up 3.5%, driven by market share gains and price hikes. Earnings per share, on the same basis, rose 11.8% to 315.5 pence, the company said on Feb. 28.

BATS shares have been under pressure as the U.S. Food and Drug Administration is considering banning menthol-flavored cigarettes, which are thought to be a gateway for new smokers, according to London-based investment firm Hargreaves Lansdowne. That would be “a major blow” to British American due to its dominant position in menthol in the U.S. following the Reynolds acquisition, Hargreaves said.

Additional headwinds emerged last week when the company said it would take a charge £436 million (USD $573 million) against 2019 earnings after losing an appeal in a class action lawsuit brought by Canadian smokers against its Imperial Tobacco Canada unit and two of its rivals. The Quebec Court of Appeal earlier this month upheld a 2015 ruling that the three companies must pay CAD15.6 billion ($11.6 billion) in damages to the smokers.

Nevertheless, Nomura’s Panizo said he remained undeterred by these developments. The accounting adjustment taken after the Canadian appeal court ruling won’t lead to any cash outflows and the most adverse potential outcome, closing the Canadian unit, would have a 4% negative impact on profit, he said.

The regulatory risk “has probably reached an inflection point” with the resignation last week of FDA commissioner Scott Gottlieb, the main proponent of strong anti-tobacco legislation, Panizo said, adding that “the future in tobacco is clearly a new range of new generation products, such as vaping and heat not burn.” BAT is investing more and more into new products, which should lead to positive results in the medium term.

2. Daimler AG

Nomura asset managers also like Daimler, owner of the Mercedes-Benz brand. It's not an intuitive choice given the multitude of challenges facing European automakers this year, including slipping sales in Europe and China, the possible fallout from the stalled resolution to the U.S.-China trade dispute and the threat of increased U.S. tariffs imposed on cars from Europe after U.S. President Donald Trump ordered the Commerce Department to investigate whether automobile imports pose a threat to national security.

Stricter diesel emission regulations that came into effect last year will also weigh on the sector. As well, competition from electric carmaker Tesla (NASDAQ:TSLA) and ride-sharing services are pressuring carmakers to speed up development of electric and hybrid vehicles, requiring significant investment.

According to Panzio, Daimler is a “higher quality company within a cheap and out of favor sector.” The stock is trading at an attractive 6.5 times 2019 projected earnings. And because of Mercedes-Benz, the company has better brand perception than rivals.

It has also committed to significant spending on electric cars and new emission technology, Panzio added. The carmaker plans to bring 10 fully electric cars to the market in the next five years.

While earnings per share declined 29% to 6.78 euros (USD $7.66) in 2018 from the year before, even with revenue increasing, according to Daimler’s financial statement on February 15, Nomura expects earnings to grow this year as well as in 2020.

3. Adecco Group

Nomura's third pick is Adecco, the world’s largest staffing company, whose shares trade at 10.6 times 2019 expected earnings, implying the market discounts “a strong deterioration in the EU labor market, possibly leading into a recession,” Panizo said.

While Europe is slowing, a full-blown recession is not on the cards. Analysts surveyed by Consensus Economics expect the eurozone economy to expand just below 1.6%, which would mark the second consecutive year of a slowdown, down from expected growth of 1.9% last year and expansion of 2.4% in 2017, the Financial Times reported in January.

The Swiss company posted an unexpected net loss of 112 million euro (USD $126.5 million) for the fourth quarter of 2018 after a goodwill impairment on its German business, due to a change in temporary staffing rules, production cuts in the German auto sector, and the German economic slowdown, said Alain Dehaze, the chief executive during a Bloomberg Television interview on Feb. 28.

Even as Europe is slowing, the company sees solid growth continuing in the U.S. and Asia, Dehaze said.

According to Thompson Reuters data, the average analyst recommendation for Adecco is “Hold." However, analysts traditionally have had concerns about a structural decline in margins within this segment, and Adecco's chief financial officer acknowledged last month that it’s becoming more difficult to improve margins in a challenging growth environment, Reuters reported. Nonetheless, Adecco posted a fourth-quarter gross margin that beat analyst expectations, which is “encouraging,” Panizo said.