This week marks the kickoff of the first quarterly earnings season of 2014 and the banks are first to bat. JP Morgan absorbed a record breaking $13 billion fine last year, but if you looked at their stock price you would never have guessed. 2013 was an outstanding year for US equities across the board and financials were no exception. Below is a chart of the KBW Bank Index which reflects how well the bank stocks performed. The index was up nearly 30% in 2013.

KBW Bank Index 2013 (BKX)

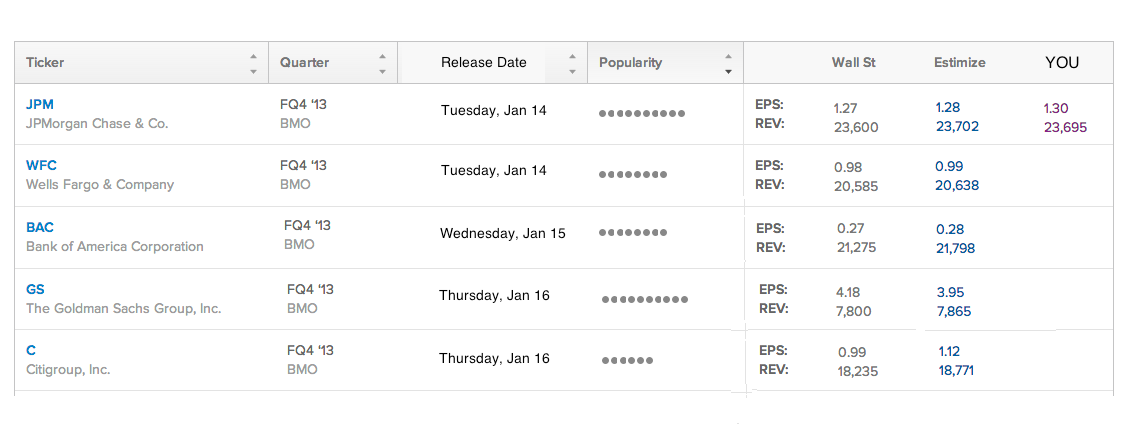

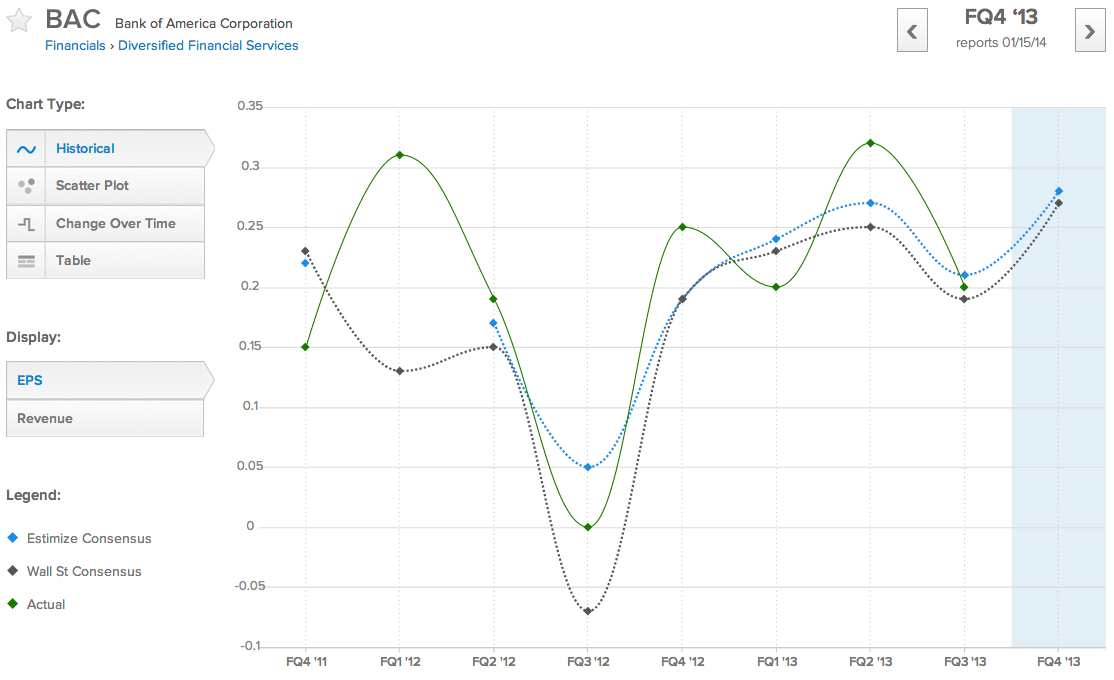

JPMorgan Chase (JPM) and Wells Fargo (WFC) will be the first two big banks to get us underway on Tuesday. Below are charts showing their financial results over the past 2 years including information derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

