Over the past several weeks we have seen the S&P 500 (SPY) and Dow (DIA) push lower while the higher beta indexes Nasdaq 100 (QQQ) and Russell 2000 (IWM).

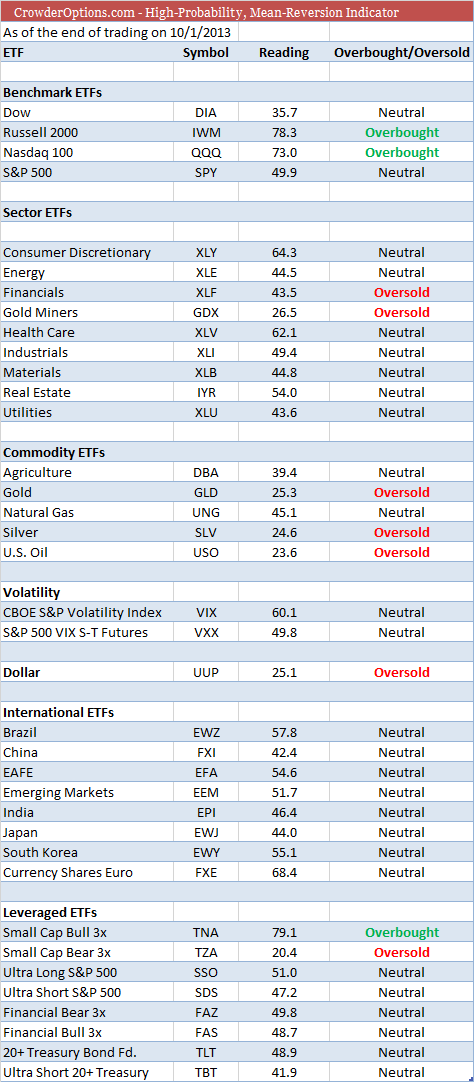

As you can see in the table below, both ETFs are now in a short-term overbought state.

There are a few ways I might play the overbought readings in IWM and QQQ.

First, I could buy a put. This would, of course, be a fairly risky trade as it would be very directional with duration working against the position. I would prefer to see a reading above 85 before I truly pursued buying a put. Moreover, due to the directional nature of the trade I would keep my size smaller than a normal spread position. Furthermore, along with an overbought reading above 85, I would prefer to see my short-term readings, say the RSI (2) above 95.

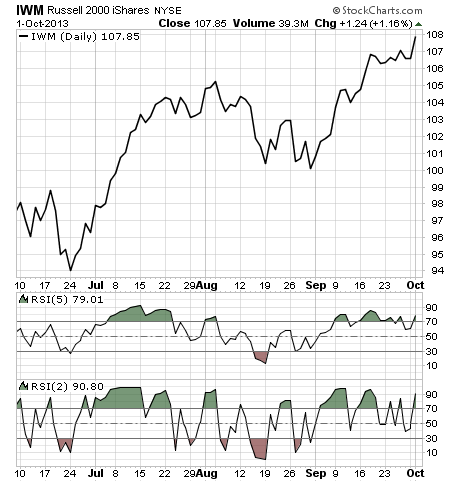

Let’s take a look at the current state of IWM:

As you can see, both time frames are in a short-term overbought state. But the problem is the readings still aren’t as extreme as I would prefer on a short-term basis, especially for a directional trade. So, with that being said, I want to wait another day or two to see how IWM reacts. If it happens to move higher and push its short-term state into “very overbought” I would place a trade. It takes great patience to wait for true extremes to hit, but it’s often worth the wait.

But that’s why we have credit spreads, more specifically in this case, a bear call spread.

With IWM currently trading at $107.85, I might sell the Nov13 113/115 call spread. The spread gives us a 82.6% probability of success and a margin of error over 4.8%. Good luck finding those odds trading stocks…which is why I prefer to trade options. In all but those few extreme cases I want to be the house, I want the odds in my favor, I want to sell speculators options with a low-probability of success. I can attest that this is the true formula for success in trading.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How I’m Playing The Surge In High Beta Stocks

Published 10/02/2013, 12:39 AM

Updated 07/09/2023, 06:31 AM

How I’m Playing The Surge In High Beta Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.