There has never been a better time for investors to profit from global market trends than right now. Both bullish and bearish price trends exist in the global equity, currency and commodity markets. Exchange-Traded Funds (ETFs) are a great investment vehicle for taking advantage of these price trends.

ETFs first traded in 1993 and have exploded in popularity ever since. While they have many of the same advantages as mutual funds, one distinct difference is that ETFs don’t typically distribute capital gains to shareholders. The accounting and tax process for ETFs is therefore much simpler than mutual funds which require investors to account for distributions. In many cases, ETFs offer cheaper expense ratios as well.

ETFs hold a pool of securities and are designed to track a particular index, sector, commodity or currency. There are thousands of ETFs that track the performance of various market indexes and sectors. Another distinct advantage of ETF investing is that by tracking specific ETFs, investors can more easily detect individual stocks that are outperforming the general market.

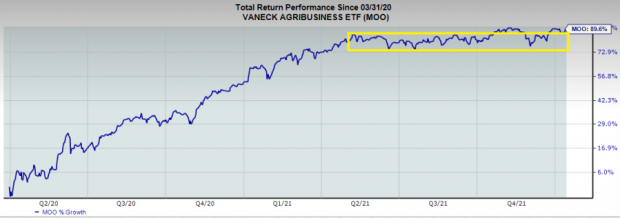

A good example in the current market environment is the VanEck Vectors Agribusiness ETF (MOO). This ETF is currently trading near an all-time high. MOO had been in a consolidation pattern since Q2 of last year as shown below. We had somewhat of a false breakout look in early November, and MOO is now knocking on the door once again as it is breaking above this range. New highs are a sign of strength.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

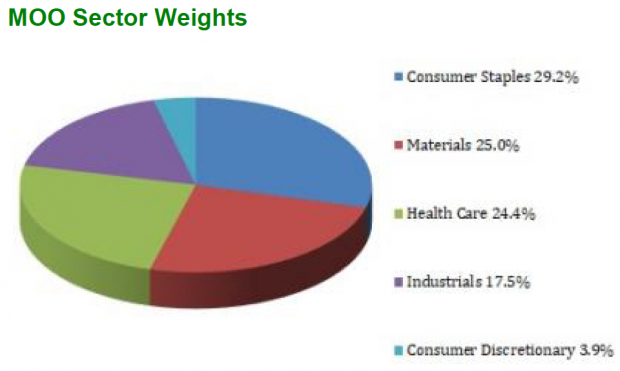

Our proprietary research here at Zacks indicates a low-risk rating for the MOO ETF. We can see the sector breakdown of MOO below:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

We’re going to analyze two stocks that are both currently ranked #1 (Strong Buy) based on our proprietary Zacks Rank system. Both stocks have witnessed positive earnings estimate revision activity. These two stocks account for approximately 8% of the total MOO holdings.

The two stocks we will discuss below are part of the Zacks Fertilizers industry group, which ranks in the top 2% of out of all 254 industries. We expect this industry group to outperform the market over the next three to six months. By focusing on stocks within the top Zacks Ranked Industries, investors can dramatically improve their probability of investing success.

CF Industries Holdings (NYSE:CF), Inc. (CF)

CF Industries Holdings is a global manufacturer and sells hydrogen and nitrogen products for clean energy, fertilizer, and related industrial applications. A worldwide leader in transforming natural gas into nitrogen products, CF is one of the largest distributors of nitrogen fertilizer and other linked products. CF Industries Holdings was founded in 1946 and is based in Deerfield, IL.

CF’s primary products include anhydrous ammonia, granular urea, and ammonium nitrate products. The company principally serves independent fertilizer distributors, traders, wholesalers and industrial users. CF is well-positioned to benefit from higher nitrogen demand in North America, driven by healthy corn acres in the United States. A recovery in nitrogen prices will also boost the company’s bottom line.

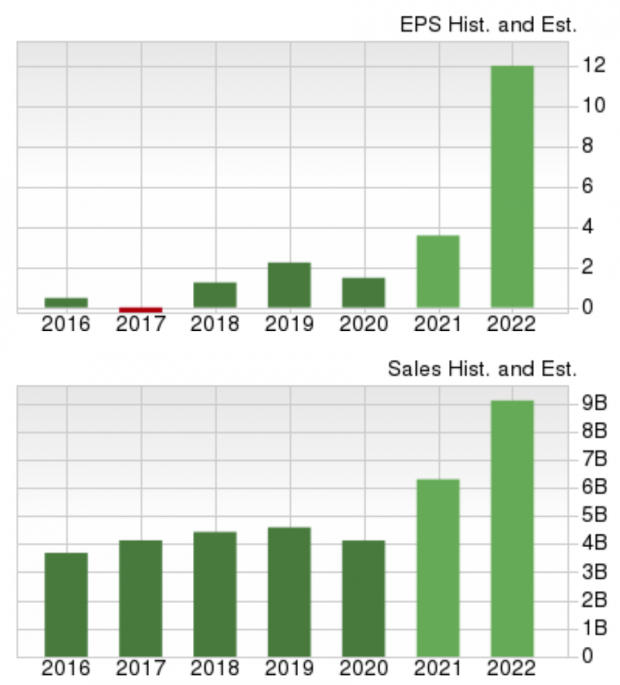

CF earnings in 2021 are expected to have risen 143.54% to $3.58 relative to 2020. Revenues are projected to have climbed 55.01% to $6.39 billion. Even more impressive is the fact that analysts have increased their 2022 EPS estimates for CF by 27.84% in the past 60 days. Earnings are expected to rise 246.42% to $12.40 versus 2021.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

CF trades at an attractive valuation (5.58 forward P/E) and is averaging a +97.82% earnings beat over the last four quarters. CF stock has outperformed the market this past year with a return of 52.73%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

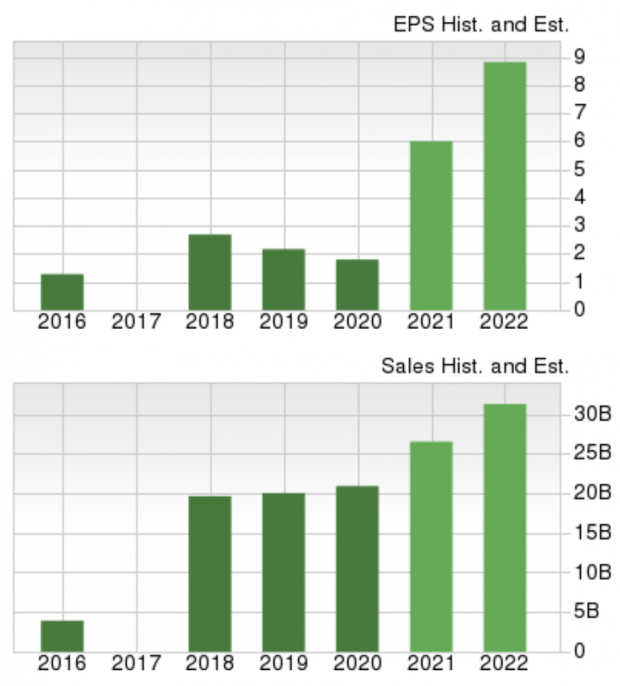

NTR trades at a 7.94 forward P/E and boasts an attractive price chart. The company most recently reported quarterly EPS of $1.38 back in November, a +12.2% surprise over consensus. NTR has delivered a trailing four-quarter average earnings surprise of +73.49%, supporting the stock’s 36.08% return over the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Nutrien Ltd. (NTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research