The investment world is undergoing a significant transformation, with Exchange-Traded Funds (ETFs) at the forefront of this change. The Trackinsight Global ETF 2024 Survey results provide a window into the current state of ETF investments and how investors are positioning themselves for future opportunities. This deep dive explores the appeal of ETFs across different categories, including fixed income, active, and thematic ETFs, and unveils the expectations and strategies of modern investors.

The Growing Appeal of ETFs: A Portfolio Staple

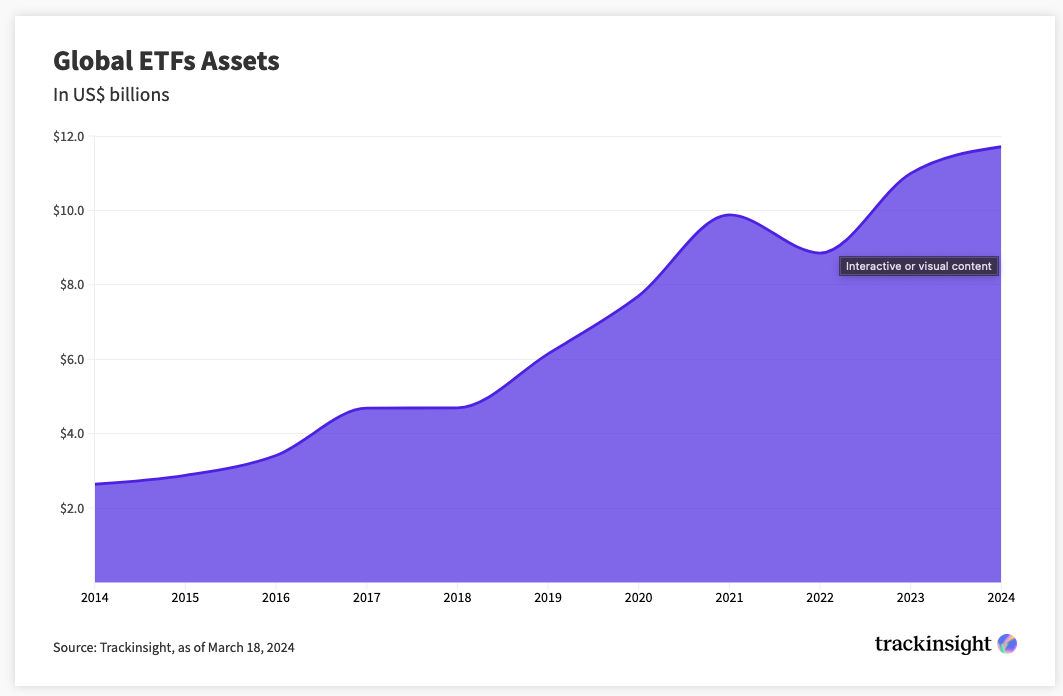

The survey and Trackinsight’s global ETF data show that ETFs have rapidly become a preferred investment vehicle, celebrated for their benefits, including diversification, liquidity cost-effectiveness, transparency, and flexibility.

A closer look at the survey respondents’ portfolios reveals a strategic embrace of ETFs, with 10% to 60% of portfolios allocated to these instruments. Notably, a significant 20.8% of investors allocate more than 60% of their portfolios to ETFs, underscoring the deep trust and reliance on these versatile financial instruments.

