Nine of the 10 trades triggered this week, and 8 were closed out before the bell Friday. That left a trade open in Cirrus Logic Inc (NASDAQ:CRUS). Three trades were closed for a gain, three at break even and two were closed for a loss. An equal weight portfolio lost 53bp on the week, using 90% of capital, again crushing the SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust (NASDAQ:QQQ) again. There are no triggers or stops or targets measured in the index ETF performance. Here is this week’s rundown:

The Premium Service does not advocate an equal weight allocation, but uses it as one way to measure performance. Equal Weighted Investment Yield assumes a buy at 1/10 portfolio size for each stock that triggers and accounts for stop loss triggers in the trade plan presented to subscribers (i.e. your performance would be better). If the security is labeled no trigger than our trade plan would not have executed a trade (i.e. you would have had no position).

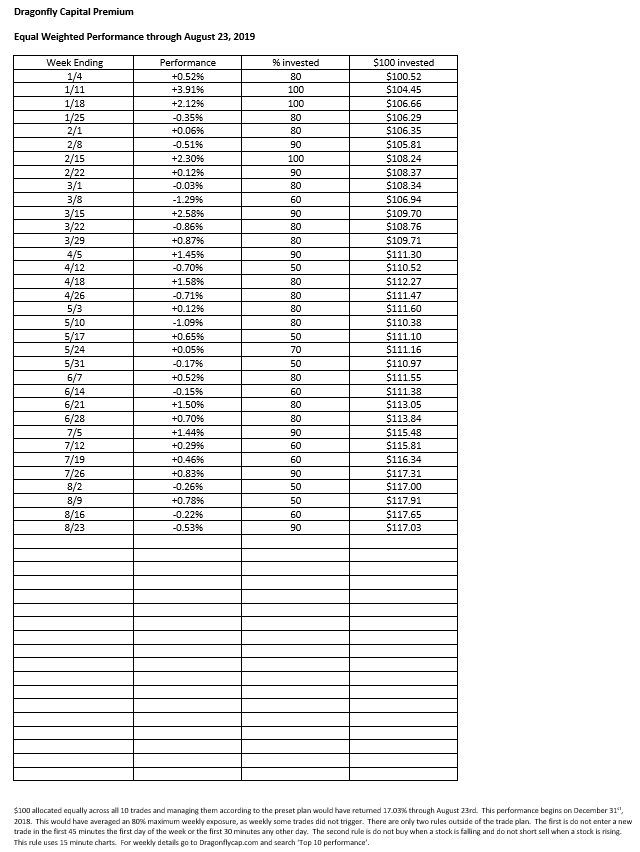

Equal weight year to date performance is now +17.03%:

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.