The US Consumer Price Index surged in April, topping estimates by a wide margin. The question is whether this is the start of an inflationary wave or just the latest run of noise?

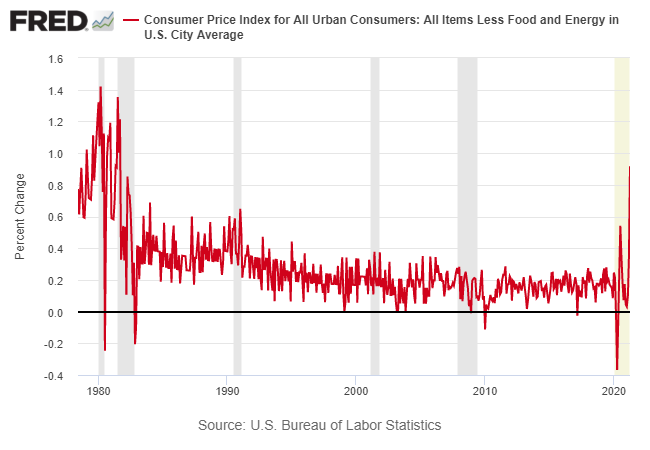

Reliably answering that question will take several months at the least, but if we ignore that caveat the numbers for last month certainly look worrisome. Let’s start with core CPI, which strips out the food and energy noise, a filter that helps identify the underlying trend. On this basis, the monthly surge in core CPI is an extreme outlier: the 0.9% increase in April is the highest since inflation was raging 40 years ago. That could be a sign that the jig is up and pricing pressure is heating up to the point that the old paradigm no longer applies. But outliers can also be one-time shocks that are mostly light and heat. Outliers, by definition, after all, aren’t usually indicative of the trend. Unfortunately, we don’t yet know which applies and so caution is still recommended for reading too much in one number.

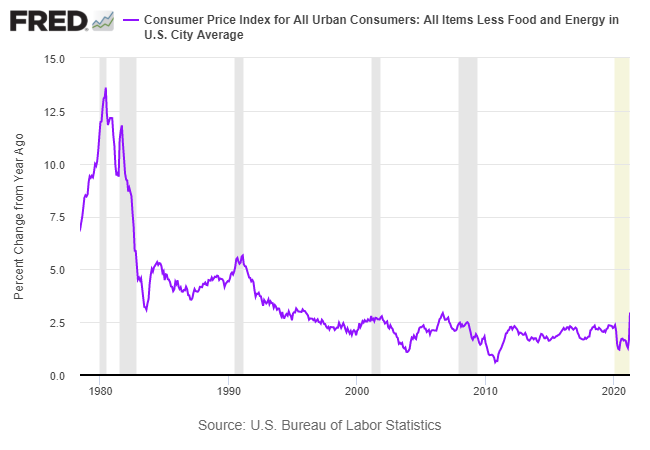

Filtering out the monthly noise paints a less severe trend, but even here the year-over-year results stand out. The 3.0% rise is the highest in nearly 15 years.

Taking the two charts at face value makes it easy to conclude that the inflation genie is out of the bottle. No one can dismiss that possibility and yesterday’s numbers raise the odds that hotter inflation is more likely than previously thought. But it’s also a mistake to see the April report as a smoking gun that cements the worst-case outlook for inflation. As anyone who traffics in economics data more than casually understands, one monthly macro report (or even two or three) can easily mislead us.

One reason is that economics data is revised, sometimes dramatically. There’s also an added complication in 2021: the pandemic effects on the economy are unprecedented in modern times and so analysts are still grappling with unusually noisy numbers. Recall that it was just a week ago that the April payrolls report was sharply weaker than expected: jobs increased 266,000 last month, a world below the expected 1-million gain.