Future Allocations: Equity and Beyond

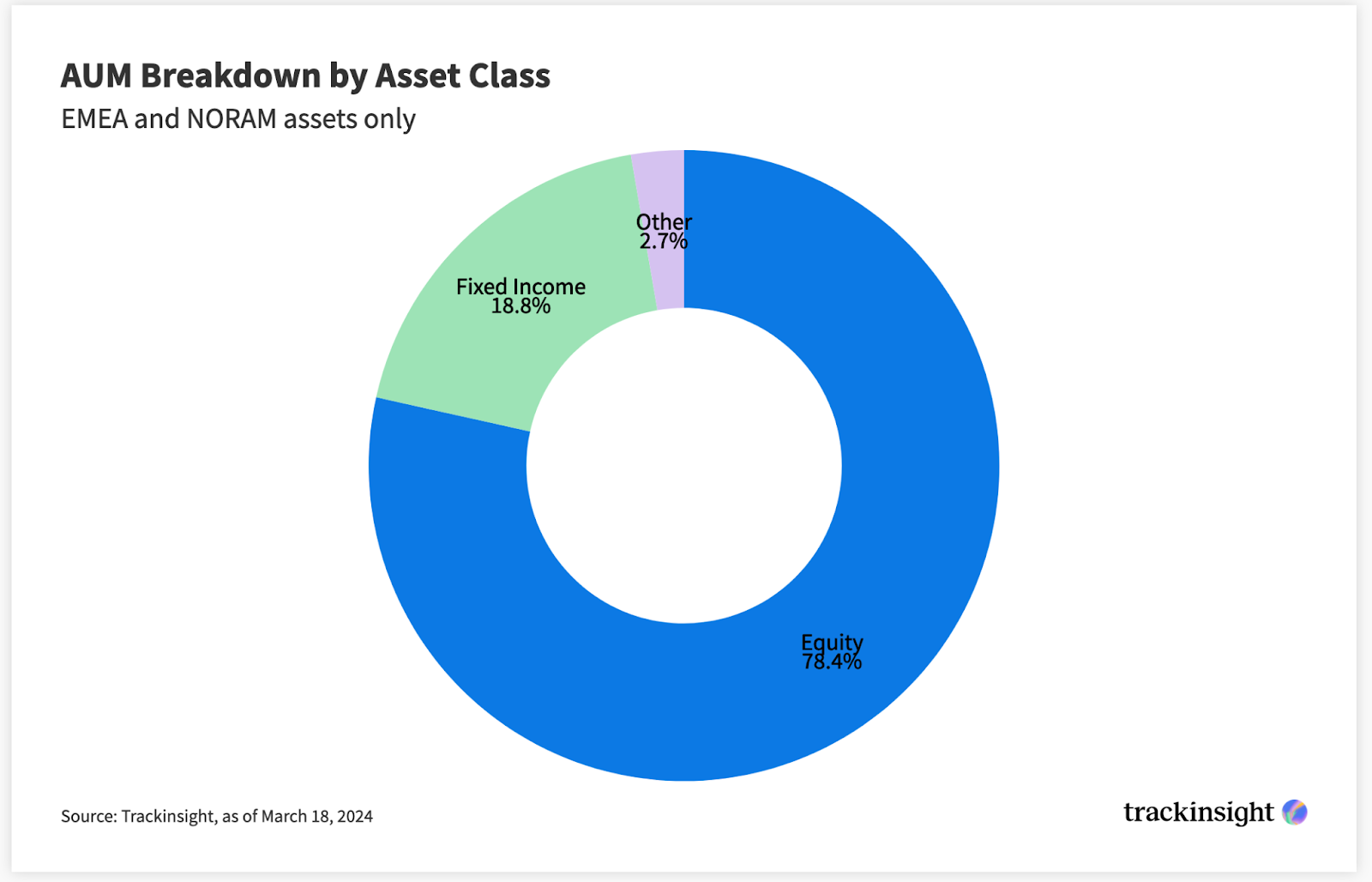

Investors are not standing still, with many planning to significantly increase their ETF allocations over the next 2-3 years. Equity ETFs are expected to see the largest uptick, with 25% of investors anticipating a boost of more than 20% in their equity ETF holdings over the next 2-3 years. This bullish sentiment extends to fixed income, commodities, and multi-assets, indicating a broad-based confidence in ETFs' potential to deliver across various asset classes.

