The search for the last bear grumbling is on and WSJ.com located one of the contestants. Peter Boockvar, managing director and chief market analyst at the Lindsey Group, estimates that the S&P 500 may drop as much as 20% based on the assumption that the Federal Reserve will terminate its third iteration of quantitative easing (QE3) in 2014. He explains that, whenever previous versions of quantitative easing came closer to the end, the “Fed-fueled bubble” faltered, and that this time will not be any different.

While Mr. Boockvar feels that the Fed will actually get across the goal line by December, I believe that committee members at the Fed do not know yet know what they will do; that is, they will make decisions that are entirely dependent on incoming data. Since most data tend to be uneven — and since Chairwoman Yellen is likely to err on the side of caution – I expect the Fed to skip a tapering increment or two at the least. At most? They may ratchet up the creation of electronic money printing to buy $100 million in U.S. debt each month. Indeed, we may see the central bank offering up more stimulus than when Ben Bernanke ran the show.

Sound crazy? Picture the acceleration of the decline in refinancing and mortgage applications if 10-year treasury yields drifted beyond 3.25%. Envision the hoarding of cash and the trepidation to hire full-time employees, as the combination of the employer mandate for small companies to provide health care collides with increased borrowing costs. And imagine Chairwoman Yellen receiving conflicting data, from an ongoing decline in labor force participation to additional deflationary trends, the result of which would certainly threaten the Fed’s mandate of price stability.

Those who believe that the economy is increasingly self-sustaining argue that the rising rates will not choke off the recovery nor adversely impact stock assets. Others like myself and Mr. Boockvar see the U.S. economy as exceptionally dependent on easy-to-get, unusually cheap money. The difference in our outlook is that I believe the Fed will act to contain rates, using any combination of excuses that it sees fit; Yellen will be particularly motivated to avoid any perception that the committee has lost the confidence of the markets.

Keep in mind, of course, rates do not even need to rise for the Fed to decide upon more stimulus. A prolonged economic soft patch might create enough uncertainty that stocks decline quickly and a risk-off trade witnesses a flight to quality in bonds. In other words, even if yields are falling, Yellen’s Fed may feel the pressure to act if economic signs indicate structural weakness.

Since the economy is likely to demonstrate uneven, and, sometimes troubling data in 2014, expect the Fed to emphasize its “data dependency.” And if that emphasis does not bolster “risk-on” dip buying in a pinch, don’t be shocked if the committee votes to offer up additional stimulus measures.

One way or another, then, ETF enthusiasts should set aside a modest amount of cash for a highly probable corrective period. The cash should be used for exchange-traded vehicles on your “Wish List.”

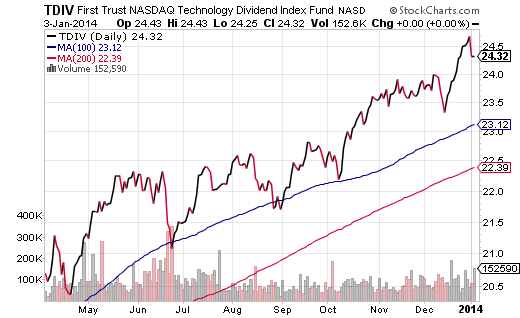

For example, I have been a long-time advocate for First Trust NASDAQ Dividend (TDIV). It does not have the flare of social media per se, though its concentration on cash-flow producing giants like Apple (AAPL) and Microsoft (MSFT) provides a basic level of protection; that is, investors tend to hold onto large company dividend yielders. Moreover, many of the holdings in TDIV trade at price-to-earnings (P/E) ratios below respective historical P/Es. In other words, TDIV may be the closest thing to “cheap” in U.S. equities today.

Nevertheless, one does not necessarily need to buy at first blush. TDIV regularly pulls back to its intermediate-term 100-day trendline. Interested investors could pick some shares up at the 100-day. Or, you might elect to wait for a more substantive sell-off based on one of the scenarios describe earlier. Should a corrective period take place, you might add TDIV when it reaches its longer-term 200-day moving average.

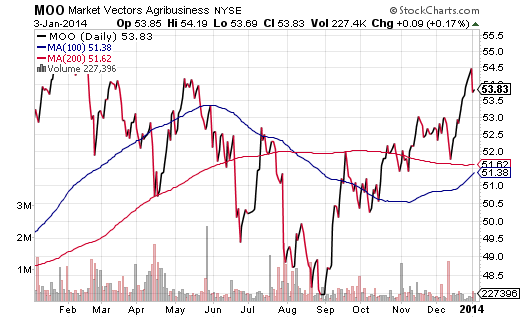

Another ETF that I’ve been talking about since November is Market Vectors Agribusiness (MOO). First, value-oriented buyers tend to gravitate towards P/Es of 10 and P/Bs of 1.5. Secondly, unlike the bulk of broad market benchmarks that have been regularly eclipsing record highs, fertilizer producers as well as equipment makers are still in recovery mode. Third, MOO has notched “higher lows” in every month since bottoming out in September.

It follows that believers in agricultural-related businesses might find MOO attractive near where the fund’s 100-day meets its 200-day. Right now, MOO is closing in on a “golden cross,” where an intermediate-term trendline rises above its 200-day. A price pullback to that level should be rewarding.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How To Buy Your Favorite ETFs On A Pullback

Published 01/03/2014, 02:25 PM

Updated 07/09/2023, 06:31 AM

How To Buy Your Favorite ETFs On A Pullback

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.