- Find the most powerful stocks in the market with the InvestingPro filters explained in this article.

- Here's everything you need to know about stocks to help you get the most out of your portfolio.

- Market capitalization, dividend yield, asset efficiency... perform your own search and narrow down the results to get the best results.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

What's happening in the market? Why is the current volatility having such a big impact on my portfolio? How can I identify the stocks that pique my interest and have the potential for the best returns right now?

InvestingPro has the answers to these questions. In the following article, we'll explain you step by step how to use our premium tool to start beating the market today.

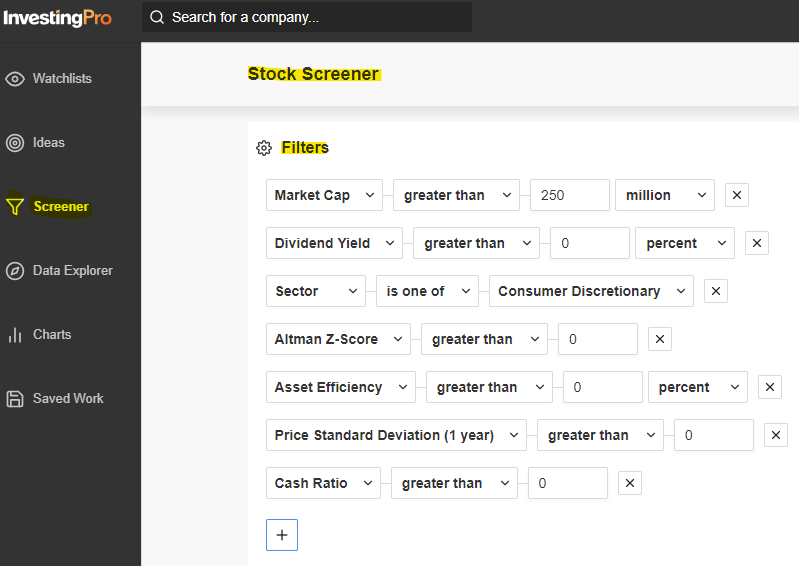

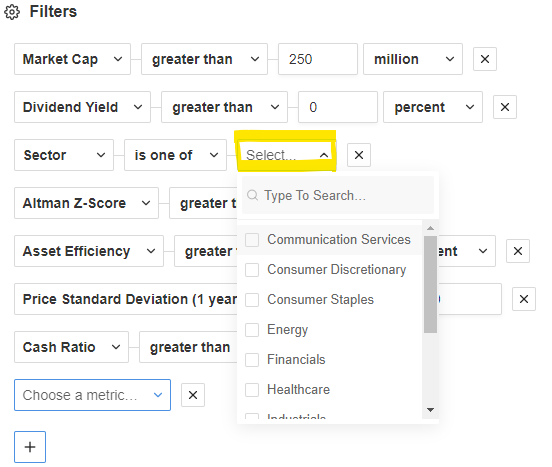

Filters

The stock finder in the "Filters" section provides you with up-to-the-minute market data and a breakdown of the pros and cons that can influence stocks.

Source: InvestingPro

For instance, InvestingPro provides a range of valuable filters, including:

- Market Cap: This metric gauges the total equity value of a public company, calculated based on the most recent stock trading price. For cryptocurrencies, it's computed by multiplying the last trading price by the outstanding supply.

- Dividend Yield: It quantifies the cash returned to shareholders by a company as a percentage of the price paid for each share.

- Sector: This filter categorizes shares based on their area of business activity.

- Altman Z-Score Formula: A predictive formula used to assess the likelihood of a company going bankrupt within a two-year period.

- Asset Efficiency: This ratio measures the cash flow generated by a company in relation to its assets.

- Stock Price Standard Deviation (1-year): This metric calculates the standard deviation of a stock's price over the past year.

- Cash Ratio: It evaluates a company's short-term liquidity.

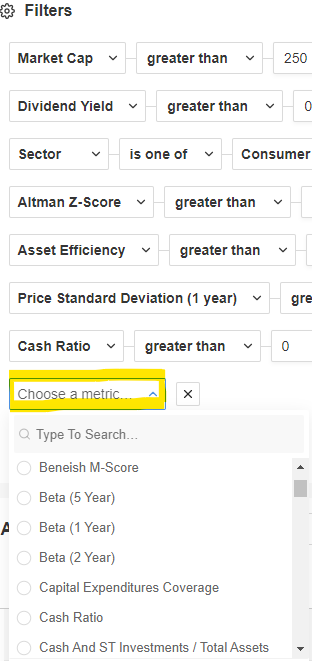

You also have the option to introduce new filters to tailor your search further. For example, consider adding filters like the Beneish M-Score Formula, Beta (1, 2, or 5 years), capital expenditure coverage, solvency ratio, total debt, and more to your selection.