The Fixed Income ETF Attraction

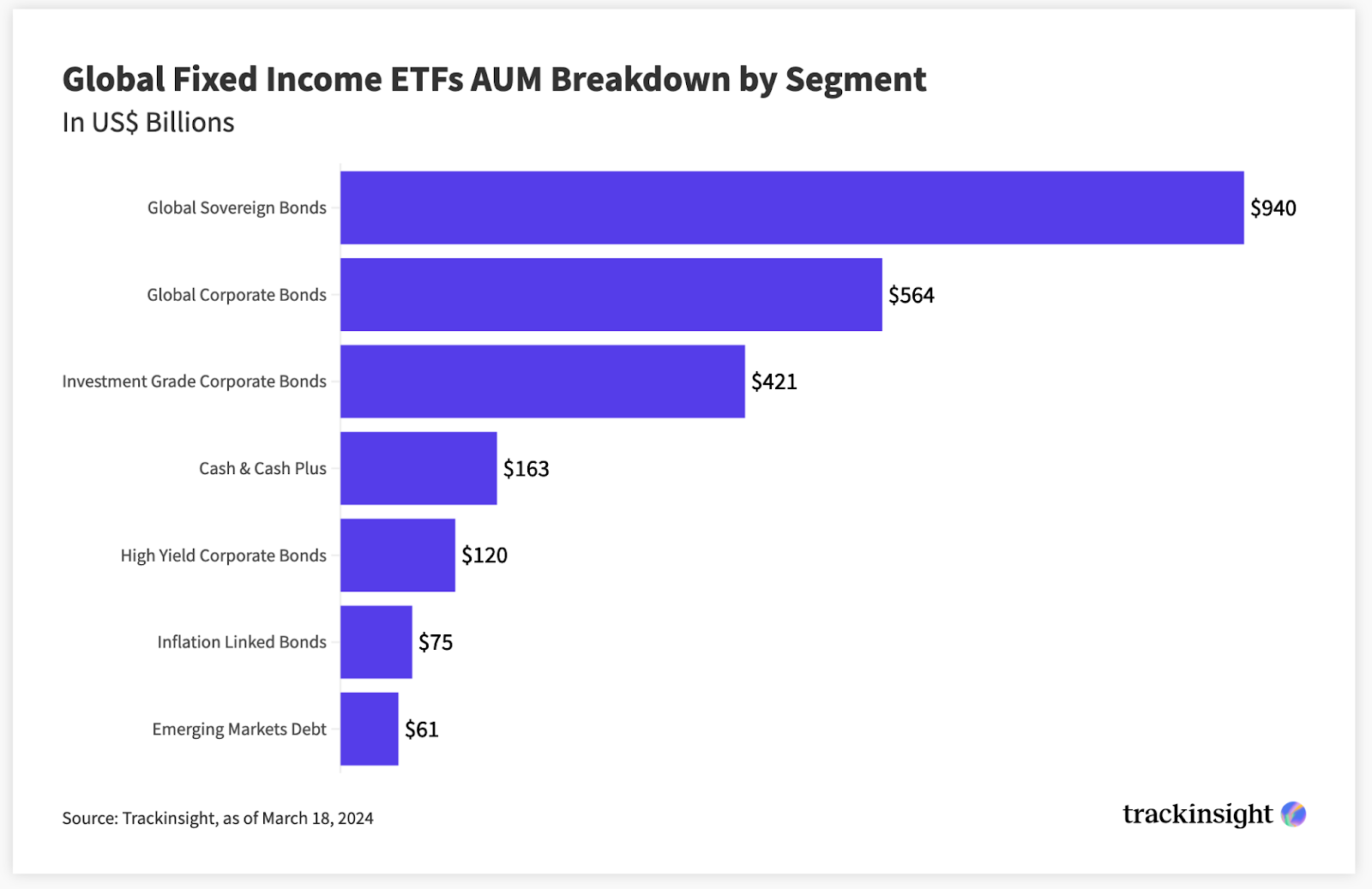

Fixed income ETFs are becoming increasingly popular, with 72.5% of the respondents either investors or showing interest in this segment. Investment strategies among allocators vary widely, with a near-even split between passive and active approaches. Looking ahead, 65.4% of investors are optimistic about the macro-economic environment for fixed income investing in 2024, with corporate investment-grade bonds expected to lead the market.

