And thus I clothe my naked villainy

With odd old ends stol'n out of holy writ;

And seem a saint, when most I play the devil

- Shakespeare, "Richard III"

We have witnessed a stunning drain of gold from the GLD ETF trust. Through last Friday, an incredible 479 tonnes - more than 35% - of GLD's gold has been removed and has disappeared, most likely to Asia - in the space of about 10 months. The biggest chunk of that 479 tonnes was removed shortly after Germany's Bundesbank issued it's feeble and hopeless request to the U.S. that the Federal Reserve start shipping back some portion of the 1500 tonnes of gold that is supposedly being "safe-kept" on behalf of Germany by the Fed in its vault in New York City. Gold luck, Angela...

I have looked at GLD suspiciously ever since James Turk issued the first analysis of GLD's prospectus back in 2004. Those of us who are familiar with securities laws and investor "safe guards" supposedly enforced by the SEC were absolutely shocked that the SEC approved the GLD prospectus as it was filed because of the egregious lack of GLD sponsor and custodian legal accountability standards typically required by the SEC for publicly traded securities.

Given this fact, I believed at the time that GLD was a scheme devised to suck in retail and institutional cash that might otherwise flow in massive quantities into actual physical gold that would be safe-kept in private vaults in this country. Although GLD has a mechanism to enable investors with a minimum of 100,000 shares to convert those shares into gold that would be delivered to the investor, the procedure is exceedingly cumbersome and expensive and there's a mechanism embedded in the language of the prospectus that enables the trustee of GLD to deny such requests.

But I also knew - through GATA's invaluable research - that there would eventually be a shortage of physical gold that would be available to allow the western Central Banks and bullion banks to maintain their oppressive and incessant manipulation of the paper gold market for the purposes of maintaining a cap on the price of gold, for the purposes of defending the credibility of the U.S. dollar. I figured that at some point the gold in GLD would used for this purpose once the Central Bank stocks of gold were largely if not fully depleted. In this context, please recall that about three years, the ECB system, which had been selling 400 tonnes per year on average, pretty much stopped selling any gold. That's sign-post #1 that I was right.

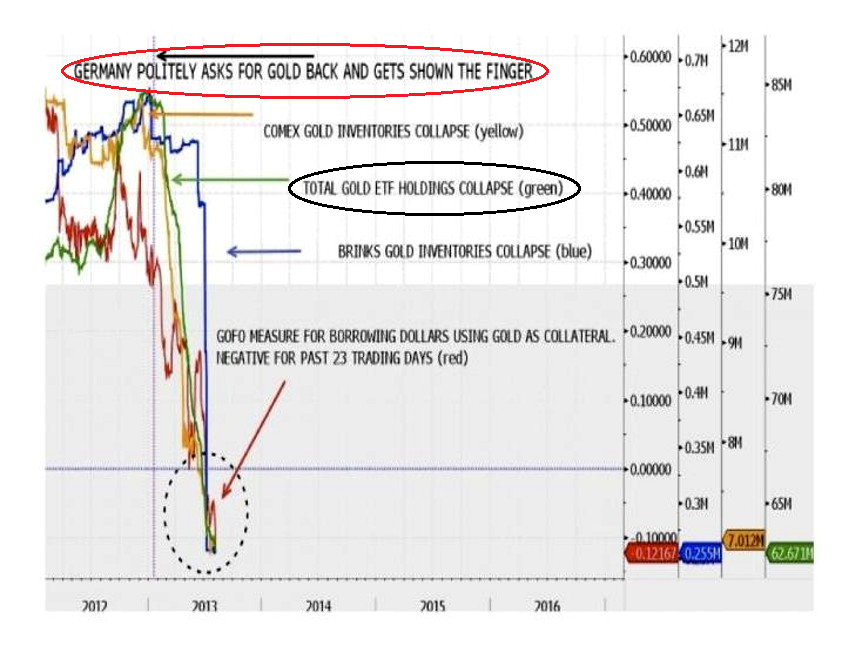

Then along comes the Bundesbank in early 2013, with a request that the Fed start shipping Germany's gold held in in New York back to Germany. That's when all hell broke loose:

(Please note: the original graph is from the TF Metals Report. I sourced it from my esteemed colleague, "Jesse," of Jesse's Cafe Americain. Solid circle edits are mine to enhance visual readability of the chart. Jesse's original post can be read here: Collapse in GLD gold holdings).

There's something really wrong with that picture because the intuitive response from the market by Germany's request of the Fed should have been a quickly rising price of gold. But as you we all know, the Fed defaulted on the request - for all intents and purposes - and that's when the massive drain of gold from GLD commenced.

The truth is that my original hunch was correct. 100% correct. The gold in the GLD trust is being used to satisfy the enormous physical delivery demands from China and the other big gold buying countries because the western Central Banks have run out of gold to deliver. That is an unmistakable fact. Reports and data ad nauseum have been published in the last six months describing and verifying the voluminous, unprecedented amount of gold bars that have been moved - literally physical transferred - from the Comex in NY and the LBMA and Bank of England vaults in London to Switzerland and then on to Hong Kong, where it flows to its ultimate destinations in China. Anyone who would deny that this is the case has a blatant and catastrophic disregard for the truth as supported by provable facts.

So the question is, how much longer can the depletion of gold from GLD continue before this scheme falls apart? Let me first say that it is likely that the U.S Government's "Waterloo" in this situation will be the gross miscalculation - when GLD was originally devised - of the growth and size of China's appetite for physical gold for which actual physical delivery is demanded.

With that in mind, my best guess is that if the gold in GLD were to be depleted by another 35% from here, the largest remaining shareholders of GLD would likely start exercising their legally ambiguous "right" to convert their shares into physical gold and have that gold delivered out of JPM's custodial vault and into their possession.

Think about the Hobson's Choice faced by the sponsor, trustee and custodian of GLD: if they don't honor shareholder conversion requests to convert and deliver gold, it will send the "default" signal to the world that indeed GLD is a fraud, that GATA has been right along. The price of gold will literally go straight up, "bid without" - meaning huge bids will appear at much higher levels and there won't be any offers. The other side of this "choice" is that it is likely that the physical gold - at that point in time - to honor such requests is actually not available in HSBC's vault to be delivered and the trustee will attempt to settle in cash. Gold goes bid without.

At this point there's really no telling just how much longer GLD can be drained of gold before the western Central Bank/BIS fiat paper gold system inevitably collapses, but with each passing day of increasing awareness and understanding of what is happening with the world's physical gold vs.the derivative paper claims on that gold, and with each additional day the LMBA GOFO rate is negative, the time to collapse is quickly shrinking. I do believe that, in what ironically was devised as a "fool-proof" tool manufactured to allow the west to "manage" the physical gold vs. paper problem for a long time, will likely be the Icarus wings of the U.S. Government's fiat money scheme.

Note: I am in the processing of revising and updating my original analysis of the GLD trust and why the shares in ETF are fraudulent - stay tuned...