My guess: the same forecast as I have given for the past 4 years – continued slow growth.

Contents

- A relatively bright part of the picture: employment

- The great hope: construction

- Manufacturing: activity rising

- Confidence Polls & Asset prices paint a sunny picture

- Other posts in this series

- For More Information

Let’s look at the Employment Situation Report for July. All numbers are in thousands.

(a) Jobs added during the past 12 months from selected industries (from the Establishment report, NSA):

- 2,296 (+1.7%)….Total (the Household report shows hours up 2%, $payrolls up 4%)

- 016 (+0.1%)….Manufacturing. Feel the revival!

- 021 (+2.4%)….Mining & Logging (the future of jobs according to some conservatives)

- 166 (+2.8%)….Construction (the great hope of many economists)

- 437 (+2.1%)….Wholesale & retail trade — Still adding jobs despite Wal-Mart & Amazon

- 477 (+3.3%)….Leisure & Hospitality (average hourly pay 56% of the average of all jobs)

- 638 (+3.5%)….Business & Professional Services

Growth in the Federal employment (civilian, not including contractors or postal workers) since Obama took office in January 2008: 97 thousand (5%). It peaked in April 2011, dropping 45 thousand (3%) since then.

(b) About those well-paying manufacturing jobs that so many optimists get juiced about:

America!

- average hourly earnings are 1.6% higher than that for all jobs

- average weekly earnings are 19.9% higher

- They are better because workers work longer.

Job growth is mostly in part-time jobs. New jobs since March from the Household report (SA):

- 978…..Total

- 187…..Full time (20% of the total)

- 791…..Part-time (80%) — feel the recovery!

Let’s look at Unemployment

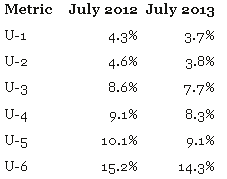

The analysts at BLS calculate six measures of unemployment, from narrow to broad definitions. None is more real than the others; none are easily comparable to the rough estimates of unemployment during the 1930s (the first reliable surveys were in the early 1940s). U-3 is the headline metric. The broadest is U-6. These are not seasonally adjusted.

Any way you count it, unemployment has decreased during the past year. But slowly, especially slowly given the large Federal deficit and extreme monetary stimulus. The broader the measure, the slower the decline (U-1 down 14%, U-6 down 6%). Not seasonally adjusted.

Why have Republicans opposed most of the measures that might stimulate employment growth? Robert Reich suggests an answer, harsh but plausible.

(2) Construction: the great hope for a stronger economy

The Census Construction Spendingreport for June shows us the current rate of growth in this improving but still depressed industry. It’s volatile month to month, so let’s look at longer periods.

- 5.1% — growth of June YoY (NSA)

- 4.9% — annualized growth during the past 4 months (SA)

Strong, but not boomtown. Let’s look forward, at starts of single-family homes (SA). Growth of multi-unit housing is growing, but is a small fraction of total construction — and has a smaller multiplier (eg, furniture sales, landscaping) than building single family homes. Starts of single-family homes peaked in September, and went negative in March — as shown in this graph of monthly starts (SAAR)

Mortgage rates spiked up sharply in May and June, How much will this slow construction?

(3) Manufacturing: activity rising

Let’s see the Census Report on Manufacturers’ Shipments, Inventoriesand Orders for June. New orders are a leading indicator.

- YTD (first half of 2013) YoY up 1.8%

- June YoY up 6.0%

If exports and auto sales continue to grow, exports could continue to boost the economy.

(4) Confidence polls and asset prices paint a sunny picture

The strong confidence polls and rising asset prices are often cited as an indication that the economy is growing stronger. That’s nice, since Fed policy is focused on increasing both.

Are confidence polls and market prices reliable predictors of the future? While there are periods of good correlations, there is little research showing that market prices are reliable guide to future trends in the economy. Nor is there any reason to expect them to be so. Shifts in market prices can have real world effects, but not always the ones predicted — nor of the scale predicted. The relationship between confidence polls (eg, builders’ confidence, consumer confidence) is even less reliable.

It is beyond the scope of this post to discuss the role of confidence as a driver of economic growth (that’s for another day). In brief I consider it grossly exaggerated.

What about markets, servants of the invisible hand. Perhaps instead of deifying markets, we should return to Adam Smith’s original — and narrow — concept of the “invisible hand”. It does not say that markets predict the future, or refer to the government-private market dichotomy, nor does he claim that it produces an acceptable level of macroeconomic stability. From The Wealth of Nations (1776), Book IV, Chapter II:

As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.

Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.