2016 is almost over. And just in time, Janet Yellen has put an end to this year’s “will they or won’t they” interest rate hike drama. On December 14, she announced that the Fed was raising the benchmark rate by 25 basis points. Then, in almost the same breath, she set the stage for another year of anxious Fed-watching.

According to Yellen, the Fed expects three interest rate hikes in 2017. But you should take that prediction with a grain of salt. After the last hike in December 2015, the markets and even the Fed expected a series of small increases over the next year.

We all saw how that played out.

The Odds of 2017 Rate Hikes

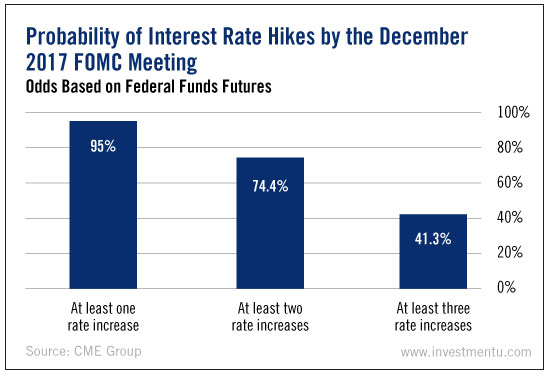

As you can see from this week’s chart, the market isn’t sure about Yellen’s prediction for 2017. The chart shows the consensus odds of different interest rate increases at the end of next year. This is based on federal funds futures trading data.

The current policy rate range, after Yellen’s announcement, is 50-75 basis points.

Traders believe there’s a 95% chance of at least one rate increase in 2017. They think there’s an almost 75% chance of at least two. But according to the trading data, the odds of three or more rate increases are hovering around just 40%.

Of course, many variables will factor into these decisions over the next 12 months. For one thing, we don’t know how the new government’s policies will affect economic growth. Interest rate policy will depend largely on the job-market and inflation numbers that come in throughout 2017.

But one thing is clear:

The market thinks Yellen is bluffing about three rate hikes.

How to Prepare Your Portfolio

This chart isn’t urging you to panic-sell your equities and prepare for a high-interest recession. In fact, it emphasizes the importance of patience in gauging our interest rate environment.

To get a better idea of where we’re headed, pay attention to jobs reports and the consumer price index. If inflation and the labor market remain strong, then we can expect a series of regular increases. If they don’t, then the Fed will probably postpone the rate hikes again.

If rates are really going up past 1.25%, then certain equities may underperform in the near future. But some stocks, like those of regional banks, stand to benefit from rising rates. And as rising rates strengthen the dollar, small caps and other domestically focused stocks could see some gains.

2017 could be the year when interest rates start recovering to a normal level. But at the moment, the market is skeptical. The best way to weather this uncertainty is to stay calm and well-informed. If a rate hike seems likely, consider moving some money to assets that are safe from interest rate risk.