Source: InvestingPro

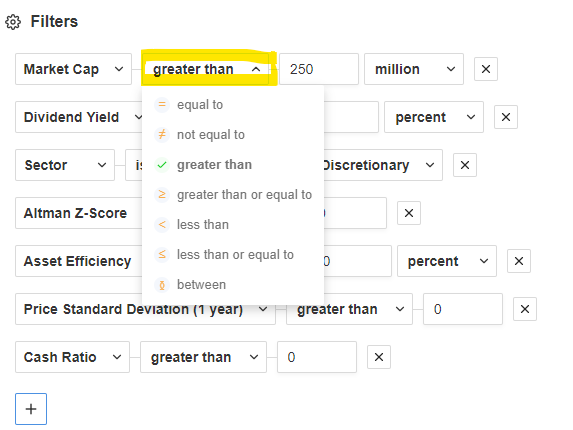

Refine Your Search

Within each filter, the search engine provides a variety of options. For instance, in the market cap or dividend yield category, you can search for amounts that are "greater than," "less than," "between," and more.

Source: InvestingPro

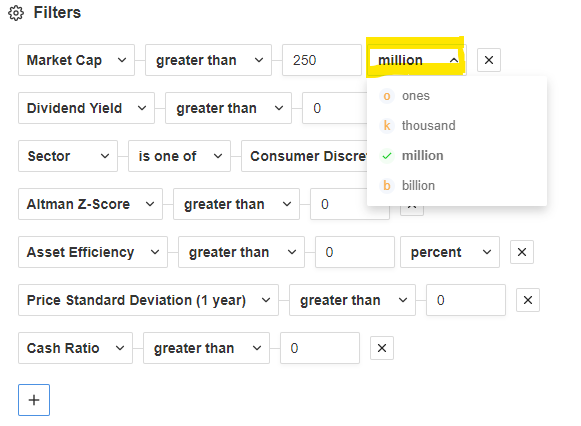

Subsequently, it permits us to manually input the specific amount and choose the desired unit, whether it be in thousands, millions, or billions.

Source: InvestingPro

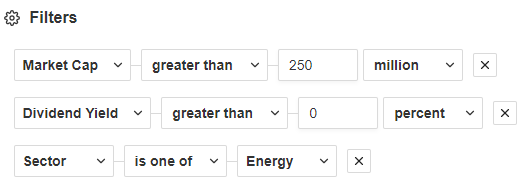

The sector filter enables us to search by industry, such as communication services, consumer discretionary, consumer staples, healthcare, energy, industrials, information technology, real estate, and more.

Source: InvestingPro

Let's take an example: if you want to search for companies with a market capitalization of more than $250 million, with a dividend yield of more than 0%, and belonging to the energy sector, you should search for the parameters as follows:

Source: InvestingPro

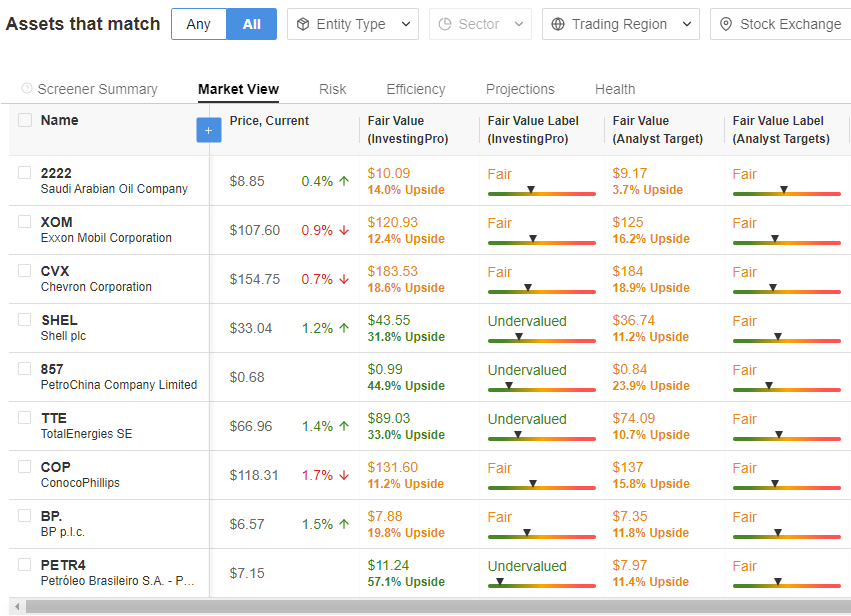

Search Results

Once you have made your selection, InvestingPro displays the list of stocks that match your search parameters:

Source: InvestingPro

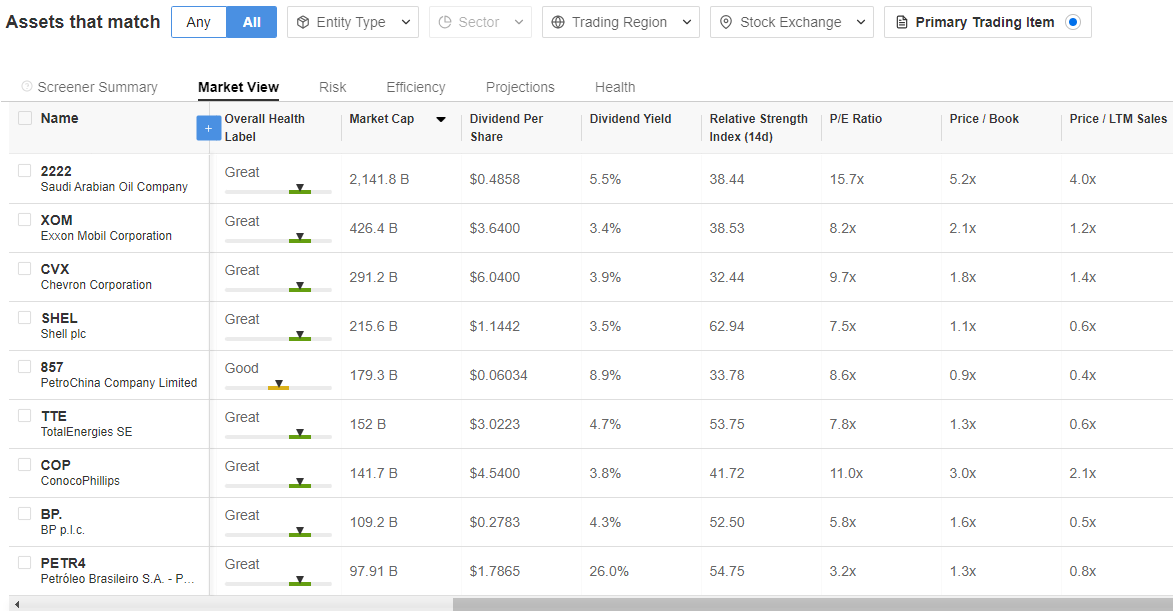

The listing provides market value, fair value, market capitalization, dividend per share, dividend yield, Relative Strength index, P/E, etc.

Source: InvestingPro

You can also find interesting data on the risk of these companies, their earnings forecasts, different efficiency ratios and everything you need to know about the stocks to help you get the most out of your portfolio.

Save Your Searches

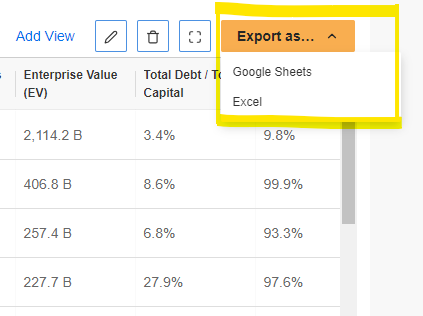

Remember that you can save and always have your search results at hand. To download your results, click on the "Export As" drop-down menu at the top right of the search engine.

Source: InvestingPro

Know what to buy and what to sell before anyone else with InvestingPro.

Our best-in-breed product offering has all tools that will help you outperform the market today. Below is what you're missing out by not subscribing for a meager $9 a month:

- ProPicks: stock portfolios managed by state-of-the-art AI technology, with proven performance

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 summary indicators based on financial data, providing instant insight into the potential and risk of each stock.

- Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: To enable fundamental analysis pros to dig into all the details themselves.

- And many more services, not to mention those we plan to add shortly!

Don't face the market alone any longer, join the thousands of InvestingPro users and make the right decisions on the stock market to help your portfolio take off, whatever your profile or expectations.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any asset class is evaluated from multiple points of view and is highly risky. Therefore, any investment decision and the associated risk remains with the investor.