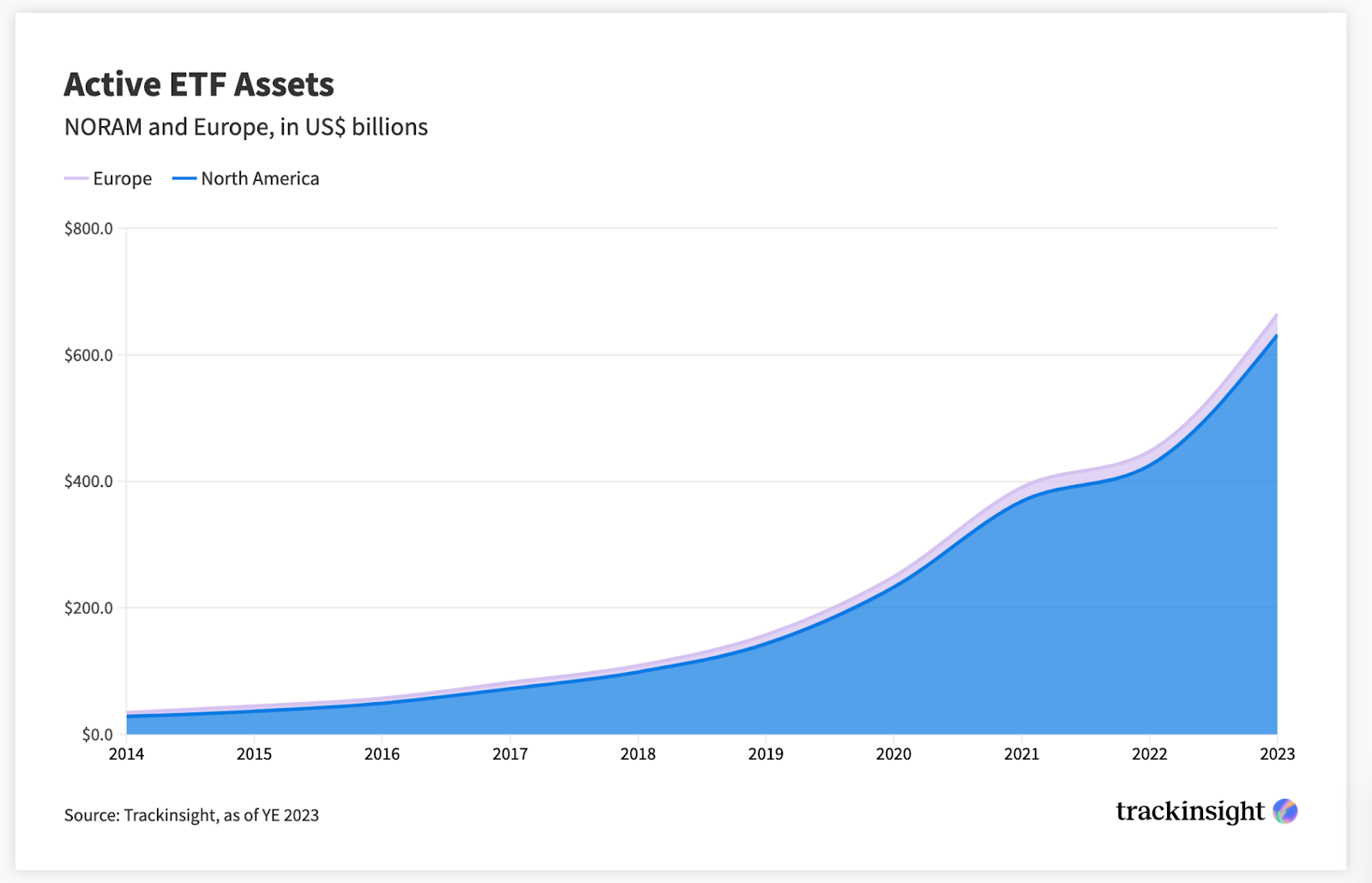

Increased adoption of Active ETFs

Active ETFs are catching the eye of 73.2% of survey respondents, drawn by their potential to enhance portfolio diversity and yield higher returns compared to passive investments. With over 71% planning to boost their active ETF investments in areas like equity, fixed income, and thematic investing, the rising interest is clear.

Moreover, a notable 80.1% favor active ETFs over mutual funds for their flexibility and benefits. Yet, challenges such as higher costs, limited options, non-transparency, and unproven histories pose significant concerns for those considering active ETFs.

