The volatility on FOMC days can be quite amazing even on days when the Fed does nothing unexpected nor says anything unexpected. Here is a case in point in regards to US Treasury Bonds.

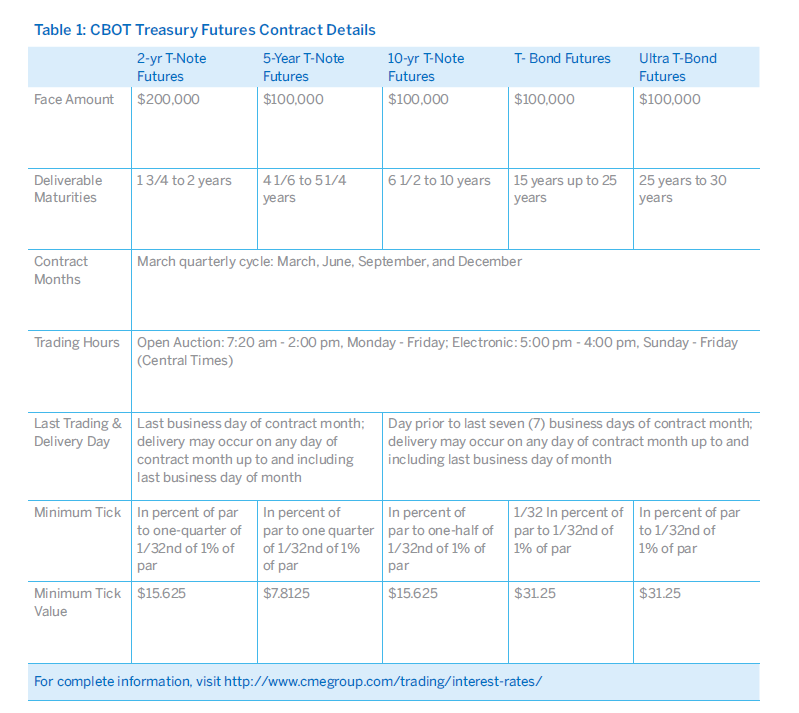

On the U.S. 30-Year bond there are 32 ticks in a point and each tick is worth $31.25 as per the following table.

Comments

In five minutes, for no apparent reason (other than to run the stops in both directions), futures swung 28 ticks. On a single future that is a swing of $875.

Anyone with a buy or sell stop in that range, got stopped out (or forced in).

This action is quite typical, and arguably mild.

In terms of yield, the entire top to bottom move for the entire day was around 5 basis points. Had the Fed really said or done something, action could easily been triple that if not more.

Priced in volatility is expensive for this reason, even though in most cases nothing unexpected is said or done, other than market makers purposely running stops in both directions.