Investing.com’s stocks of the week

Yesterday, global stock markets sold off mainly on the Hollande and Holland news. European stocks are in a well-defined one-month downtrend.

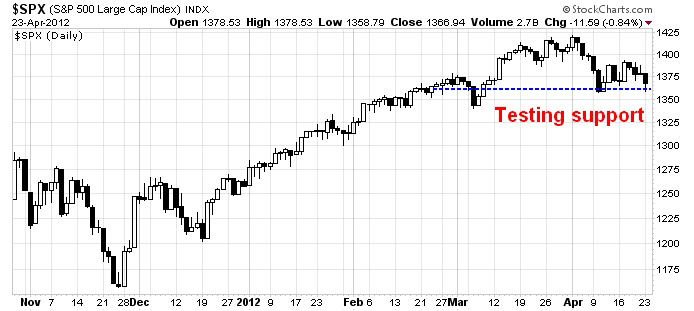

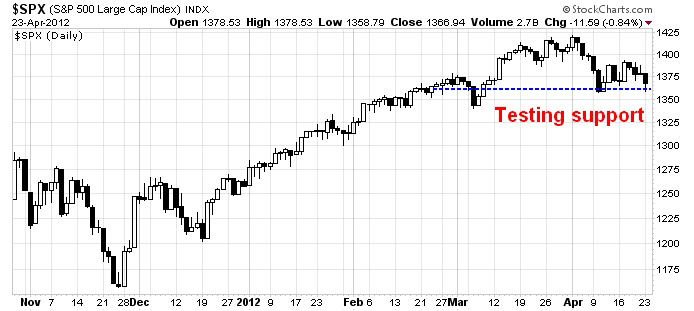

US equities descended to test an important technical support level.

However, when I look at the FX and bond markets, I can't see the same level of investor angst that seems to exist in the equity markets. For example, if Europe is such a mess, why is the EUR/USD exchange rate holding up so well?

EUR/USD" title="EUR/USD" width="695" height="309" />

EUR/USD" title="EUR/USD" width="695" height="309" />

Also consider the CAD/USD exchange rate, which is sensitive to commodity prices and a measure of risk appetite. The loonie remains in a trading range relative to the greenback.

CAD/USD" title="CAD/USD" width="695" height="307" />

CAD/USD" title="CAD/USD" width="695" height="307" />

There are no signs of panic in the bond market either. High yield, or junk, bonds continue to perform reasonably well in light of the difficulties experienced by the stock market. Why isn't risk aversion showing up in this market?

In conclusion, until we get signs of a significant decline in risk appetite from the foreign exchange and bond markets, this bout of stock market weakness is just another phase in a sideways and choppy market.

US equities descended to test an important technical support level.

However, when I look at the FX and bond markets, I can't see the same level of investor angst that seems to exist in the equity markets. For example, if Europe is such a mess, why is the EUR/USD exchange rate holding up so well?

EUR/USD" title="EUR/USD" width="695" height="309" />

EUR/USD" title="EUR/USD" width="695" height="309" />Also consider the CAD/USD exchange rate, which is sensitive to commodity prices and a measure of risk appetite. The loonie remains in a trading range relative to the greenback.

CAD/USD" title="CAD/USD" width="695" height="307" />

CAD/USD" title="CAD/USD" width="695" height="307" />There are no signs of panic in the bond market either. High yield, or junk, bonds continue to perform reasonably well in light of the difficulties experienced by the stock market. Why isn't risk aversion showing up in this market?

In conclusion, until we get signs of a significant decline in risk appetite from the foreign exchange and bond markets, this bout of stock market weakness is just another phase in a sideways and choppy market.