Last year JPM was hit with a record breaking $13b fine and took it in stride to end probes from regulators over its mortgage-bond sales. JP Morgan Chase has beaten the Wall Street and Estimize consensus in each quarter over the past year. In each of these quarters the Estimize consensus from Buy-side and Independent contributing analysts has been more optimistic than the Wall Street consensus.

By tapping into a wider distribution of contributors including hedge-fund analysts, asset managers, students, and non professional investors Estimize has built a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations.

The Estimize consensus has been more accurate than Wall Street over the 4 previous quarters by forecasting JPM will beat the Street, and this quarter contributing analysts on Estimize are expecting that pattern to continue but by a smaller margin.

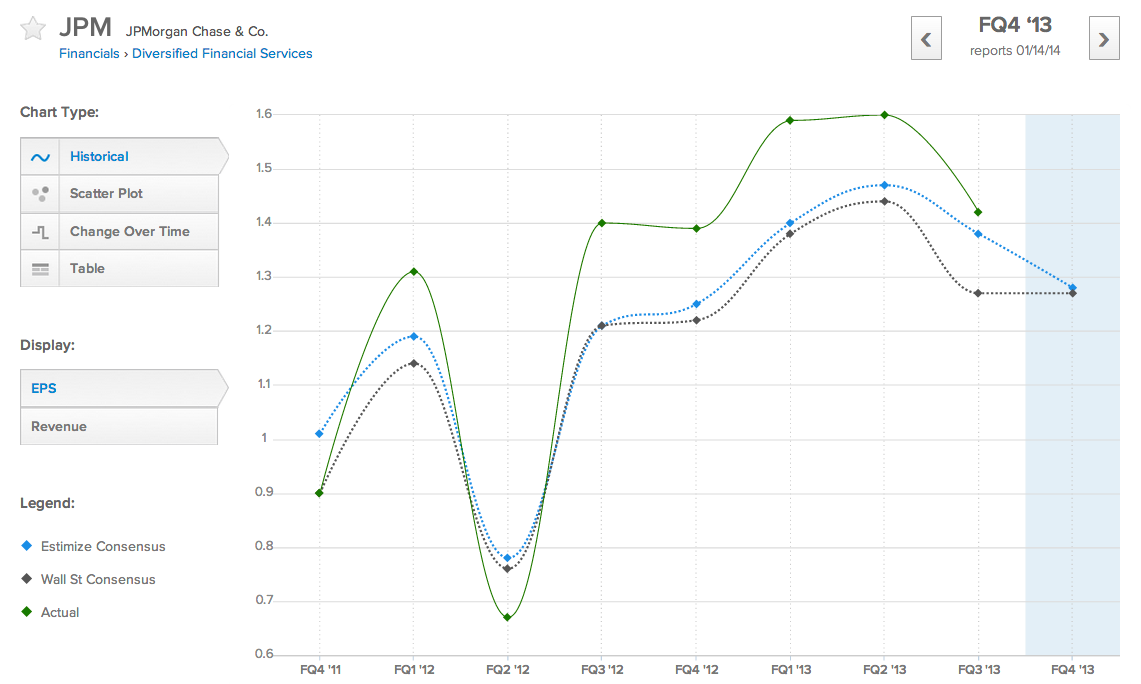

2. Wells Fargo (WFC)

Wells Fargo (WFC) is the other large bank reporting on Tuesday. Wells Fargo has consistently outperformed the Wall Street consensus and Estimize contributing analysts are expecting them to do it again on Tuesday. Wall Street is expecting 98c EPS while the forecast from Estimize is 99c.