The Rise of Thematic ETFs

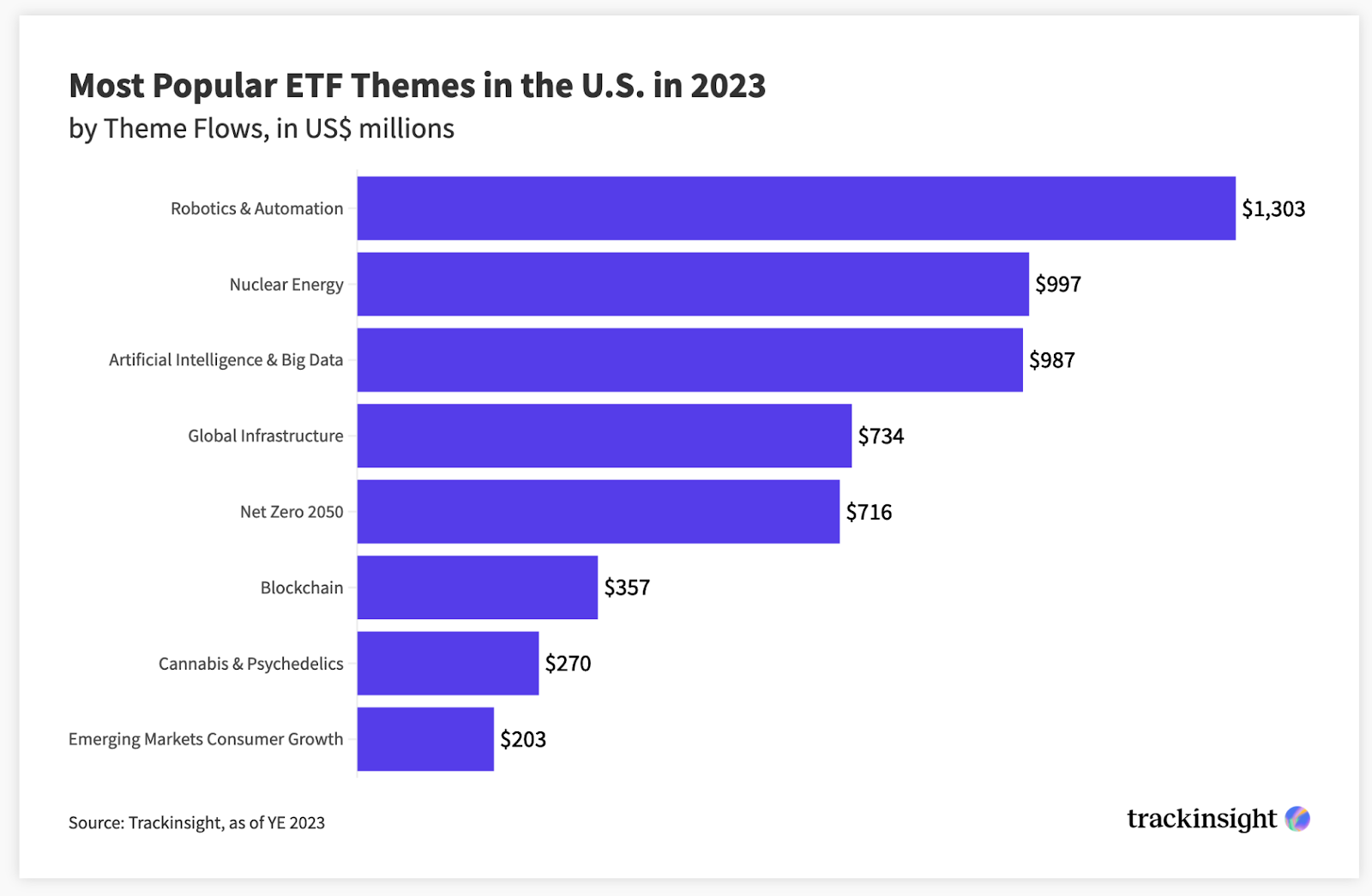

Thematic ETFs are notable for their capacity to focus on specific trends or sectors. According to the survey, 68% of investors express interest in these ETFs, viewing them as strategic long-term investments and diversification tools.

When asked about their future thematic investing appetite, respondents expect to significantly increase allocation to thematic ETFs over the next 2-3 years, with 15.2% planning to increase by more than 20% and 51.6% aiming for an increase of 5% to 20%.

Thematic ETFs are predominantly used as satellite exposures according to the survey, enhancing portfolios by targeting growth sectors such as disruptive technology and digital infrastructure.

Regulatory Trends Can Unlock Room for more ETF Growth

Recent regulatory developments have made it easier to transition from mutual funds to ETFs, with a staggering 81.9% of survey respondents inclined to transfer mutual fund holdings to ETF share classes through tax-free exchanges. This shift reflects a strong preference for the ETF structure over traditional mutual funds.

The growth of ETFs has been remarkable, and it looks set to continue rapidly as more investors adopt them and innovation keeps advancing. A standout moment came with the early 2024 launch of Spot Bitcoin ETFs in the U.S., attracting immense interest and record investments. As investors aim to diversify their portfolios across various asset classes and benefit from regulatory changes that simplify transitions, the investment landscape is increasingly leaning towards ETFs.

Interested in learning more about Global ETF trends?

Download Trackinsight’s 2024 Global ETF Survey Report titled “Unlock 50+ Charts of Worldwide ETF Trends” to gain access to valuable insights on the global ETF universe, from active and fixed income strategies to the latest trends in crypto, ESG and thematic investing.