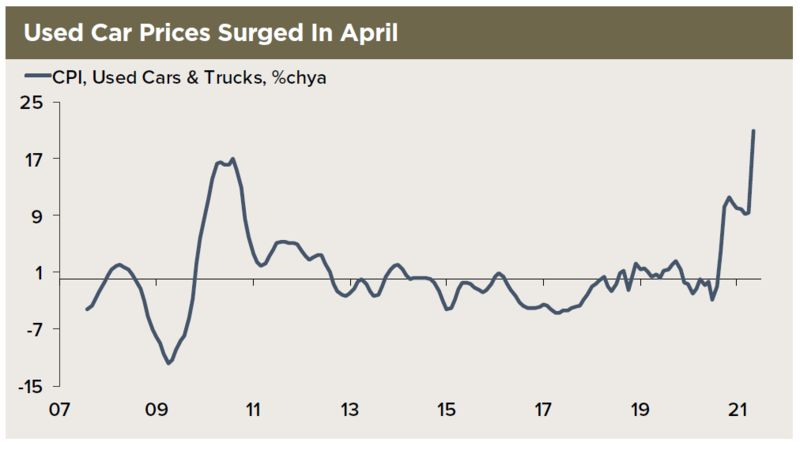

As for CPI, there are surely several temporary factors that drove inflation up last month. As Bloomberg’s John Authers observes:

"There are a number of bizarre numbers within the data that plainly wouldn’t have happened without the pandemic, and must be transitory to an extent. Most notably, inflation in the prices of used cars and trucks took off as rental companies struggled to cope with reawakened demand:"

In fact, supply chain issues generally have conspired to be a key contributing factor in the jump in inflation. But supply shortages aren’t necessarily inflationary, at least not beyond the short term. Indeed, higher prices are the catalyst that typically leads to greater supply, which suggests that many of the supply chain shortages will be short-lived.

Eric Winograd, senior economist at AllianceBernstein, makes this point, writing in a note to clients:

“The more persistent categories of inflation (services, and rent specifically) were relatively tame last month, but goods prices surged, as did transportation and travel. None of those moves are likely to be persistent. Over time, that means that the most likely course of events is still for inflation to settle down as the supply side of the economy catches up to the demand side.”

Perhaps the biggest risk is expectations. Even if the supply-demand gap lessens in the months ahead, there’s a danger that the mindset on inflation will change, unleashing a self-reinforcing pattern that drives prices higher. Such inflationary sentiment has been dormant in the US for much of the past four decades, but some analysts wonder if it could return.

“If everybody else is raising prices, it becomes a lot easier for you to do that, too,” notes Kristin Forbes, an MIT economist.

Adding to the inflation-is-coming narrative: a ramp-up in government stimulus and ongoing dovish monetary policy. The combination, runs the thinking, will break the disinflation-deflation trends of the past generation.

Nonetheless, one data point doesn’t tell us much, even if it’s easy to characterize the April results as a tipping point. The true smoking gun, if there is one, will take time to emerge. Exhibit A on that front will be a sharply higher pace in core CPI on a year-over-year basis that holds on to the jump.

For the moment, the latest pop still looks like one more transitory run-up. Note that there have been several spikes over the years, and every one so far has turned out to be fleeting, as the annual core CPI chart above indicates.

The argument for thinking that a run-up in inflation is one more passing phase includes the failed efforts by policymakers to raise pricing pressure over the past ten years. Despite continued efforts at ever-greater unprecedented monetary stimulus programs, inflation has remained muted.

Perhaps the question to ask: What would inflation be if the Federal Reserve shifted from dovish to neutral or even hawkish tomorrow?

The cold, hard facts tell us that structural forces in the global economy have put downward pressure on inflation for 40 years. Have these forces receded to the point that allows pricing pressure to sustainably surge? Maybe, but that’s not evident in the April CPI data.

Jeff Snider at Alhambra Investments asks the essential question: “The economy right now is improving, even rebounding as more reopening gets done, but with such a long way still to go and having squandered so much time just to get this far once the latest sugar high wears off, what will the CPI look like this summer?”

We may be on the cusp of a new inflationary regime, but the secular forces of the past 40 years (still) suggest otherwise. That leaves us with just one task: monitor the incoming data in the months ahead to decide which way the wind is blowing and whether it’s shifted. Meantime, as a baseline forecast, the disinflation/deflation still resonates – until or if the reports ahead tell us otherwise.

“Add it all up, and I would say that it will be at least six months for the Fed to get a sense of whether inflation pressures are transitory and more likely 12 months to make a firm conclusion in that respect,” advises Brett Ryan, an economist at Deutsche Bank.