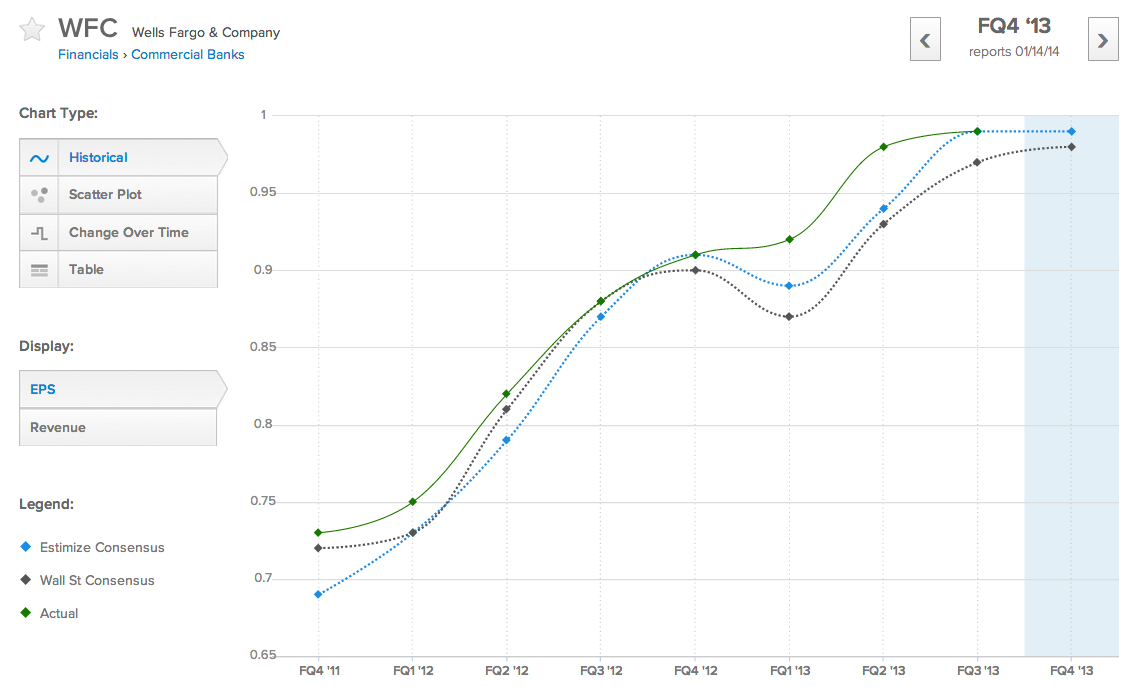

3. Bank of America (BAC)

Over the past 6 quarters Estimize has been more accurate than the Street in forecasting Bank of America’s earnings 5 times and 4 times on revenue. This quarter BAC stock is up big and analysts are expecting the company to beat the Street again on Wednesday.

