Every quarter following Options Expiration I post performance metrics of the Dragonfly Capital Model Portfolio. This includes all trades that I entered over time. What it does not include is the one’s I miss for whatever reason (getting lunch, going to the bathroom, etc….). So each week I post the performance of the stocks that were given to subscribers the previous Sunday. All performance is measured against the plan given to subscribers.

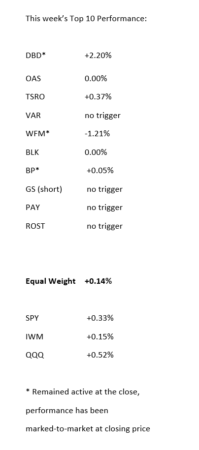

Six trades triggered this week, with 3 remaining active at the close Friday, Diebold Incorporated (NYSE:DBD), Whole Foods Market Inc (NASDAQ:WFM) and BP PLC (NYSE:BP). 2 trades triggered long and advanced enough to raise the stop and were eventually stopped out break even. 1 trade progressed a bit further and was stopped for a gain. An early stop in Tesaro was a killer. An equal weight portfolio lost to all 3 index ETF’s this week, but with only 60% of your capital exposed. There are no triggers or stops or targets measured in the index ETF performance. Here is this week’s rundown:

Equal Weighted Investment Yield assumes a buy at 1/10 portfolio size for each stock that triggers and accounts for stop loss triggers in the trade plan presented to subscribers (i.e. your performance would be better). Short position performance is calculated opposite of security movement. If the security is labeled no trigger than our trade plan would not have executed a trade (i.e. you would have had no position).

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.