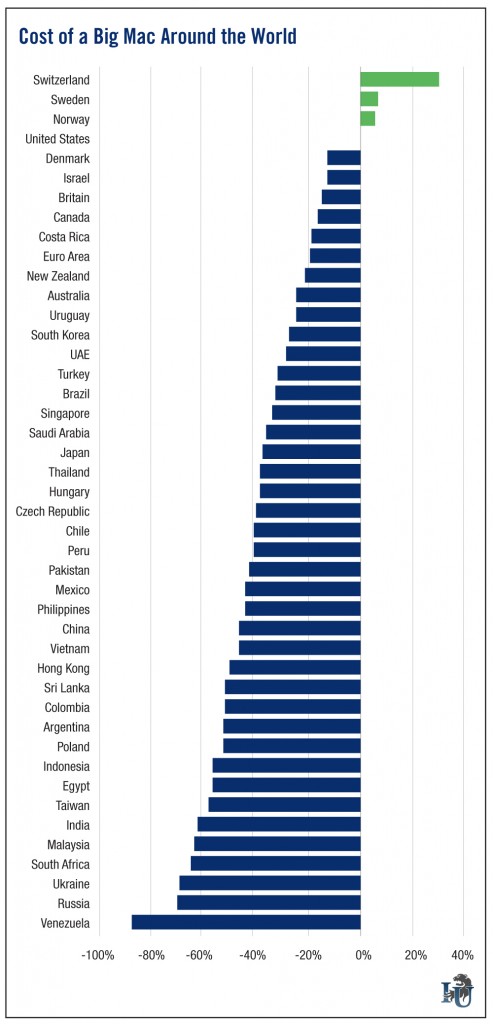

Editorial Note: This week’s chart comes from our good friend Karim Rahemtulla, editor and co-founder of Beyond the Dollar. It shows the price of a McDonald`s Corporation (N:MCD). Big Mac around the world, using the U.S. dollar as its base. Stateside, a Big Mac costs $4.93 at the moment. But in Peru, the signature burger costs 10 sol, the equivalent of $2.93.

Purchasing power is the key measure of wealth. Does a can of Coke really taste better in Switzerland or United States versus Malaysia? You better hope so. Because if you’re buying that can of Coke in Zurich or New York, you’re paying about 60% more for it than you would in Kuala Lumpur, Bangkok or a host of other countries

As the owner of U.S. dollars or Swiss francs, you’re missing out on one of the greatest opportunities of your lifetime. You’re missing out on getting rich... or if you’re already rich, you’re missing out on getting richer.

Imagine paying $500 a month in rent for an oceanfront condominium in a city not much different from most in the West. How about a live-in maid for less than $300 per month or an Uber ride across town for $1.50?

These are not fantasies. In fact, I just returned from a country where all of this is the norm, not the exception. And I am not talking about some “third world” dump where you would not want to live at any price.

It’s a notion that is often misunderstood: the value of money versus the purchasing power value of that same money. You may think you don’t have much money if you are making $50,000 a year in the U.S., but in places like Thailand or Malaysia you would be living like a king.

The currencies of both countries and many others are trading much lower thanks to the strength of the dollar. But the purchasing power on a local basis has not adjusted higher. The opposite is true.

In early 2015, a 12-mile Uber ride from George Town in the Malaysian state of Penang to the airport would have cost you 20 Malaysian ringgit or about $6. Last week, that same ride would have cost you $4.40. A condo overlooking the Strait of Malacca would have set you back $630 last year but only $500 today. The prices on the local level have not changed year over year, but for you or me the bargains have gotten only better.

The U.S. dollar is indeed in rarefied territory today. And that’s something to celebrate if you own dollars. Many major economies are on the other end of the spectrum, especially if that economy is tied to resources (or perceived to be tied to resources).

Take the Mexican peso, for example. It just hit 18.50 to the dollar, down 7% just since the end of last year. Two years ago, the peso was trading at 12-to-1 compared to the dollar. The fall is attributed to the decline in oil prices. Yet, on the streets of Mexico, things are not indicative of a 50% collapse in the currency. In fact, the lower currency is inviting even more economic activity.

The Canadian dollar is trading at less than US$0.69, a level not seen in more than a decade. Again, the perception is that the Canadian economy is so dependent on oil prices that it’s heading for a recession. Last week, home prices in Toronto hit record highs, far from a recessionary mood. And this week, the Bank of Canada stepped back from reducing interest rates, commenting on the resiliency of the economy and its diversity.

But if you’re buying imported goods such as fruits or vegetables from California, you’re paying through the nose as a Canadian.

In fact, as the chart above shows, of all the major and not-so-major global currencies, only three are pricier than the U.S. dollar.

Now, this is not to say that you should make plans to move to Venezuela, the lowest on the totem pole, and with good reason. But it should make you step back and ask this question: Am I as wealthy as I could be?