Lululemon Athletica Inc (NASDAQ:LULU) built an empire by reinventing women’s athletic apparel. Since the company’s inception in 1998, its comfortable and convenient athletic wear has spread rapidly through the growing yoga market. And it has inspired copycat products from the likes of Nike (NYSE: NYSE:NKE) and Under Armour (NYSE:UAA).

You can credit (or blame) Lululemon for the so-called “athleisure” trend, where gym clothes became fashionable... and a staple of many people’s wardrobes.

However, there’s a difference between “first to market” and “best in market.” Lululemon may have pioneered modern leggings and yoga pants, but the quality of these products hasn’t always satisfied customers.

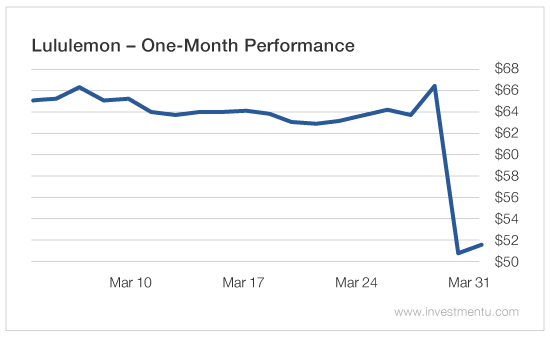

In recent years, patrons have complained that the pants end up wearing too thin - sometimes to the point of being transparent. And as you can see below, Lululemon stock has been wearing thin lately as well.

Last week, shares crashed by more than 20% after fourth quarter earnings missed expectations by one penny. Ordinarily, a little miss like that wouldn’t be a big deal. But in the context of Lululemon’s product quality issues (and an increasingly bleak outlook for clothing retailers), it has investors running for the exits.

Has the Vancouver-based clothier stretched itself too thin? Or does Lululemon stock still have a prospect for recovery?

Lululemon’s Problems

As is often the case, this earnings report sell-off was about more than earnings. The $0.01 miss was just a catalyst that caused investors to act on their pre-existing concerns.

One underlying cause of concern is Lululemon’s product line. As we mentioned previously, the firm has grappled with a reputation for making flimsy pants. In 2013, it was hit by a major recall after customers discovered that its black yoga pants were so thin that they were see-through.

More recently, it has made some aesthetic missteps. CEO Laurent Potdevin said that one cause of sluggish sales is “an assortment lacking depth and color for spring.” And more broadly, leggings may not be such a profitable item going forward.

Many fashion analysts are predicting a return to heavier bottoms for women (e.g. jeans) in the next few years. That’s a threat to Lululemon’s business, which is all about lightweight and tight-fitting stuff.

What’s more, many investors are getting tired of waiting for Lululemon stock to break into triple digits. The stock has been bouncing between $50 and $80 for almost five years now, and it pays no dividend.

All of these problems are deeply worrying in a retail environment that has become brutally competitive. As stores close and malls empty out, investors are having concerns about Lululemon’s ability to compete with its larger rivals like Nike and Adidas (DE:ADSGN.

Prospects for Recovery

Lululemon stock certainly has its problems, but its outlook isn’t all bad. For one thing, the recent Q4 report showed a tiny earnings miss but a fairly substantial revenue beat.

And the recent earnings miss is just about the only negative item on Lululemon’s balance sheet. It has no debt, and the company has a cash surplus of more than $200 million, which it could use for share buybacks or dividend payments if things get worse.

Finally, Lululemon enforces its intellectual property rights very aggressively. It patents all of its most important products and technologies. And it’s not afraid to sue competitors that imitate them, as it did with Calvin Klein back in 2012.

Willingness to defend your products is an important quality in the clothing business. Think about how big the market is for designer knockoffs.

The Bottom Line for Lululemon Stock

Lululemon isn’t going to dig itself out of this hole overnight. As is the case with many clothing retailers, things are likely to get worse before they get better.

So Lululemon isn’t a good buy for short-term growth. But it still has potential as a long-term value play. If the company can survive through the current “retail winter,” then its healthy balance sheet should set it up to recover rapidly when market conditions improve.