The Bears Had A Nice Set-Up

In late January/early February, economic fundamentals were looking shaky. The text below comes from a February 3 Reuters article:

U.S. manufacturing activity slowed sharply in January on the back of the biggest drop in new orders in 33 years while construction spending barely rose in December, pointing to some loss of steam in the economy. “The disappointing data provide further confirmation of a dramatic slowing in economic growth momentum,” said Millan Mulraine, deputy chief economist at TD Securities in New York. The Institute for Supply Management (ISM) said its index of national factory activity fell to 51.3 last month, its lowest level since May 2013, from 56.5 in December.

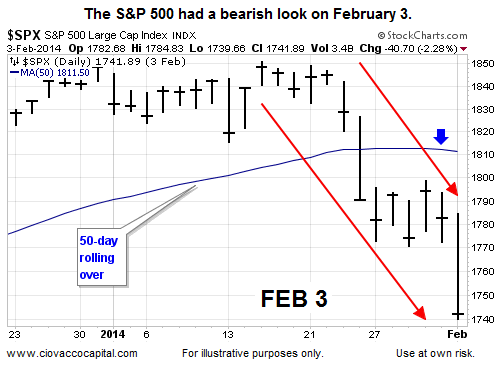

The negative data spilled over from the fundamentals into the technicals. The chart of the S&P 500 below shows a vulnerable stock market on Monday, February 3.

Observable Evidence Said Buy On February 7

Regular readers know our thoroughly backtested approach to the markets is based on staying aligned with hard evidence, rather than investing based on forecasting or personal opinions. Despite all the bearish sentiment born from the weak economic data, the evidence started to improve on February 7 prompting this “buy” tweet below:

Then Came That Scary 1929 Parallel Chart

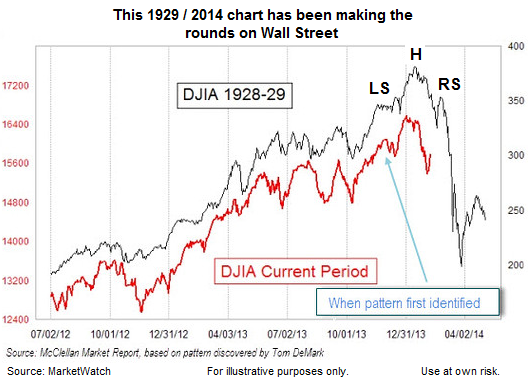

With investors already spooked by the recent slide in economic reports, the bears picked up some ammunition when the chart below started making the rounds on Wall Street. The text below comes from a February 11 MarketWatch article:

There are eerie parallels between the stock market’s recent behavior and how it behaved right before the 1929 crash. That, at least, is the conclusion reached by a frightening chart that has been making the rounds on Wall Street. The chart superimposes the market’s recent performance on top of a plot of its gyrations in 1928 and 1929. The picture isn’t pretty. And it’s not as easy as you might think to wriggle out from underneath the bearish significance of this chart.

The chart above is a form of forecasting. The forecast created fear. Forecasting brings bias. In this case, the 1929 forecast created a bearish bias for many investors. What did the evidence say to do on February 11, the day the 1929 chart appeared on MarketWatch? The evidence said “take a second incremental step to increase exposure to stocks.” The time stamped tweet below was based on facts in hand, rather than bias, fear, or a bearish 1929 forecast.

Were we aware of the 1929 parallel when we added to our stock exposure on February 7 and 11? Yes, in fact we wrote about the 1929 chart in a February 11 article.

In Face Of Fear, February Was Best Month Since July

If we fast forward to Friday, February 28, Bloomberg told us the improving evidence in early February was followed by an impressive month for stocks, bonds, and commodities:

For all the talk of a crisis at the start of the month, February ended up being the best period for global markets since July. Stocks, bonds and commodities rose together in February for the first time in seven months, reversing January’s losses in equities and raw materials. The Standard & Poor’s 500 Index has closed at a record for two straight days, erasing losses from January spurred by concern economic turmoil would spread from emerging markets as the Federal Reserve began reducing stimulus efforts.

How Does The Evidence Look Now?

Markets are driven by fundamentals, or more specifically asset prices are set by the aggregate and net interpretation of the all the fundamental data. If the aggregate opinion is favorable, stocks tend to rise. If the aggregate opinion is unfavorable, stocks tend to drop. Charts allow us to monitor the aggregate interpretation of the fundamentals. What are the charts saying now? To answer that question, this week’s video looks at the S&P 500 (SPY), NASDAQ (QQQ), small caps (IWM), consumer staples (XLP), consumer discretionary stocks (XLY), high beta (SPHB), emerging markets (EEM), warnings from 2008, and a significant development on the long-term chart of the broad NYSE Composite Stock Index.

Are There Reasons To Be Concerned?

Yes, there are always reasons to be concerned. There is no such thing as an “all clear” time to invest in stocks. If you are waiting for the perfect time to buy stocks, you will be waiting for the rest of your life. We outlined some potentially bearish reasons to pay attention with an open and flexible mind on February 20. We can add Ukraine to the list. From Friday’s The Wall Street Journal:

Traders blamed the late-day reversal in sentiment on news reports indicating intensifying tensions in Ukraine, whose government collapsed nearly a week ago following weeks of protests in Kiev. News agencies reported an incursion of Russian military forces in the Ukrainian region of Crimea. U.S. officials said they were closely watching the latest developments. “You see headlines like that, and you get a little spooked,” especially ahead of a weekend, said Sal Arnuk, co-head of equity trading at brokerage firm Themis Trading. But Mr. Arnuk played down the potential for any conflict in Ukraine to affect financial markets. “If anything, it’s an overreaction,” he said.

Investment Implications - The Charts Don’t Lie

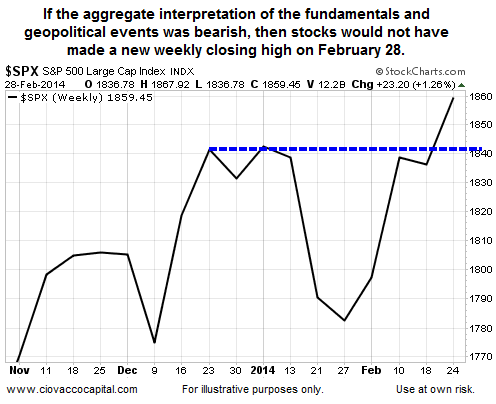

If slow growth, rising inflation, or tensions in Ukraine are to derail stocks, which they may, then we know with 100% certainty the concerns will eventually show up as observable and bearish shifts on the chart of the S&P 500. That bearish shift could start Monday, but it has not occurred yet. On February 27, we noted the bullish significance of the S&P 500 printing a new all-time closing high. We can add a new all-time weekly closing high to the list.

When we look at the chart above, it helps us understand the concept of “the market does not care what you think”. The expression is harsh, but our personal opinions have little impact on asset prices. What matters is what the market thinks, or the aggregate opinion of future economic outcomes. When the market gets concerned/bearish, then we should be concerned as well since the odds of investment success will become less favorable.

The evidence in hand calls for an allocation heavily slanted toward “risk-on”. Consequently, we own U.S. stocks (SPY), and technology stocks (QQQ). Given the improvement seen over the last five trading sessions, we added to our stock exposure Friday for the sixth time since making the first incremental buy on February 7. When the evidence shifts, our rules-based system will call for an incremental reduction in equity exposure.

When will that happen? You will have to ask the millions of people around the globe that make up the aggregate opinion driving asset prices, or you could follow the charts with an open, flexible, and unbiased mind.