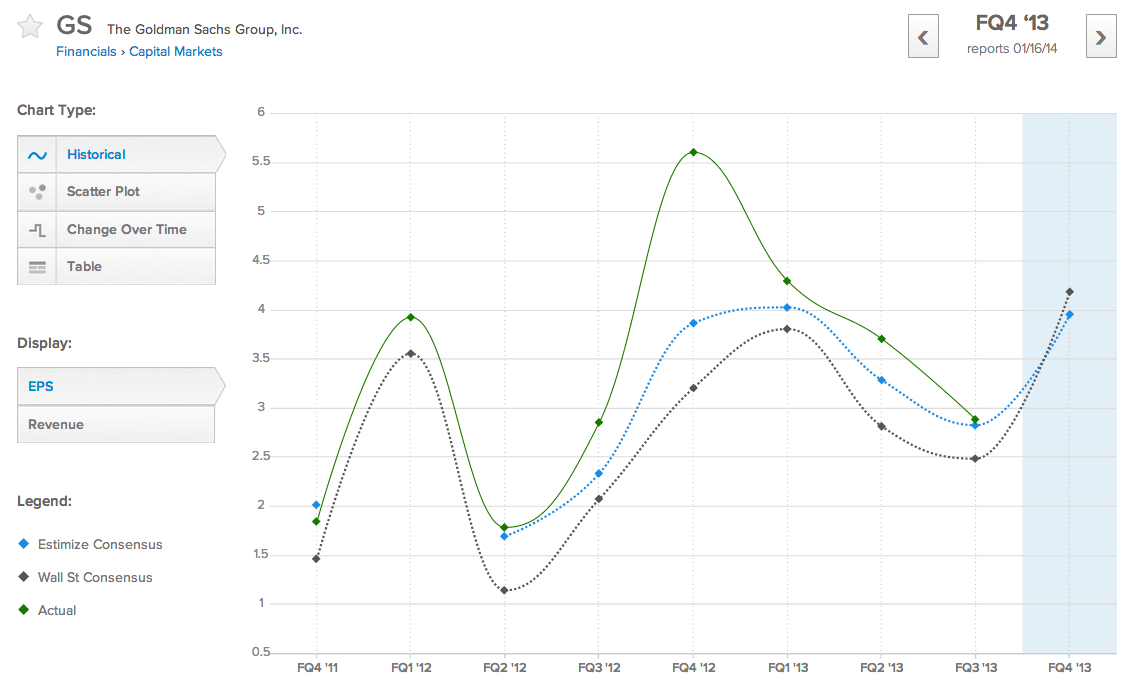

4. Goldman Sachs (GS)

Over the past 2 years the Estimize consensus has been more accurate than Wall Street on Goldman Sachs every time. Interestingly this is the first quarter that contributing analysts are expecting GS to miss the Street profit consensus. The consensus from Estimize is $3.95 EPS while Wall Street is forecasting $4.18.

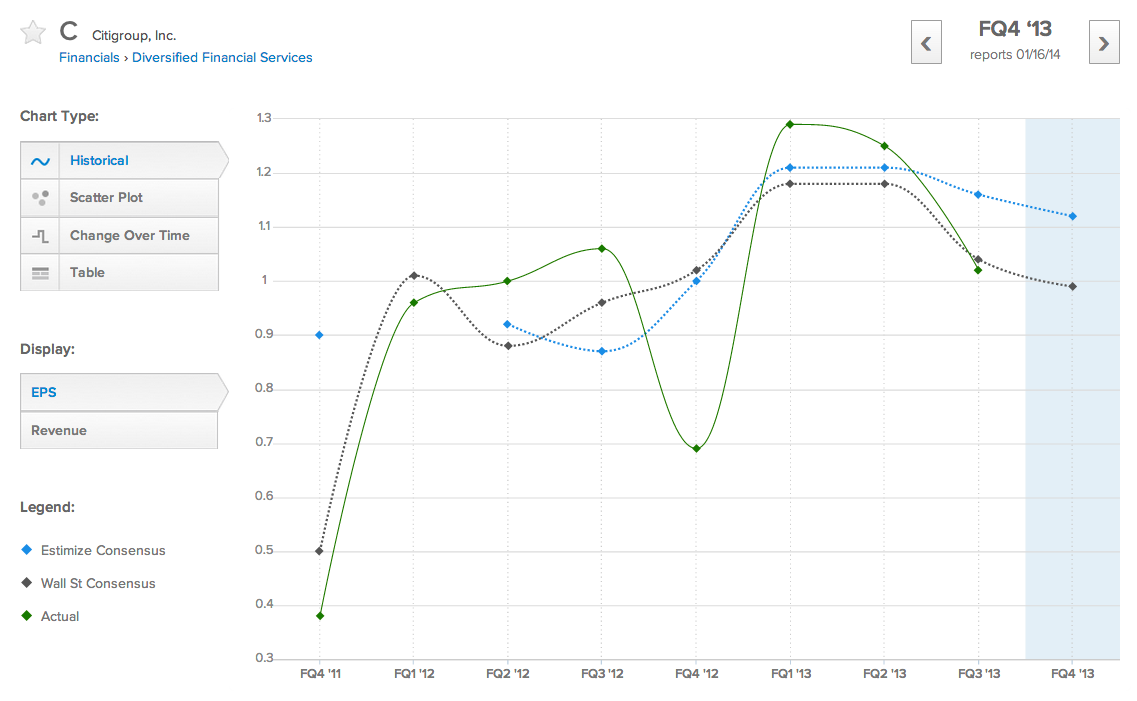

5. Citigroup (C)

Over the past 6 quarters Estimize has been more accurate in forecasting Citigroup’s EPS 4 times. This quarter the contributing analysts are expecting Citi to beat the Street by a wide margin despite missing by a narrow one last quarter.

It seems that with the exception of Goldman Sachs hedge funds, buy side, and independent analysts are forecasting better than expected earnings reports from the banks this week.

Get access to earnings season estimates published by your Buy Side and Independent analyst peers, and register for free to make your own estimates to see how you stack up to Wall Street by heading over to Estimize now.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How Much Hedge Funds And The Buy Side Expect Banks To Profit

Published 01/12/2014, 03:23 AM

How Much Hedge Funds And The Buy Side Expect Banks To Profit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.